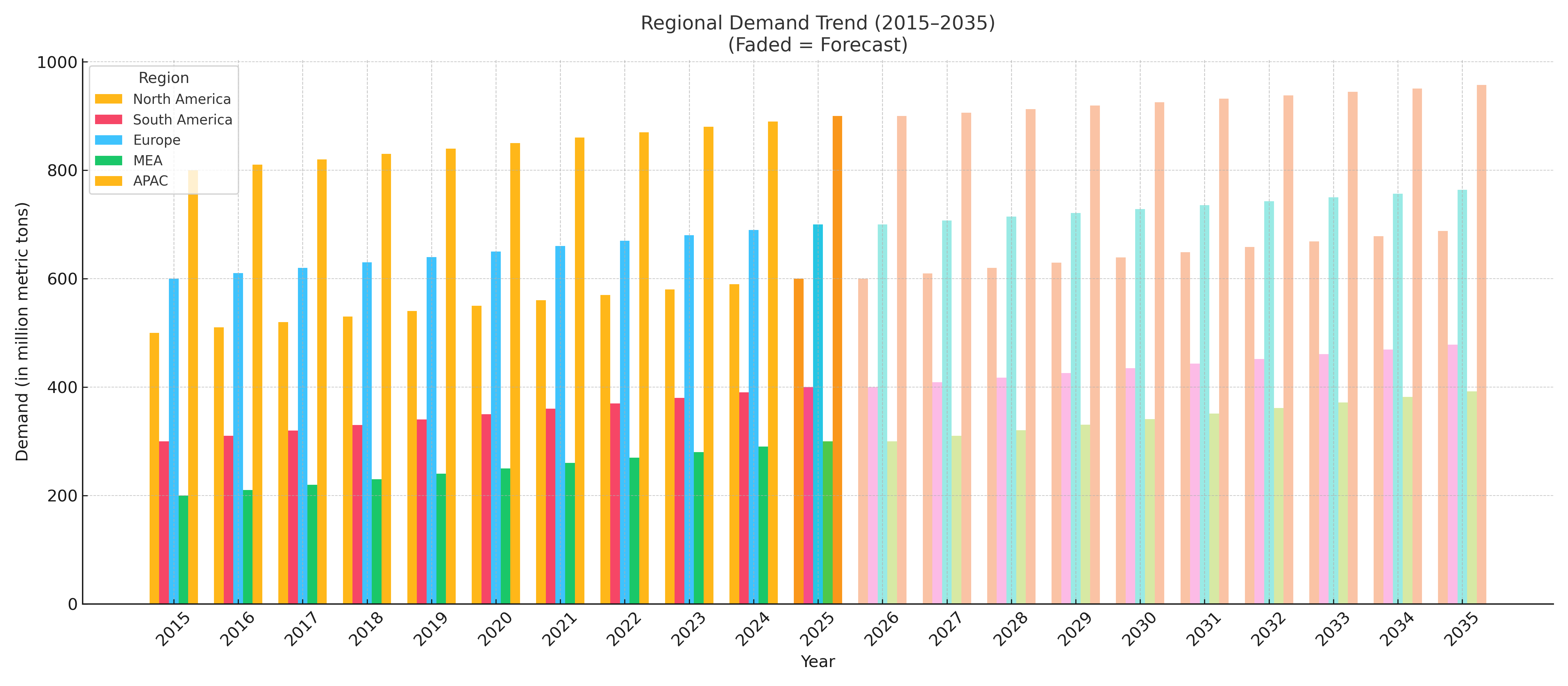

Demand doesn’t look the same everywhere. Our regional demand analysis helps you understand what sells where—so you can allocate resources, refine go-to-market strategies, and grow with precision.

Why Regional Matters

Markets are shaped by geography—economic conditions, consumer behavior, infrastructure, and local regulation all play a role. Region-specific demand data helps you respond to real-world nuances, not just global averages.

What You’ll Unlock

Local Insight, Global Impact

This isn’t just about heatmaps—it’s a detailed breakdown of demand by region, layered with economic, demographic, and industry-specific signals that help you stay sharp and proactive.

