Price-Watch’s most active coverage of Neopentyl Glycol (NPG) price assessment:

- Flakes(99.5% min purity) FOB Shanghai, China

- Flakes(99.2% min purity) FOB Busan, South Korea

- Flakes(99% min purity) FOB Houston, USA

- Flakes(99.2% min purity) CIF JNPT (South Korea), India

- Flakes(99.2% min purity) CIF Jakarta (South Korea), Indonesia

- Flakes(99.5% min purity) CIF JNPT (China), India

- Flakes(99.2% min purity) CIF Mersin (South Korea), Turkey

- Flakes(99.5% min purity) CIF Santos (China), Brazil

- Flakes(99.2% min purity) CIF Santos (South Korea), Brazil

- Flakes(99.2% min purity) Ex-Mumbai, India

Neopentyl Glycol (NPG) Price Trend Q3 2025

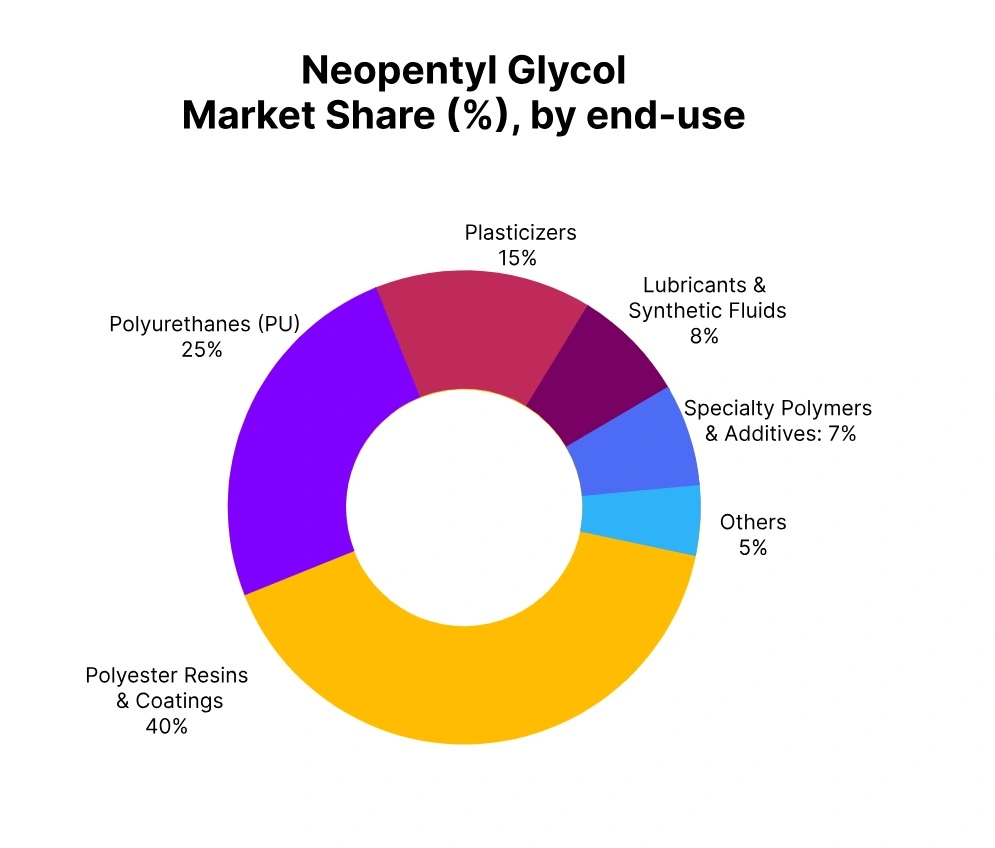

In Q3 2025, the global Neopentyl Glycol (NPG) market experienced a downward trend, with prices declining by around 10–20%. The dip was primarily driven by weaker demand from key downstream sectors such as polyester resins, coatings, and polyurethanes, coupled with softening orders from the automotive and construction industries. In spite of production levels staying largely stable, high inventories across major markets and cautious purchasing behavior among end-users applied additional downward pressure on prices.

