Price-Watch’s most active coverage of Merchant Bar price assessment:

- 50*20mm Ex Alabama, USA

- 50*20mm FD Taranto, Italy

- Q235-50*20mm FOB Shanghai, China

- 50*20mm EX Iskenderun, Turkey

- E250 BR-50*5mm Ex Raipur, India

Merchant Bar Price Trend Q3 2025

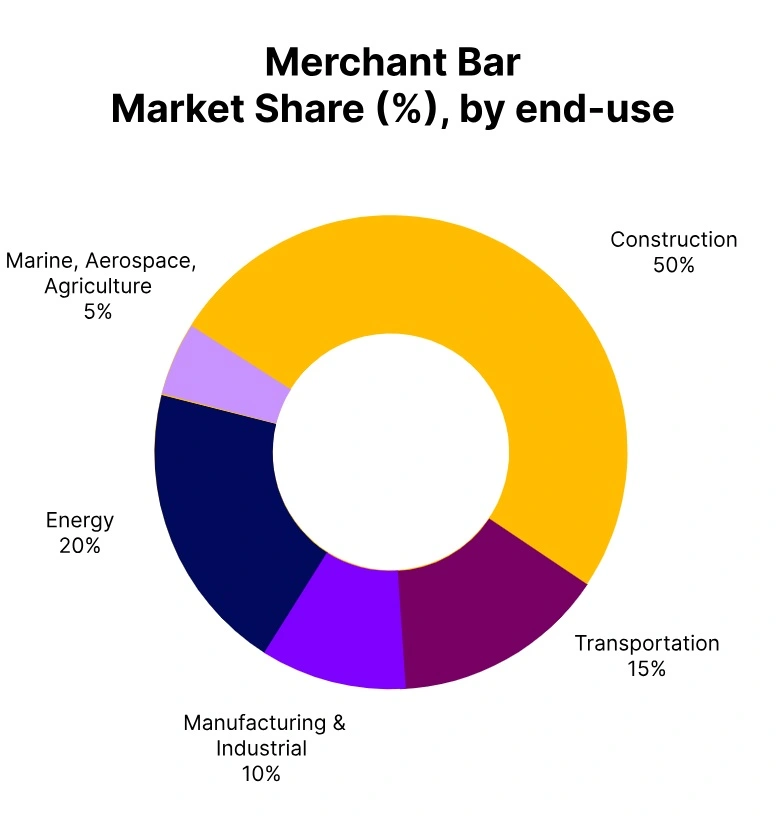

In Q3 2025, the global merchant bar market (primarily referring to merchant bar quality steel) experienced a negative price trend, driven by weak demand from the construction sector, elevated inventory levels, and a broader downturn in steel and base metal markets. Prices declined across key regions, notably with China reporting a 2.4% quarter on quarter drop, while input cost volatility and global oversupply further pressured margins. Despite some regional variations, the overall outlook remained bearish, with producers resorting to price cuts amid sluggish downstream activity and limited stimulus driven demand.

China: Merchant Bar Export prices FOB Shanghai, China, Grade- Q235 – 50*20mm.

In Q3 2025, the price trend for China’s Merchant Bar market experienced a 1.7% decline compared to Q2, reflecting continued weakness in downstream demand, high inventory levels, and ongoing pricing pressure. The merchant bar price trend showed a mild downward movement as sellers responded to slow construction activity and tighter procurement strategies. With domestic consumption subdued and limited support from export markets, producers faced margin compression, prompting more competitive pricing.

Despite the decline being less steep than the previous quarter, the market remains cautious, with further softening possible if demand fails to recover in Q4. The 2.42% decrease in Merchant Bar prices in China during September 2025 can be attributed to sluggish demand from the construction and manufacturing sectors amid a broader economic slowdown. Additionally, increased domestic production and inventory levels may have exerted downward pressure on prices.

India: Merchant Bar Domestic Prices Ex Raipur, E250 BR-50*5mm.

According to the PriceWatch, in Q3 2025, the price trend of Indian Merchant Bar market witnessed a 3.45% decline compared to Q2, driven by softening demand from the construction and fabrication sectors, delayed infrastructure projects, and rising input costs. The merchant bar price trend remained under pressure, with limited upward movement as producers faced margin squeezes and resorted to selective discounting to maintain volumes.

Competitive imports and high logistics costs further strained the market, while subdued downstream activity limited buying interest. Looking ahead, price recovery may remain constrained unless there’s a notable rebound in infrastructure spending or raw material cost relief.

The 0.26% increase in Merchant Bar prices in India during September 2025 can be attributed to rising input costs, particularly steel billets, and a slight recovery in construction demand post monsoon. Additionally, supply constraints from key producers contributed to the upward price adjustment.

United States: Merchant Bar Domestic Prices Ex Alabama, USA, 50*20mm.

According to the PriceWatch, in Q3 2025, the price trend of U.S. merchant bar market experienced a slight 0.91% decrease in prices compared to Q2 2025, reflecting a modest downward price trend after earlier increases earlier in the year. This adjustment suggests a stabilization in supply and demand dynamics, with domestic mills cautiously managing price levels that remain below 2024 highs.

Strong export activity, particularly to Mexico and Canada, helped support market stability despite the slight price dip. Overall, the merchant bar price trend indicates a balanced market outlook with steady demand and supply conditions.

The 0.49% decrease in Merchant Bar prices in the USA during September 2025 likely reflects a combination of improved supply chain efficiencies and a slight dip in consumer demand. This modest price adjustment helps maintain competitive market positioning while responding to changing economic conditions.

Italy: Merchant Bar Domestic Prices FD Taranto, Italy, 50*20mm.

In Q3 2025, price trend of Italy’s merchant bar market saw a 2.01% decrease compared to Q2, reflecting a slight downward price trend influenced by easing industrial inflation and a 0.6% drop in energy costs. Despite this overall decline, the retail sector showed strong growth, with investments up 38% year over year, supporting steady demand for merchant bars in construction and infrastructure.

Looking forward, prices are expected to stabilize, with market dynamics closely tied to energy prices and domestic investment activity. The 0.31% decrease in Merchant Bar prices in Italy during September 2025 likely reflects a combination of lower demand and increased competition within the sector. Additionally, this slight price reduction may be a strategic response to inflationary pressures or changes in consumer spending habits.

Turkey: Merchant Bar Domestic Prices EX Iskenderun, Turkey, 50*20mm.

In Q3 2025, the price trend of Turkey’s merchant bar market saw a 2.63% price decrease from Q2, driven by weakening import scrap prices and regional market adjustments. Despite some areas experiencing price hikes earlier in the year, overall price trends shifted downward amid ongoing inflationary pressures and the Turkish lira’s depreciation against the US dollar.

These economic factors influenced producers to revise pricing strategies, reflecting a cautious market outlook. Going forward, stakeholders should closely monitor currency fluctuations and inflation, as these will continue to shape the merchant bar price trend in Turkey.

The 0.86% decrease in Merchant Bar prices in Turkey in September 2025 likely reflects reduced production costs or increased competition among suppliers. Additionally, this price drop could be influenced by fluctuations in raw material prices or shifts in consumer demand within the market.