Argentina

Argentina Brazil

Brazil China

China Egypt

Egypt France

France India

India Israel

Israel Italy

Italy Japan

Japan Russia

Russia Saudi Arabia

Saudi Arabia South Africa

South Africa South Korea

South Korea Spain

Spain Turkey

Turkey Thailand

Thailand Vietnam

Vietnam Indonesia

Indonesia Pakistan

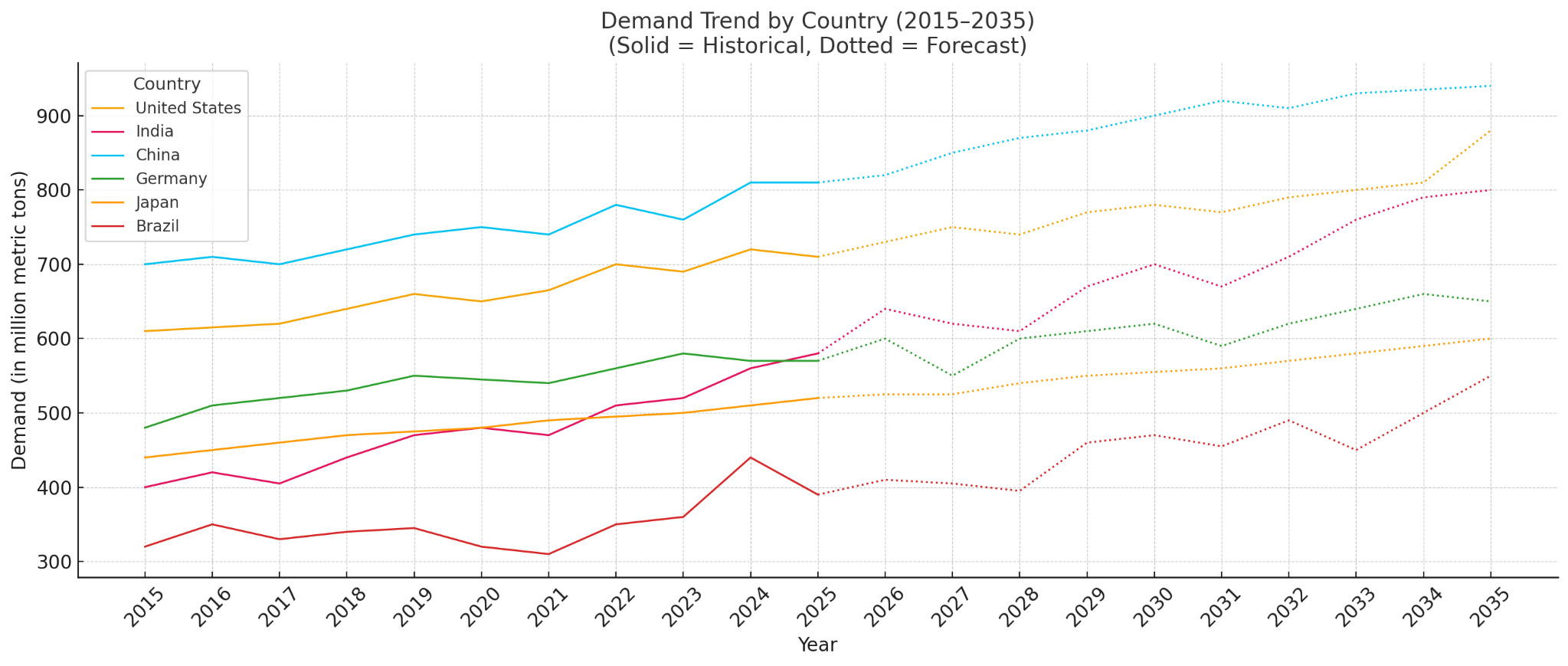

PakistanYour strategy shouldn’t stop at the border. Our country-level demand insights help you tailor decisions to each market’s unique profile—so you’re not flying blind.

Why Country-Level Data Counts

No two countries behave the same. Cultural preferences, economic cycles, industry development, and policy shifts all influence how demand evolves.

