Price-Watch’s most active coverage of Mild Steel (MS) Channel price assessment:

- Primary(100*50mm) EX-Delhi NCR, India

- Primary(100*50mm) EX-Mumbai, India

Mild Steel (MS) Channel Price Trend Q3 2025

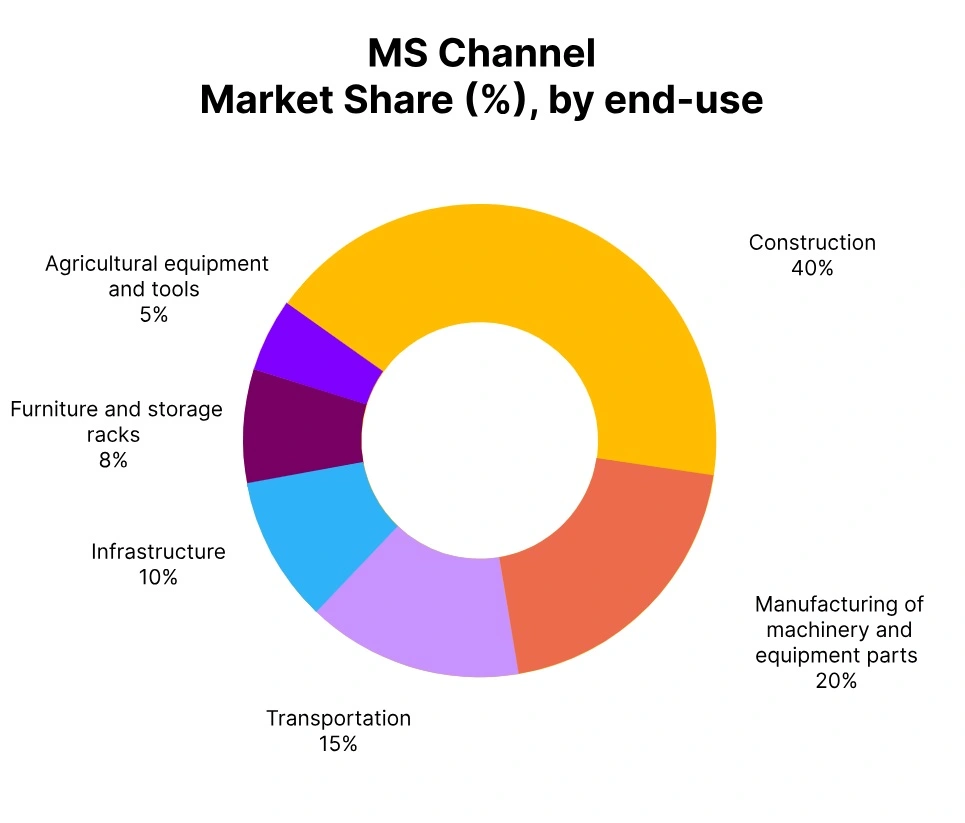

During the third quarter of 2025, the mild steel (MS) channel price trend worldwide has witnessed downward trajectory, as a result of weakened demand for mild steel channels in major sectors, such as construction and automotive, and in the face of oversupply in the marketplace driven by increased exports from China.

Although there has been some minor price fluctuations in selected regions, the overall marketplace sentiment remained bearish. Market prices have been further under pressure from trade tariffs, rising inventory levels, and low industrial activity.

Major producers have decreased capacity in an effort to maintain profitability, while prices have been expected to continue at decreased levels throughout 2025, unless there has to be a substantial increase in demand for the MS channel.

India: MS Channel Domestically traded prices Ex-Delhi-NCR, India; Grade- Primary (100*50mm).

According to Price-Watch, in Q3 2025, the mild steel (MS) channel price trend channel in India has recorded a 2.23% decline compared to Q2 2025, driven primarily by subdued demand from construction and infrastructure sectors due to seasonal monsoon slowdowns and delayed project activity.

Easing raw material costs and stable energy prices have contributed to the softer pricing environment, while competitive pressure from substitute structural steel products has further weighed on prices. Although long-term demand fundamentals have remained positive, short-term market sentiment has been cautious, resulting in moderate inventory build-up and pricing corrections across key regions.

In September 2025, Mild steel (MS) channel prices have increased marginally by 0.24%, attributable to a slight rise in raw material costs and steady demand from construction and infrastructure sectors. Additionally, global supply chain adjustments and fluctuations in iron ore prices have contributed to this marginal price increase.