Price-Watch’s most active coverage of Methyl Methacrylate (MMA) price assessment:

- Liquid (Purity: 99.8%) FOB Busan, South Korea

- Liquid (Purity: 99.8%) FOB Shanghai, China

- Liquid (Purity: 99.8%) FOB Jurong, Singapore

- Liquid (Purity: 99.8%) CIF Nhava Sheva (Singapore), India

- Liquid (Purity: 99.8%) CIF Nhava Sheva (China), India

- Liquid (Purity: 99.8%) Ex-Mumbai, India

- Liquid (Purity: 99.8%) Ex-Mumbai , India

- Liquid (Purity: 99.8%) FD Hamburg, Germany

- Liquid (Purity: 99.8%) CIF Chittagong (Singapore), Bangladesh

- Liquid (Purity: 99.8%) CIF Santos (China), Brazil

- Liquid (Purity: 99.8%) CIF Alexandria (China), Egypt

Methyl Methacrylate (MMA) Price Trend Q3 2025

In Q3 2025, the global MMA price trend has been largely downward across most regions, with prices having been continuously declining due to weaker demand from key industries like automotive, construction, and electronics. The MMA price trend has been influenced by a combination of factors such as overcapacity in production and slower-than-expected recovery in consumer spending.

The MMA price trend has shown significant declines, especially in countries like South Korea and Germany, where procurement activity has remained low. Supply has been largely stable, but demand has continued to underperform, contributing to the ongoing price reductions. Overall, the MMA price trend has reflected the broader economic challenges, with only a few regions like Brazil having seen slight price increases due to supply constraints.

South Korea: Methyl Methacrylate (MMA) Export prices FOB Busan, South Korea, Grade Liquid (Purity: 99.8%).

In South Korea, MMA export prices have been decreasing by 8.3% in Q3 2025, with prices having been ranging between 1320–1340 USD. The MMA price trend in South Korea has been driven by weak demand from key downstream industries such as automotive and construction. The MMA price trend has continued to decline as industrial production has been slower than expected, and procurement activities have been limited.

The MMA price trend has been reflecting a market under pressure, where supply has remained stable but demand from major sectors has been insufficient to prevent further price reductions. As the quarter progressed, the MMA price trend in South Korea has indicated ongoing challenges due to low procurement and global economic uncertainty. In September 2025, MMA prices in South Korea have decreased by 1.1%.