What We Deliver

See the Full Market Picture

We go beyond surface stats—delivering in-depth consumption trends, forecasts, and sector breakdowns that put you in control of country-specific strategy.

Want to know who’s actually using your product? Our end use industry analysis shows where demand is concentrated, what’s driving it, and how to win in each sector.

Why It Matters

From packaging to pharmaceuticals, each industry has its own needs, pace, and patterns. Knowing which sectors to focus on means better alignment and sharper growth.

What You’ll Gain

Tailor Your Strategy by Sector

Our breakdown covers everything from automotive to agriculture, helping you position smarter and sell better.

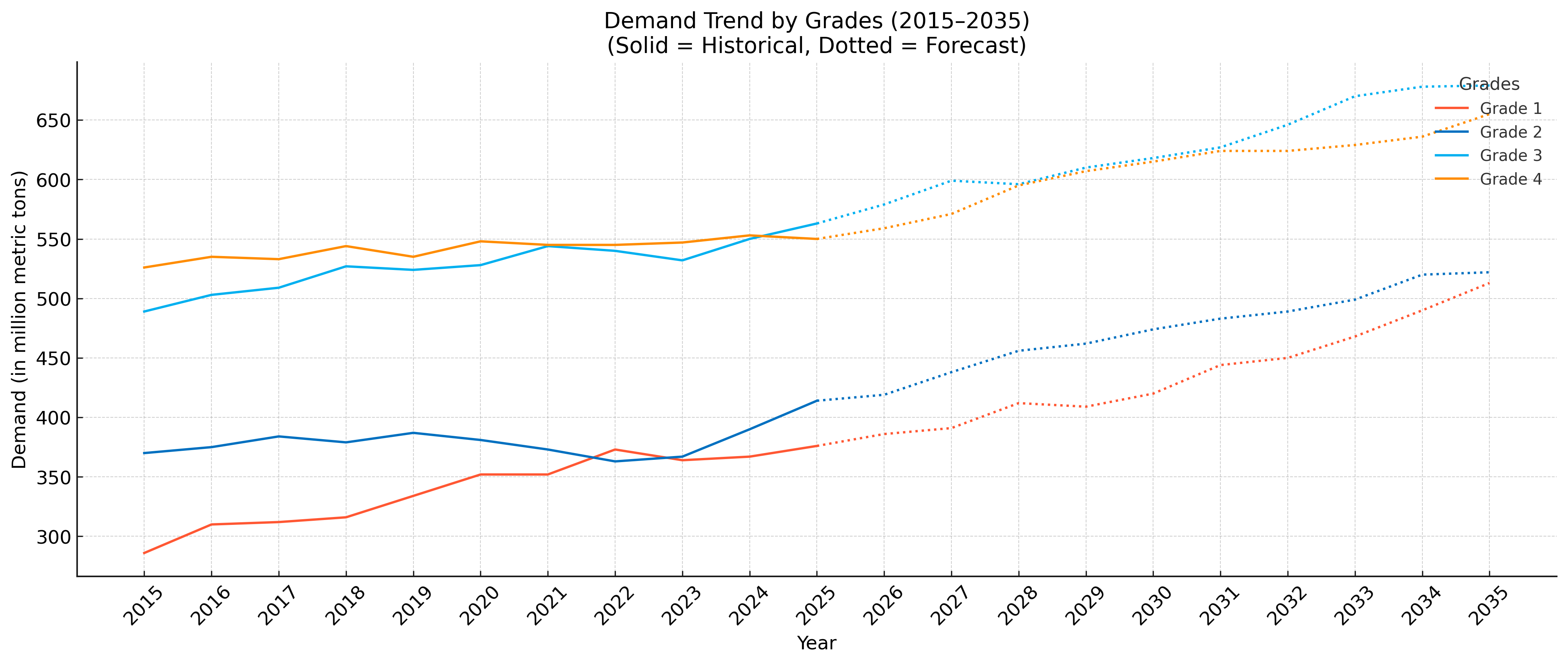

Not all products are created equal—and neither is the demand behind them. Our grade-level demand analysis lets you zoom into the specifics of what the market really wants.

