Price-Watch’s most active coverage of Methyl Chloride price assessment:

- Industrial Grade (99.9%) FOB Hamburg, Germany

- Industrial Grade (99.9%) FOB Ningbo, China

- Industrial Grade (99.9%) CIF Nhava Sheva (China), India

- Industrial Grade (99.9%) CIF Santos (Germany), Brazil

- Industrial Grade (99.9%) CIF Houston (Germany), USA

- Industrial Grade (99.9%) FD Southampton, United Kingdom

- Industrial Grade (99.9%) FD Le Havre , France

- Industrial Grade (99.9%) FD Genoa, Italy

Methyl Chloride Price Trend Q3 2025

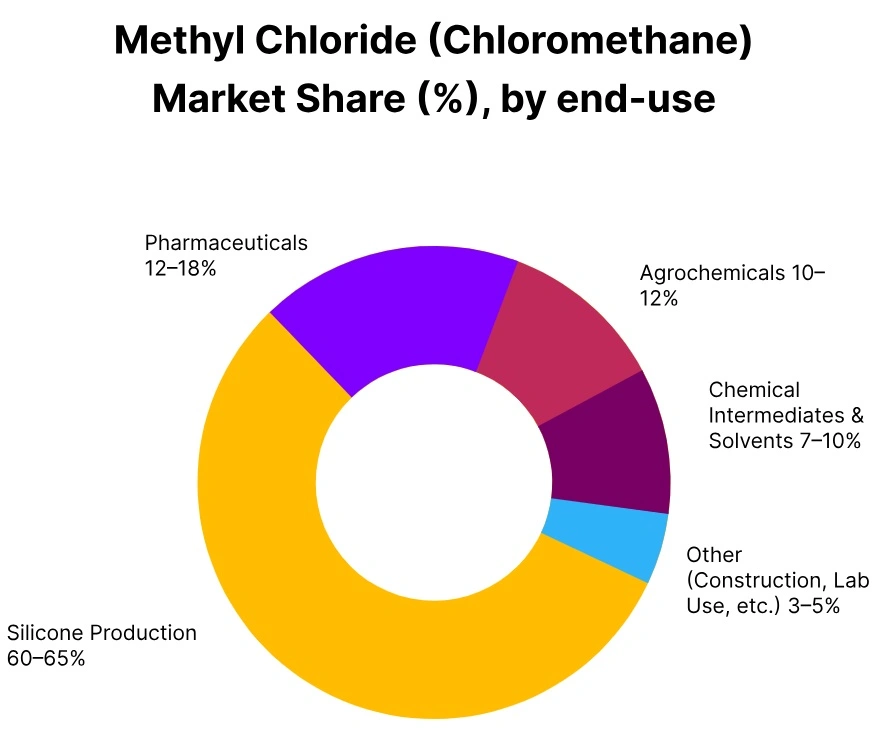

In Q3 2025, the global Methyl Chloride market exhibited moderate price growth, supported by strong industrial demand, stable supply conditions, and consistent production activity across major trading regions. Prices for Industrial Grade (99.9%) Methyl Chloride increased between 2% to 5%, driven by firm consumption in pharmaceutical, polymer, and chemical manufacturing sectors, along with steady export and import flows.

Freight cost adjustments and efficient logistics aided trade stability, while balanced inventories prevented sharp price swings. Market participants maintained cautious but steady procurement strategies to manage supply chain dynamics effectively. Overall, the Methyl Chloride market showed a firm and optimistic tone, with stable fundamentals and favorable industrial activity expected to sustain price stability in the near term.

Germany: Methyl Chloride Export prices FOB Hamburg, Germany, Grade- Industrial Grade (99.9%).

In Q3 2025, The Methyl Chloride prices in Germany went up by 3.26%, with a quarterly price range of USD 995–1085 per MT. The Methyl Chloride price trend in Germany was supported by stronger demand from pharmaceutical and chemical manufacturing sectors, alongside steady operating rates from producers. Downstream users accelerated procurement amid improving industrial activity, while stable supply chains and balanced inventories helped underpin price gains.

In September 2025, Methyl Chloride prices in Germany continued their rise by 3.05%, mirroring cautious optimism, consistent export flows, and resilient market fundamentals throughout the quarter, as producers capitalized on continued demand and buyers showed steady purchasing confidence.

China: Methyl Chloride Export prices FOB Ningbo, China, Grade- Industrial Grade (99.9%).

According to Price-Watch, in Q3 2025, The Methyl Chloride prices in China went up by 1.46%, with a quarterly price range of USD 453–530 per MT. The Methyl Chloride price trend in China was supported by stable output from domestic producers and stable demand from chemical intermediates. Buyers maintained sustained purchasing patterns amid balanced inventory levels, while market sentiment remained neutral to positive.