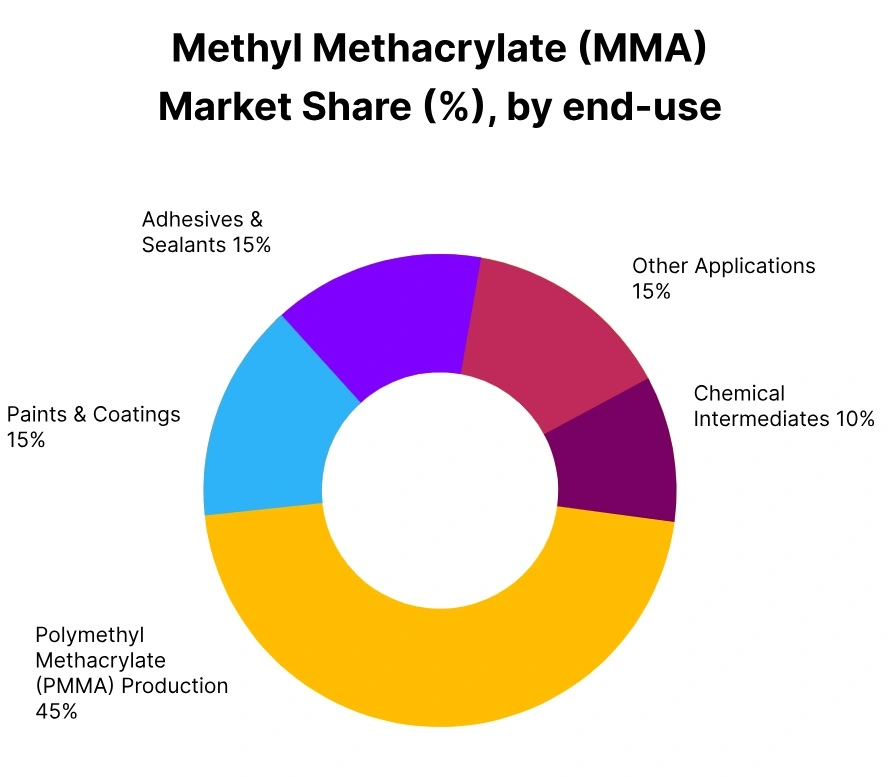

The price decline has been driven by weak demand from downstream Polymethyl Methacrylate (PMMA) and coatings sectors, where consumption has slowed amid reduced manufacturing activity across East Asia. Despite steady feedstock Acetone and Methanol prices, producers have faced limited cost support as supply levels have remained comfortable.

China: Methyl Methacrylate (MMA) Export prices FOB Shanghai, China, Grade Liquid (Purity: 99.8%).

According to the Price-Watch AI, in China, MMA export prices have been showing a decline of 6.0% in Q3 2025. The MMA price trend in China has been influenced by a combination of reduced demand and oversupply in the market. While supply levels have remained consistent, the MMA price trend has continued downward as key industries have shown weak procurement activity.

The MMA price trend has been reflecting a global slowdown in manufacturing and production, particularly in the automotive and construction sectors. Despite stable supply, the MMA price trend in China has continued to show declines as international and domestic demand has remained lower than expected, keeping prices under pressure. In September 2025, MMA prices in China have been decreased by 1.0%.

The downward trend has been primarily due to soft demand from the PMMA, adhesives, and coatings industries, where production rates have been curtailed due to weak downstream consumption. Feedstock costs for Acetone and Hydrogen Cyanide have remained stable, providing limited cost pressure for producers.

Singapore: Methyl Methacrylate (MMA) Export prices FOB Jurong, Singapore, Grade Liquid (Purity: 99.8%).

In Singapore, MMA export prices have been falling by 8.7% in Q3 2025. The MMA price trend in Singapore has been showing a significant decline due to weakened demand from both regional and international markets. The MMA price trend has been driven by low procurement activity, particularly from the automotive and electronics sectors, which have not been picking up as expected.

The MMA price trend in Singapore has been reflecting broader market conditions, where weak industrial activity and slow economic recovery have led to lower-than-anticipated demand. Despite stable supply levels, the MMA price trend has continued to decline, with prices having dropped further as a result of ongoing market challenges. In September 2025, MMA prices in Singapore decreased by 1.1% from the previous month.

The decline has been supported by weak regional offtake and reduced export inquiries from India and Bangladesh. Despite steady feedstock Methanol and Acetone costs, MMA producers in Singapore have faced oversupply conditions due to sluggish PMMA demand and limited activity in the coatings sector.

Germany: Methyl Methacrylate (MMA) Domestically Traded prices FD Hamburg, Germany, Grade Liquid (Purity: 99.8%).

In Germany, MMA domestically traded prices have been dropping by 10.9% in Q3 2025. The MMA price trend in Germany has been experiencing one of the sharpest declines, reflecting weaker demand and economic uncertainty in the region. The MMA price trend has been largely influenced by reduced purchasing from key industries like automotive, construction, and consumer electronics.

Supply has remained steady, but the MMA price trend has shown significant downward movement due to low procurement activity. The MMA price trend in Germany has indicated a market under significant pressure, where economic slowdowns and weak demand have kept prices falling throughout the quarter.

In September 2025, MMA prices in Germany decreased by 4.9%, reflecting the sharpest decline among major regions. Demand from the European coatings and construction industries has weakened significantly, while imports from Asia have increased due to competitive pricing. Feedstock Acetone prices have softened in line with reduced crude oil values, further lowering cost support for MMA producers.

Bangladesh: Methyl Methacrylate (MMA) Imported prices CIF Chittagong, Bangladesh from Singapore, Grade Liquid (Purity: 99.8%).