China: Neopentyl Glycol (NPG) Export prices FOB Shanghai, China, Grade- Flakes (99.5% min purity).

In Q3 2025, Neopentyl Glycol (NPG) prices in China displayed a noticeable downward movement, with NPG prices in September 2025 ranging from USD 1050–1200/MT on an FOB China basis. The market trend during the quarter was influenced by the going down for feedstock costs for formaldehyde and butanal, following generally stable operating rates at major production facilities. Less demand from downstream polyester resins, coatings, and polyurethane sectors contributed to the weaker sentiment.

South Korea: Neopentyl Glycol (NPG) Export prices FOB Busan, South Korea, Grade- Flakes (99.2% min purity).

In Q3 2025, Neopentyl Glycol (NPG) prices in South Korea exhibited a notable downward movement, with NPG prices in September 2025 were between USD 1100–1250/MT on an FOB South Korea basis. The market trend during the quarter was influenced by declining feedstock costs, specifically formaldehyde and butanal, alongside stable production rates at major domestic facilities. Weakening demand from downstream sectors such as polyester resins, coatings, and polyurethanes further weighed on market sentiment.

USA: Neopentyl Glycol (NPG) Export prices FOB Houston, USA, Grade- Flakes (99% min purity).

In Q3 2025, Neopentyl Glycol (NPG) price trend in the USA had a noticeable downward movement, with NPG prices in September 2025 ranging between USD 1150–1300/MT on an FOB USA basis. The market trend during the quarter was swayed by less feedstock costs, including formaldehyde and butanal, along with mostly steady operating rates at major domestic production sites. Less demand from downstream applications, particularly in polyester resins, coatings, and polyurethanes, further weighed on market sentiment.

India: Neopentyl Glycol (NPG) import prices CIF JNPT, India, Grade- Flakes (99.2% min purity).

According to Price-Watch, in Q3 2025, Neopentyl Glycol (NPG) import prices into India showed a moderate downward trend, with NPG prices in September 2025 ranging between USD 1150–1300/MT on a CIF India basis. The price movement was mainly influenced by softer FOB prices from key suppliers in China and South Korea, coupled with steady freight rates. Weak demand from downstream industries, including polyester resins, coatings, and polyurethanes, added mild pressure on import pricing.

Indonesia: Neopentyl Glycol (NPG) import prices CIF Jakarta, Indonesia, Grade- (99.5% min purity).

In Q3 2025, Neopentyl Glycol (NPG) price trend in Indonesia exhibited a noticeable downward movement, with NPG prices in September 2025 ranging from USD 1150–1300/MT on a CIF Indonesia basis for products imported from South Korea. The market trend was influenced by softer FOB South Korea prices and steady freight conditions across regional shipping routes. Demand from downstream polyester resin and coatings industries remained quiet, which slightly weighed on market sentiment.

Turkey: Neopentyl Glycol (NPG) import prices CIF Mersin, Turkey, Grade- (99.2% min purity).

In Q3 2025, Neopentyl Glycol (NPG) prices in Turkey displayed a moderate downward movement, with NPG prices in September 2025 ranging between USD 1200–1350/MT on a CIF Turkey basis for products imported from South Korea. The market trend during the quarter was shaped by softer FOB South Korea pricing and steady freight rates across major shipping routes. Weakened demand from downstream polyester resin and lubricants sectors also weighed on market sentiment.

Brazil: Neopentyl Glycol (NPG) import prices CIF Santos, Turkey, Grade- (99.2% min purity).

In Q3 2025, Neopentyl Glycol (NPG) prices in Brazil displayed a moderate downward movement, with Neopentyl Glycol prices in September 2025 ranging between USD 1200–1350/MT on a CIF Brazil basis for products imported from South Korea and China. The Neopentyl Glycol price trend in Brazil was shaped by softer export prices from both supplying countries, along with stable freight rates and moderate import activity. Less demand from downstream coating resins and polyester applications further weighed overall sentiment, leading to quieter market dynamics.