Price-Watch’s most active coverage of Magnesia price assessment:

- D.B. 90%min.(3-15mm) FOB Sanghai, China

- D.B. 95%min.(0-30mm) FOB Sanghai, China

- D.B. 90%min.(3-15mm) CIF Nhava Sheva (China), India

- D.B. 95%min.(0-30mm) CIF Nhava Sheva (China), India

- D.B. 90%min.(3-15mm) FD Rotterdam , Netherlands

- D.B. 95%min.(0-30mm) FD Rotterdam , Netherlands

- D.B. 90%min.(3-15mm) CIF Houston (China), USA

- D.B. 95%min.(0-30mm) CIF Houston (China), USA

Magnesia Price Trend Q3 2025

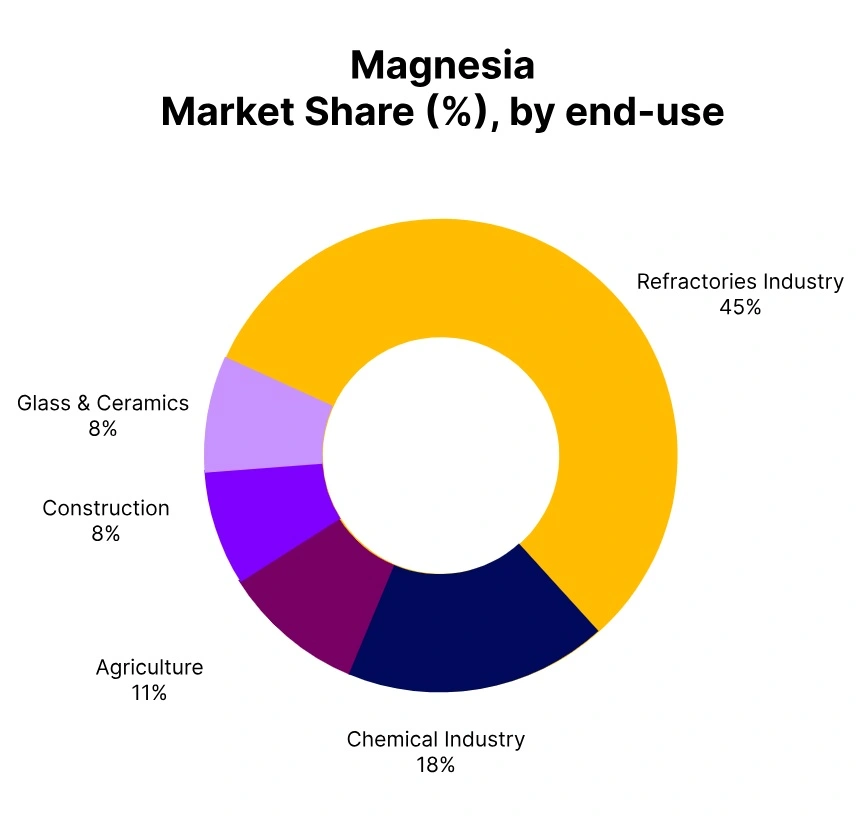

In Q3 2025, the global magnesia market experienced a negative price trend driven by decreased demand from key sectors like steel and cement, which rely heavily on refractory grade magnesia. Oversupply, rising energy and production costs, and inventory build-up further pressured prices downward.

Furthermore, stricter environmental regulations and geopolitical trade uncertainties, notably from major producers like China, added to market instability. While high purity and specialty magnesia segments remained relatively stable, overall market sentiment turned bearish, with producers experiencing tightening margins and cautious buyer activity.

China: Magnesia Export prices FOB Shanghai, China, Grade D.B. 95%min.(0-30mm).

In Q3 2025, the magnesia price trend in China showed a modest 1.26% decline compared to Q2, reflecting a slight decrease in market demand, specifically from downstream sectors such as steel and refractories. The decline was driven by reduced industrial activity, rising inventories, and increased export competition, though prices remained relatively stable due to production cost pressures and environmental regulations decreasing supply expansion.

While the market showed slight bearish sentiment, the overall price movement was controlled, signalling cautious buyer behaviour rather than aggressive sell offs, with future trends likely hinging on industrial recovery or policy shifts. Magnesia prices in China remained stable in September 2025 due to balanced supply and demand dynamics in both domestic and export markets. Additionally, steady raw material costs and limited policy changes contributed to price stability throughout the month.

India

In Q3 2025, the price trend in Indian magnesia market witnessed a modest 1.33% decline in demand compared to Q2 2025, driven by softened consumption from key end use sectors such as steel, refractory, and ceramics. The magnesia price trend remained relatively stable to slightly bearish, influenced by easing raw material and energy costs, stable import flows, and cautious buyer sentiment. While domestic supply remained stable, light inventory build-up and competitive pricing especially from imported grades added downward pressure.

Overall, the market showed resilience, but subdued industrial activity and macroeconomic headwinds limited growth, with expectations for gradual stabilization in Q4. Magnesia prices in India remained stable at 0% change in September 2025 due to balanced supply and demand dynamics in both domestic and international markets. In addition, steady input costs and consistent industrial consumption helped maintain price equilibrium throughout the month.

Netherlands

In Q3 2025, the price trend for Netherlands magnesia market is expected to experience a slight downturn, with prices declining by approximately 0.97% compared to Q2 2025. This modest decrease mirrors a softening demand in key sectors such as steel and refractory industries amid broader economic uncertainties, while supply side constraints limit sharper price drops.

The overall magnesia price trend indicates a slight correction rather than a steep decline, with expectations of stabilization or gentle recovery in the coming quarter, supported by steady demand for specialty grades and caustic calcined magnesia in chemical and agricultural applications.

Magnesia prices in the Netherlands remained stable in September 2025 due to balanced supply and demand dynamics in both domestic and European markets. Furthermore, steady industrial activity and stable raw material costs contributed to price consistency during the month.

USA

According to PriceWatch, In Q3 2025, the price trend of U.S. magnesia market saw a slight 0.89% decrease in price compared to Q2, driven by a combination of improved domestic supply, shifting demand from key industries like steel and cement, and evolving geopolitical factors affecting trade.

This slight decline in the magnesia price trend mirrors market adjustments amid balanced demand, with expectations for prices to steady as infrastructure investments and technological advancements continue to support the sector.

Magnesia prices in the USA remained stable at 0% change in September 2025 due to a balanced supply and demand scenario, where consistent production met steady consumption levels. No significant disruptions in raw material availability or market regulations occurred, maintaining price equilibrium.