In Bangladesh, MMA imported prices have been seeing a decline of 7.6% in Q3 2025. The MMA price trend in Bangladesh has been driven by weak demand from local industries such as construction and packaging, which have not been recovering as quickly as expected.

The MMA price trend has shown a consistent downward movement as procurement from these sectors has remained subdued. The MMA price trend has been reflecting broader regional challenges, where slow economic recovery and low industrial activity have kept prices under pressure.

Despite stable supply, the MMA price trend in Bangladesh has continued to be negative, as demand has failed to pick up in the quarter. In September 2025, MMA prices in Bangladesh decreased by 1.3%. The price fall has been influenced by cheaper imports from Singapore, where weaker FOB levels have reduced landed costs. Downstream demand in Bangladesh has remained subdued as construction and coatings industries have operated below capacity.

Brazil: Methyl Methacrylate (MMA) Imported prices CIF Santos, Brazil from China, Grade Liquid (Purity: 99.8%).

In Brazil, MMA imported prices have been increasing by 2.1% in Q3 2025. The MMA price trend in Brazil has been an exception to the broader downward movement, reflecting tight supply conditions and stronger-than-expected demand from the local market. The MMA price trend has been influenced by limited imports and strong demand in key sectors such as packaging and consumer goods, which have supported price increases.

The MMA price trend in Brazil has shown a slight positive shift, indicating that while the global market has been facing slowdowns, local conditions have been somewhat more favourable. The increase in Brazil has been driven by regional supply constraints and higher procurement activity compared to other regions.

In September 2025, MMA prices in Brazil decreased by 3.8%. The fall has been primarily driven by weaker Chinese export prices and reduced demand from Brazilian coatings manufacturers. Importers in Brazil have faced comfortable inventory levels, prompting reduced spot activity.

Egypt: Methyl Methacrylate (MMA) Imported prices CIF Alexandria, Egypt from China, Grade – Liquid (Purity: 99.8%).

In Egypt, MMA imported prices have been decreasing by 5.8% in Q3 2025. The MMA price trend in Egypt has been reflecting a decline in demand from the packaging and construction industries. The MMA price trend has been influenced by slower industrial activity, as key sectors have not been seeing the expected rebound.

Despite stable supply, the MMA price trend in Egypt has shown a downward movement, with prices having continued to fall as procurement has remained low. The MMA price trend in Egypt has mirrored broader regional trends, where weak economic conditions and low demand have kept prices under pressure throughout the quarter. In September 2025, MMA prices in Egypt have decreased by 2.2%.

The decline has stemmed from weaker export offers from Chinese suppliers and subdued downstream activity in Egypt’s coatings and plastics sectors. Importers have limited purchases to essential volumes amid stagnant construction activity. Freight rates have remained steady, while adequate regional supply further has constrained price recovery.

India: Methyl Methacrylate (MMA) Domestically Traded prices Ex-Mumbai, India: Grade – Liquid (Purity: 99.8%, Bulk)

In India, MMA prices have been showing a sharp decline of -6.9% in Q3 2025, driven by weak buying sentiment and subdued downstream activity. The MMA price trend in India has been being influenced by reduced demand from the coatings, adhesives, and PMMA sectors, where manufacturers have been cutting operating rates due to slow order inflows.

While supply availability has been remaining steady, the market has been experiencing persistent downward pressure as both domestic processors and traders have been limiting fresh procurement. The overall MMA trend has been reflecting broader global weakness, with sluggish consumption in key industries such as automotive and construction.

Despite stable feedstock Acetone and Hydrogen Cyanide costs, prices have been continuing to drift lower due to an oversupplied regional market and muted inquiries from end-use segments. September 2025, it has been decreasing by 0.9%. The decline reflected weak domestic buying interest and competitive import offers from Singapore and China.

Indian producers faced lower price realizations as downstream industries curtailed purchases due to subdued seasonal activity. Feedstock Acetone and Methanol costs remained largely unchanged, offering no production cost relief. Ample supply from both local and imported sources weighed on market sentiment. Overall, MMA prices in India fell slightly during September 2025, consistent with regional bearishness.