Price-Watch’s most active coverage of Neoprene Rubber price assessment:

- Mercaptan Modified (MV: 46-55) FOB Shanghai, China

- Mercaptan Modified (MV: 45-53) FOB Tokyo, Japan

- Mercaptan Modified (MV: 42-52) FOB Hamburg, Germany

- Mercaptan Modified (MV: 45-53) CIF Nhava Sheva (Japan), India

- Mercaptan Modified (MV: 46-55) CIF Capetown (China), South Africa

- Mercaptan Modified (MV: 45-53) CIF Jakarta (Japan), Indonesia

- Mercaptan Modified (MV: 45-53) CIF Laem Chabang ( Japan), Thailand

- Mercaptan Modified (MV: 45-53) Ex-Delhi, India

Neoprene Rubber Price Trend Q3 2025

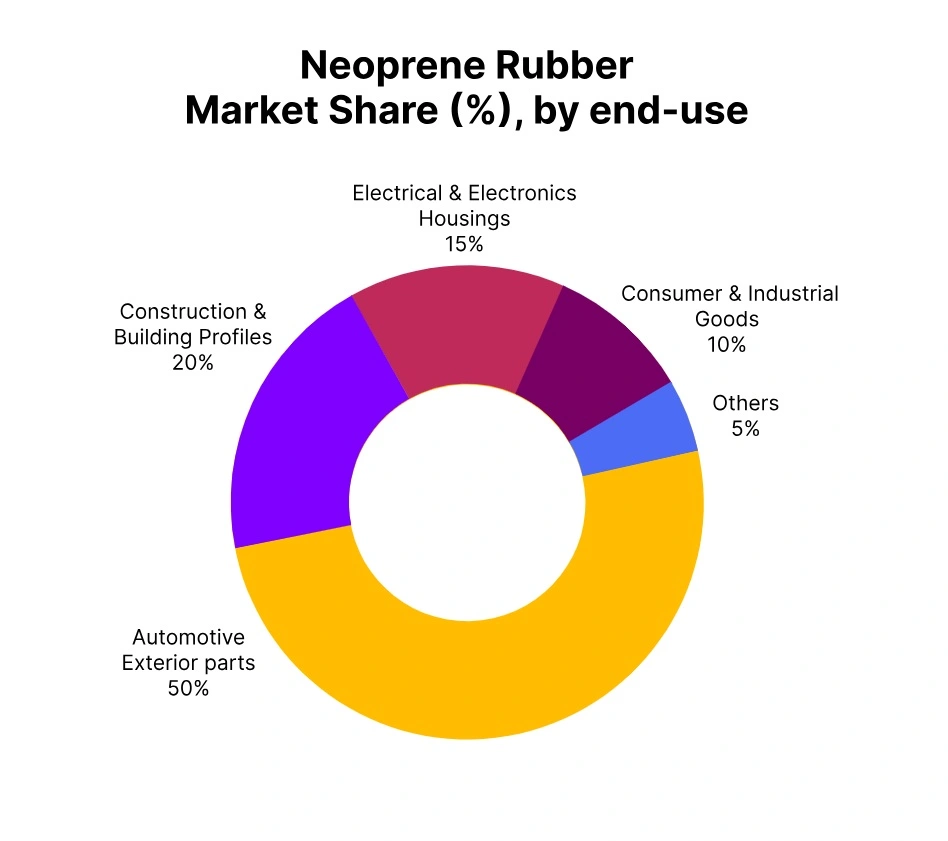

According to the PriceWatch, the global Neoprene Rubber price trend in Q3 2025 has reflected mixed trends across major regions, with an overall stable-to-soft sentiment. In the APAC region, China has witnessed slight weakness due to moderate demand from the construction and industrial sectors, while Japan and Southeast Asian markets such as Thailand and Indonesia have recorded mild gains supported by steady consumption from automotive and adhesive applications.

In Europe, prices in Germany have edged lower amid subdued industrial activity, whereas South Africa has maintained relative stability with balanced trade flows. Mid-quarter, supply conditions have tightened marginally following Arlanxeo’s force majeure and the DPE plant shutdown, which has contributed to reduced product availability in select regions.

Despite these constraints, global price movements have remained largely contained, reflecting offsetting regional dynamics. Looking ahead, gradual demand recovery in automotive and non-tire rubber goods manufacturing, coupled with expected normalization in supply, is likely to lend moderate support to market sentiment in the next quarter.

Japan: Neoprene Rubber Export prices FOB Tokyo, Japan, Grade- Mercaptan Modified (MV: 45-53).

Neoprene Rubber price trend in Japan has displayed a steady upward movement during Q3 2025, marking a 0.94% increase from the previous quarter. The Neoprene rubber prices have remained supported by consistent demand from the automotive, wire and cable, and industrial rubber goods sectors.

In September 2025, Neoprene rubber prices in Japan have further strengthened by 0.65% from August, reflecting steady procurement activity from downstream manufacturers. Midway through the quarter, a slight tightening in regional supply has been observed due to Arlanxeo’s force majeure and the DPE plant shutdown, which has temporarily impacted overall availability.

However, stable domestic production and firm export inquiries have helped maintain balanced market conditions. Looking ahead, continued demand from non-tire automotive applications and electrical components is expected to support a moderate price outlook into the next quarter.

