Price-Watch’s most active coverage of Methenamine price assessment:

- Industrial grade(99%) FOB Novorossiysk, Russia

- Industrial grade(99%) CIF Nhava Sheva (Russia), India

Methenamine Price Trend Q3 2025

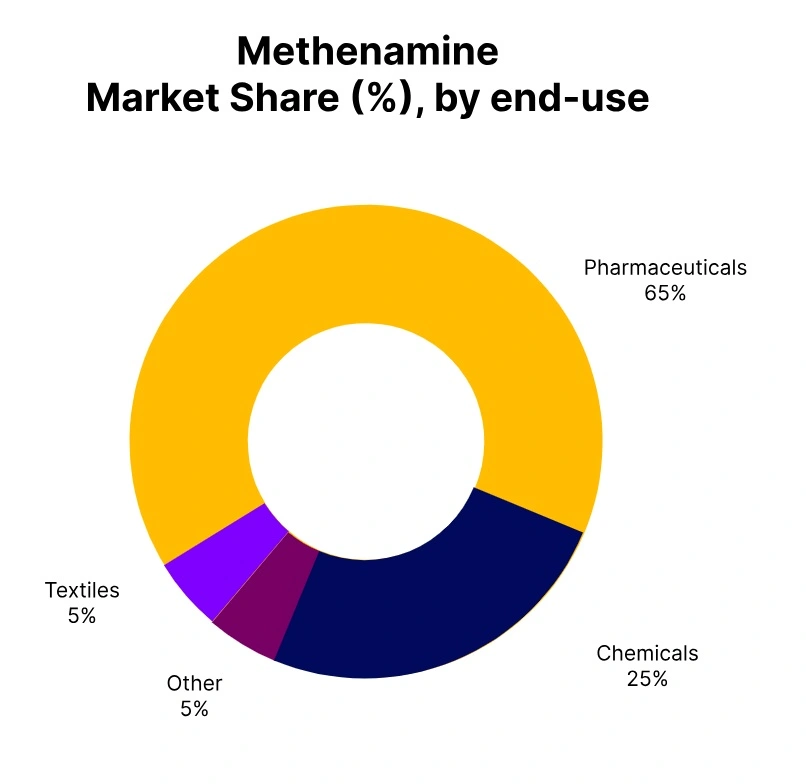

In Q3 2025, Methanamine prices in both Russia and India registered a notable decline of 9% compared to the previous quarter. The Methanamine price trend in Russia was driven by weakened demand across the resins and plastics, textile, and pharmaceutical industries, along with ample inventories and stable production, which created oversupply conditions. Meanwhile, the Methanamine price trend in India was impacted by subdued import demand, despite steady shipments from Russia.

Indian buyers remained cautious due to high inventory levels, lower freight rates, and currency fluctuations. Both markets reflected bearish sentiment throughout the quarter. The Methanamine price in September 2025 in both countries continued this downward trend, with limited restocking activity and uncertainty about demand recovery in the upcoming quarter.

Russia: Methenamine Export Prices FOB Novorossiysk, Russia, Grade- (99% min) Industrial Grade.

In Q3 2025, Methanamine price in Russia had a stark downturn compared to the previous quarter, declining by 9% from Q2 levels. The Methanamine price trend in Russia was mainly influenced by weakened demand across key downstream sectors, particularly the resins and plastics, textile, and pharmaceutical industries. Reduced export orders from European and Asian markets, coupled with ample domestic inventories, added to the downward pressure on prices.

In addition, operational stability at local production facilities ensured a steady supply, further driving the oversupply conditions. Despite minor procurement activity from the pharmaceutical segment, overall market sentiment remained bearish. The Methanamine price in September 2025 reflected this trend, marking one of the quarter’s lowest points. Market participants anticipated cautious buying in the upcoming quarter.

India: Methenamine Import prices Nhava Seva, India; Grade- (99% min) Industrial Grade

According to Price-Watch, in Q3 2025, Methanamine price in India recorded a notable decline of 9% compared to the previous quarter, mirrored weak import demand and easing supply-side concerns. The Methanamine price trend in India was influenced by reduced industrial activity and subdued procurement from key downstream sectors such as resins and plastics, textile, and pharmaceutical industries. Imports from Russia stayed steady, but Indian buyers adopted a cautious approach amid oversupplied inventories and softening regional prices.

Currency fluctuations and lower freight rates contributed to the downward pressure. Despite occasional restocking activity in early August, overall sentiment remained bearish. The Methanamine price in September 2025 mirrored this trajectory, reflecting weaker trade volumes. Buyers remained attentive to global price cues heading into the next quarter.