In September 2025, Methyl Chloride prices in China continued their rise by 7.22%, reflecting aligned production and consumption, firm operating rates, and steady market fundamentals throughout the quarter, as producers and buyers adopted balanced trading strategies to maintain stability in regional market conditions.

India: Methyl Chloride Import prices CIF Nhava Sheva, India, Grade- Industrial Grade (99.9%).

According to Price-Watch, in Q3 2025, The Methyl Chloride prices in India increased by 7.00%, with a quarterly price range of USD 530–610 per MT. The Methyl Chloride price trend in India was influenced by moderate increases in freight costs and downstream demand from pharmaceutical and agrochemical sectors. Importers faced harsher supply conditions and rising transport expenses, prompting accelerated purchases to sustain plant operations.

In September 2025, Methyl Chloride prices in India continued their upward movement by 9.95%, reflecting strong market sentiment, tighter supply-demand dynamics, and sustained logistic cost pressures throughout the quarter, as producers capitalized on consistent demand while buyers prioritized timely procurement to avoid shortages.

Brazil: Methyl Chloride Import prices CIF Santos, Brazil, Grade- Industrial Grade (99.9%).

In Q3 2025, The Methyl Chloride prices in Brazil increased by 3.12%, with a quarterly price range of USD 1025–1115 per MT. The Methyl Chloride price trend in Brazil was supported by moderate downstream demand and slightly lower freight charges in comparison to Q2. Buyers in the agrochemical and pharmaceutical sectors maintained steady procurement, benefiting from improved shipping economics and stable domestic supply.

In September 2025, Methyl Chloride prices in Brazil continued their moderate rose by 3.53%, reflecting consistent trade activity, balanced inventories, and favourable market conditions throughout the quarter, as both producers and buyers-maintained confidence in the market’s stable outlook and steady operating fundamentals.

USA: Methyl Chloride Import prices CIF Houston, USA, Grade- Industrial Grade (99.9%).

In Q3 2025, The Methyl Chloride prices in the USA increased by 2.52%, with a quarterly price range of USD 1105–1180 per MT. The Methyl Chloride price trend in the USA was supported by slightly increased downstream demand from polymer and pharmaceutical manufacturers, while freight costs stayed stable to slightly lower compared to previous quarters. Import volumes from Germany were steady, and buyers cautiously expanded procurement amid balanced inventory levels.

In September 2025, Methyl Chloride prices in the USA continued their moderate rise by 2.80%, mirroring reliable supply chains, consistent trade activity, and stable market fundamentals throughout the quarter, supported by stable production rates and cautious but positive market sentiment.

United Kingdom: Domestically Traded Methyl Chloride price in Southampton, United Kingdom, Grade- Industrial Grade (99.9%).

In Q3 2025, The Methyl Chloride prices in the UK increased by 3.49%, with a quarterly price range of USD 1045–1145 per MT. The Methyl Chloride price trend in the UK was supported by steady industrial activity in chemical manufacturing and efficient port operations in Southampton, ensuring smooth deliveries and timely shipments. Buyers refreshed inventories amid balanced supply, sustaining upward price momentum and market confidence.

In September 2025, Methyl Chloride prices in the UK continued their moderate rise by 4.24%, reflecting stable market fundamentals, consistent trading activity, and positive sentiment throughout the quarter, as producers maintained steady output and buyers showed continued purchasing interest.

France: Domestically Traded Methyl Chloride price in Le Havre, France, Grade-Industrial Grade (99.9%).

In Q3 2025, The Methyl Chloride prices in France edged up by 3.44%, with a quarterly price range of USD 1045–1135 per MT. The Methyl Chloride price trend in France was supported by strong demand from pharmaceutical and chemical sectors, alongside steady supply from regional producers. Buyers remained active in replenishing inventories ahead of projected production schedules, sustaining price gains and maintaining regular market fundamentals.

In September 2025, Methyl Chloride prices in France continued their upward movement by 3.78%, reflecting balanced supply-demand conditions, healthy downstream consumption, and positive market sentiment throughout the quarter, as producers benefited from favourable economic indicators and consistent regional demand support.

Italy: Domestically Traded Methyl Chloride price in Genoa, Italy, Grade-Industrial Grade (99.9%).

In Q3 2025, The Methyl Chloride prices in Italy went up by 3.26%, with a quarterly price range of USD 1050–1140 per MT. The Methyl Chloride price trend in Italy was supported by growing demand from downstream polymer and specialty chemical manufacturers, alongside steady operating rates from domestic producers. Buyers continued moderate procurement activities to align with expected production runs and maintain stock levels, which sustained a stable and firm market environment.

In September 2025, Methyl Chloride prices in Italy maintained their upward trend by 2.90%, reflecting balanced supply-demand dynamics, consistent regional demand, and positive market sentiment that encouraged steady trading activity throughout the quarter.