Price-Watch’s most active coverage of MS Beam price assessment:

- Primary (400 NB) EX-Delhi NCR, India

- Primary (400 NB) EX-Mumbai, India

Mild Steel (MS) Beam Price Trend Q3 2025

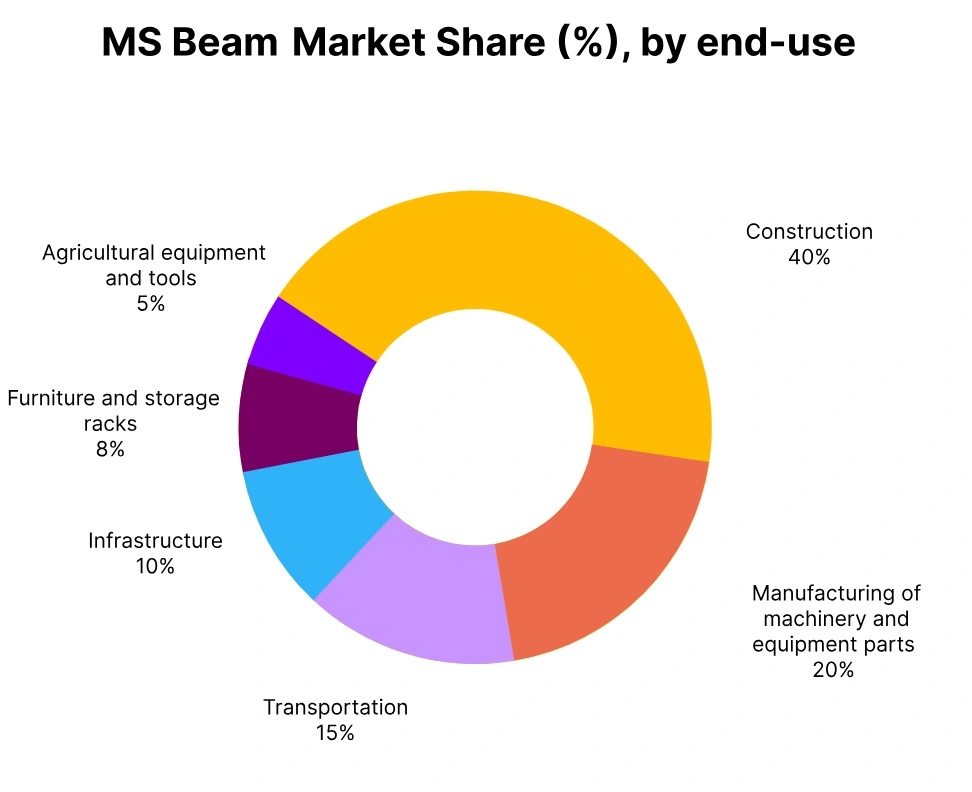

In the third quarter of 2025, the price of mild steel beams has seen a decline around the world due to lowered demand in the construction and automotive industries, with further pressure regarding oversupply as predictable increases in Chinese exports.

There have been minor price differences in each region, yet sentiment remained bearish overall with downward pressure from trade tariffs, increased inventories, and weak industrial activity. Major producers have reduced capacity to protect margins.

India: Mild Steel (MS) Beam Domestically traded prices Ex-Delhi-NCR, India, Grade- Primary (400NB).

According to Price-Watch, In Q3 2025, the mild steel (MS) beam price trend in India has witnessed a 2.17% decline compared to Q2 2025, primarily due to seasonal moderation in demand during the monsoon period and slight easing in raw material costs. Despite this decline, underlying demand from infrastructure and real estate sectors has remained supportive, with India’s overall steel demand projected to grow steadily throughout the year.

The decrease primarily reflects a short-term correction rather than a structural weakness, as government safeguards on imports and stable domestic production have continued to provide a price floor. Market participants have closely monitored input cost movements and policy changes, maintaining cautious optimism heading into Q4.

A 0.23% increase in mild steel (MS) beam prices in India during September 2025 has been attributed to a slight rise in raw material costs and steady demand from construction and infrastructure sectors. Additionally, global supply chain fluctuations and marginal increases in transportation expenses have contributed to this modest price adjustment.