Price-Watch’s most active coverage of Monel price assessment:

- Alloy 400 Del Alabama, USA

- Alloy 400 FD Hamburg, Germany

- Alloy 400 FOB Shanghai, China

- Alloy 400 Ex-Mumbai, India

Monel Price Trend Q3 2025

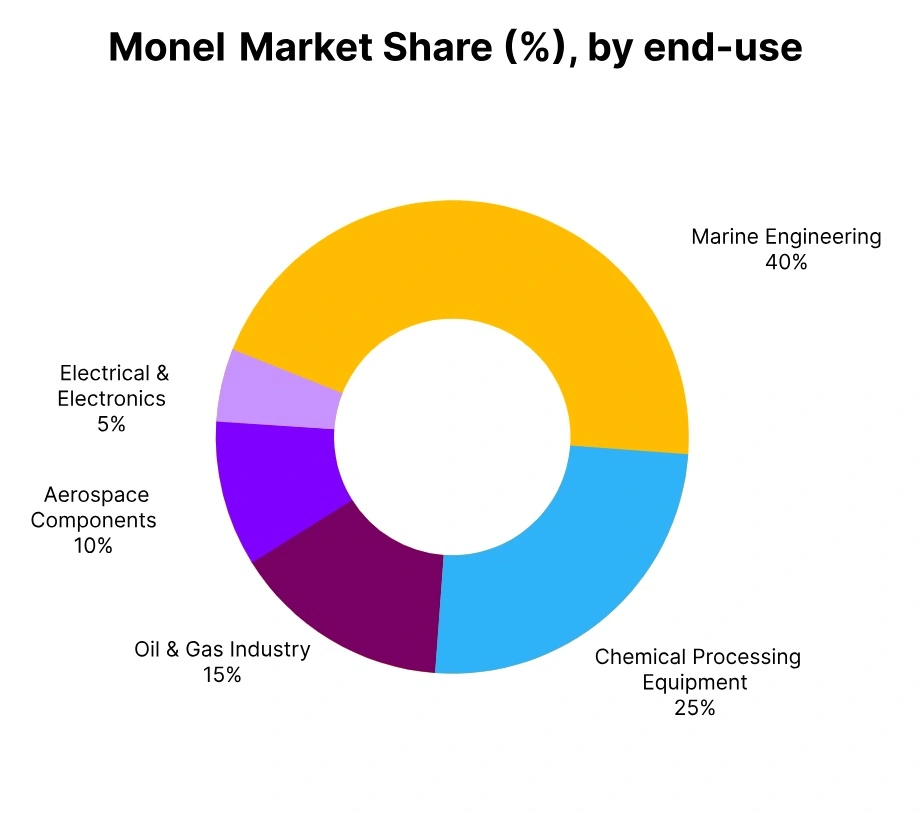

In Q3 2025, Monel prices have been on the rise in the global market, benefiting from strong demand in the marine, aerospace, and chemical industries, a tightening of supply from producers in the U.S. and Europe, and moderate gains in nickel and copper prices. Regional pricing data earlier in the quarter indicated a slight improvement earlier in the quarter however current Monel prices have seen an increase in the U.S., Germany, and Japan.

Although the nickel market remains in oversupply the price appears stable due to supply discipline and potential production cuts in key producing countries. In general, we feel that the outlook is positive, particularly with moderate nickel and copper pricing increases expected for the quarter.

China: Monel Export prices FOB Shanghai, China, Grade- Alloy 400.

According to Price-Watch, the price trend for Monel market in China in Q3 2025 continued to increase by 3.8% in prices compared to Q2 due to tighter nickel feedstock supply, recovering demand from chemical processing and marine sector, and caution in inventory management by producers. The price trend of Monel in China has been on an upward curve as limited new production capacity and rising input costs supported higher price realization.

While downstream demand showed signs of recovering, market sentiment has been cautious due to perceived risks of global nickel pricing fluctuations and weak stainless steel sector performance. Overall, Monel prices in China improved slightly supported by fundamentals and supply discipline.

In September 2025, Monel prices in China increased by 3.24%, reflecting upward pressure from raw material cost inflation from nickel and copper feedstocks and tight supply conditions in the alloy marketplace. At the same time, the incremental recovery in demand in some chemical processing and marine equipment sectors may have allowed producers to pass costs on to buyers.

India: Monel Domestic prices EX-Mumbai, India, Grade- Alloy 400.

According to Price-Watch, in India, Monel price trend experienced a slight 2.27% rise in Q3 2025 compared to Q2, fuelled by consistent demand from primary sectors like marine, chemical, and aerospace, and increased input costs of nickel and copper. Limited domestic capacity and steady industrial activity have further constrained supply, creating an enabling environment for higher prices.

Rising global nickel prices and supply chain constraints have also pressured the price of Monel and helped support a mild bullish sentiment in India’s specialty alloy market in the quarter. Monel prices rose 2.44% in September 2025 due to increasing global demand for corrosion-resistant alloys in marine and aerospace. Chain and increased import costs are creating upward pressure on prices as well.

Germany: Monel Domestic prices FD Hamburg, Germany, Grade- Alloy 400.

In Q3 2025, the price trend of Monel in Germany has increase by approximately 1.8% compared to Q2 2025, reflecting a modest upward momentum driven primarily by rising nickel and copper input costs and steady industrial demand. This slight price uptick has signaled cautious optimism amid ongoing supply constraints and potential restocking activities, while risks such as soft economic growth and competitive alloy alternatives have tempered further increases.

The 1.14% increase in Monel prices in Germany in September 2025 has been attributed to rising demand from the aerospace and marine industries, driven by renewed manufacturing activity. Additionally, global supply constraints and higher nickel costs have contributed to the upward pressure on prices. Overall, the market outlook has suggested a stable but gradually strengthening Monel pricing environment in Germany for Q3 2025.

USA: Monel Domestic prices Del Alabama, USA, Grade- Alloy 400.

According to Price-Watch, in Q3 2025, the price trend for the U.S. Monel market has seen a 2.03% increase compared to Q2, driven by rising costs of key raw materials like nickel and copper, strong demand from aerospace, marine, and chemical processing sectors, and ongoing supply chain constraints including limited melting capacity and trade delays.

This positive price trend has reflected the alloy’s critical role in high-performance applications, with expectations for continued upward pressure amid sustained demand and supply challenges, although potential raw material volatility could impact future pricing.

The 1.45% increase in Monel prices in the USA in September 2025 has likely reflected rising demand in key industries such as aerospace and chemical processing, coupled with supply chain constraints. Additionally, fluctuations in raw material costs and global market dynamics have contributed to the price adjustment.