Price-Watch’s most active coverage of Magnesium Alloy Ingot price assessment:

- AZ91D FOB Shanghai, China

- AZ91D CIF Nhava Sheva (China), India

- AZ91D CIF Rotterdam (China), Netherlands

- AZ91D CIF Houston (China), USA

Magnesium Alloy Ingot Price Trend Q3 2025

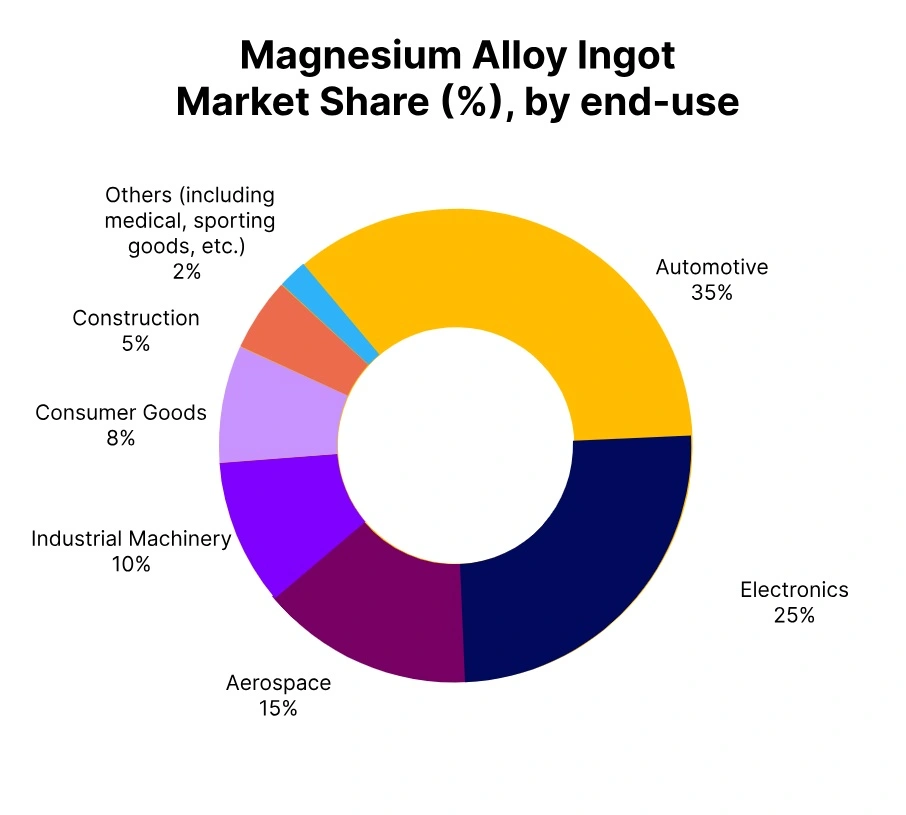

In Q3 2025, the global magnesium alloy ingot market experienced a mixed price trend, fluctuating around 1% in comparison to the previous quarter. This change reflected a balance between supportive and restraining market forces. Stable demand from the automotive and aerospace sectors driven by lightweight material preferences helped maintain price levels.

Alongside that, global economic uncertainties, rising energy costs, and cautious procurement activities apply downward pressure. Supply-side factors also contributed, as production in major regions like China remained stable but faced intermittent disruptions due to environmental regulations. Meanwhile, inventory levels in key consumer markets remained adequate, limiting any strong upward momentum in pricing.

United States: Magnesium Alloy Ingot import prices CIF Houston (China), USA, Grade- AZ91D.

In Q3 2025, magnesium alloy ingot prices in the U.S. market have shown a slight upward movement, increasing by 0.50% compared to Q2. This growth has been supported by steady demand from the automotive and aerospace sectors, along with tight supply conditions resulting from ongoing logistical constraints and limited imports.

However, in September 2025, magnesium alloy ingot prices in the US have declined by 2% as downstream demand has slowed and domestic production rates have improved.

Buyers have adopted a cautious purchasing approach amid high inventory levels, contributing to the softening of prices toward the end of the quarter. While the quarterly average has still reflected a marginal gain, the late-quarter dip has indicated a potential shift in market sentiment.

Netherlands: Magnesium Alloy Ingot import prices CIF Rotterdam (China), Netherlands, Grade- AZ91D.

In Q3 2025, magnesium alloy ingot price trend in the Netherlands have shown a modest upward movement, rising by 0.50% compared to Q2. This increase has been supported by firm downstream demand from the automotive and aerospace sectors, coupled with tight supply conditions due to reduced imports from key Asian markets.

However, in September 2025, magnesium alloy ingot prices in the Netherlands have declined by 1% as market sentiment has weakened amid signs of slowing demand and improved inventory levels across European distributors.

Despite this brief correction, the quarterly average has remained higher, underpinned by strong pricing in July and August. Additionally, rising energy costs and stricter environmental regulations affecting production have contributed to elevated costs, reinforcing the overall upward price trend for Q3.

China: Magnesium Alloy Ingot Export prices FOB Shanghai, China, Grade- AZ91D.

According to PriceWatch, the magnesium alloy ingot price trend in China demonstrated a slight increase at the conclusion of Q3 2025, appreciating by close to 1% in comparison to Q2. The increases in price have largely been a result of persistent demand from consumer electronics and other growth sectors, alongside reduced capacity due to enforced environmental checks restraining production in key mainland production provinces of Shaanxi and Shanxi.

However, in September 2025, magnesium alloy ingot price in China retreated by 2% due to weakening market developments amid increased stockpiles of magnesium alloy ingot and weaker downstream demand. Softening raw material pricing as well as improved operations have been noted in addition to price drops.

India: Magnesium Alloy Ingot import prices CIF Nhava Sheva (China), India, Grade- AZ91D.

According to PriceWatch, magnesium alloy ingot price trend within India have exhibited a slight decrease in Q3 2025, by about 0.50% relative to Q2. This decline has stemmed from soft demand from the automotive and aerospace sectors and relatively healthy supply in India and around the world. Magnesium alloy ingot prices have been mostly stable through July and August. However, in September 2025, Magnesium alloy ingot prices in India fell by almost 1%, a significant decline over the quarter.

This trend has been led by increased imports from China at more favorable prices and easing raw material costs, particularly for ferro silicon and aluminum, which have been the primary building blocks for magnesium. Moreover, limited purchasing from manufacturers during 2025 as they adjusted their inventories has continued to keep downward pressure on prices. While the Indian rupee has remained stable, weaker logistics costs have also contributed to a downward trend in prices.