Germany: Neoprene Rubber Export prices FOB Hamburg, Germany, Grade- Mercaptan Modified (MV: 42-52).

In Europe, Neoprene Rubber price trend in Germany has shown a downward trend through Q3 2025, reflecting a 1.16% fall from the previous quarter. The Neoprene rubber prices have faced mild pressure early in the quarter due to subdued industrial demand and cautious procurement from the construction and automotive sectors amid ongoing economic uncertainty. In September 2025, Neoprene rubber prices in Germany have rebounded by 1.0% from August, supported by improved buying interest and tighter regional availability.

The supply situation has remained moderately constrained mid-quarter following disruptions from Arlanxeo’s force majeure and the DPE plant shutdown, which has limited product flow across select European buyers. Despite this, stable consumption from adhesive, gasket, and industrial rubber applications has helped maintain a balanced market outlook, with gradual recovery expected heading into Q4 2025.

China: Neoprene rubber Export prices FOB Shanghai, China, Grade- Mercaptan Modified (MV: 46-55).

Neoprene Rubber price trend in China has witnessed a downward trend during Q3 2025, registering a 2.05% fall from the previous quarter. The softening Neoprene Rubber price sentiment has been mainly attributed to weak downstream demand from the construction and industrial sectors, alongside sluggish activity in the export market.

In September 2025, Neoprene rubber prices in China have declined by 0.35% from August, as buyers have remained cautious amid sufficient inventories and slow order inflows. Although supply tightness has emerged mid-quarter following Arlanxeo’s force majeure and the DPE plant shutdown, it has had limited immediate impact on local pricing due to muted consumption levels.

However, steady offtake from the adhesive and wire coating segments has provided some support. Looking ahead, moderate restocking and gradual recovery in industrial production could lend mild stability to prices entering Q4 2025.

South Africa: Neoprene rubber Import prices CIF Cape town (China), South Africa, MV (46-55).

Neoprene Rubber price trend in South Africa has remained relatively stable during Q3 2025, showing a marginal 0.12% increase from the previous quarter. The Neoprene Rubber prices have maintained a balanced tone, supported by consistent demand from the construction and automotive component sectors, while industrial consumption has remained moderate.

In September 2025, Neoprene rubber prices in South Africa have dropped 0.16% from August, as trading activity has softened amid stable inventory levels. Midway through the quarter, limited supply availability has been noted due to Arlanxeo’s force majeure and the DPE plant shutdown, which has slightly constrained regional sourcing options.

However, steady import arrivals and firm end-user demand have helped prevent any significant market fluctuations. Looking ahead, stable downstream consumption and the potential for moderate restocking activity are expected to keep prices largely steady through the early part of Q4 2025.

Thailand: Neoprene rubber Import prices CIF Laem Chabang (Japan), Thailand, Mercaptan Modified (MV: 45-53).

In Thailand, Neoprene Rubber price trend has been rising during Q3 2025, reflecting a 0.95% increase from the previous quarter. The Neoprene Rubber prices have remained supported by healthy demand from automotive components and industrial manufacturing sectors, while overall consumption in downstream industries has stayed moderate.

In September 2025, Neoprene rubber prices in Thailand have marked a modest 0.64% increase from August, as steady import flows and ongoing restocking by end-users have helped sustain market momentum. Supply constraints have been minimal during the quarter, although regional logistics and shipping schedules have occasionally influenced short-term availability.

Looking forward, continued stable demand from key consuming industries and potential incremental restocking activities are likely to keep Neoprene Rubber prices relatively steady in the early part of Q4 2025.

Indonesia: Neoprene rubber Import prices CIF Jakarta (Japan), Indonesia, Mercaptan Modified (MV: 45-53).

Neoprene Rubber price trend in Indonesia has been demonstrating an upward trend in Q3 2025, representing a 0.93% increase from the previous quarter. The Neoprene Rubber prices have been supported by consistent demand from the automotive components and industrial manufacturing sectors, while overall downstream consumption has remained moderate.

In September 2025, Neoprene Rubber prices in Indonesia have marked a 0.64% increase from August 2025, as steady import arrivals and ongoing restocking by end-users have helped maintain market momentum. Supply has remained largely stable throughout the quarter, with minimal disruptions reported. Looking ahead, continued firm demand from key consuming industries and potential moderate restocking activities are expected to keep Neoprene Rubber prices relatively steady in early Q4 2025.

India: Neoprene rubber Domestically traded prices Ex-Delhi, India, Grade- Mercaptan Modified (MV: 45-53).

According to the PriceWatch, in India, the neoprene rubber price trend in the domestic market has been showing a slight downward movement during Q3 2025, reflecting a 0.7% decrease from the previous quarter. The Neoprene Rubber prices in India have been pressured by moderate downstream consumption from automotive components and industrial sectors, while overall buying sentiment has remained cautious.

In September 2025, Neoprene Rubber prices in the Indian domestic market have recorded a further 0.5% fall from August levels, as limited restocking activity and steady supply availability have continued to weigh on the market.

Supply has remained largely balanced throughout the quarter, with no major disruptions reported. Looking ahead, subdued demand and cautious buying are expected to keep prices relatively soft in early Q4 2025.