Why Grade-Level Demand is Crucial

Different grades serve different applications, industries, and standards. Understanding these differences helps you align production, pricing, and positioning.

What You’ll Learn

Precision Over Generalization

We don’t stop at product categories—we break it down by grade to give you clarity where it counts most.

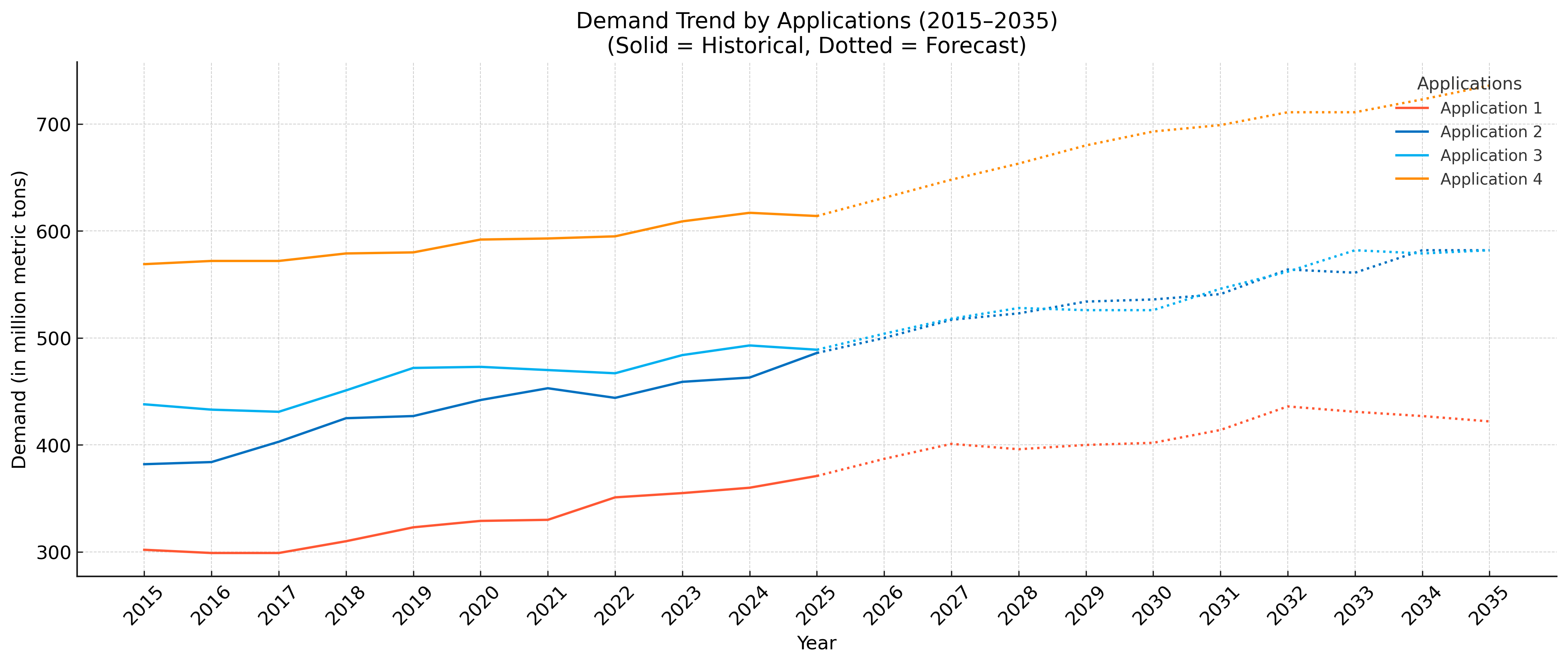

Products don’t sell in a vacuum—they solve specific problems. Our application-based demand analysis shows where and how your materials are being used, so you can align solutions with real-world needs.

Why Application Data Matters

A single product might serve ten different applications, each with different growth curves, risks, and standards. Application-level insights reveal the why behind the what.

What You Can Do

Build for Use, Not Just for Sale

This is insight for R&D, product, and marketing teams alike—get granular and get aligned.

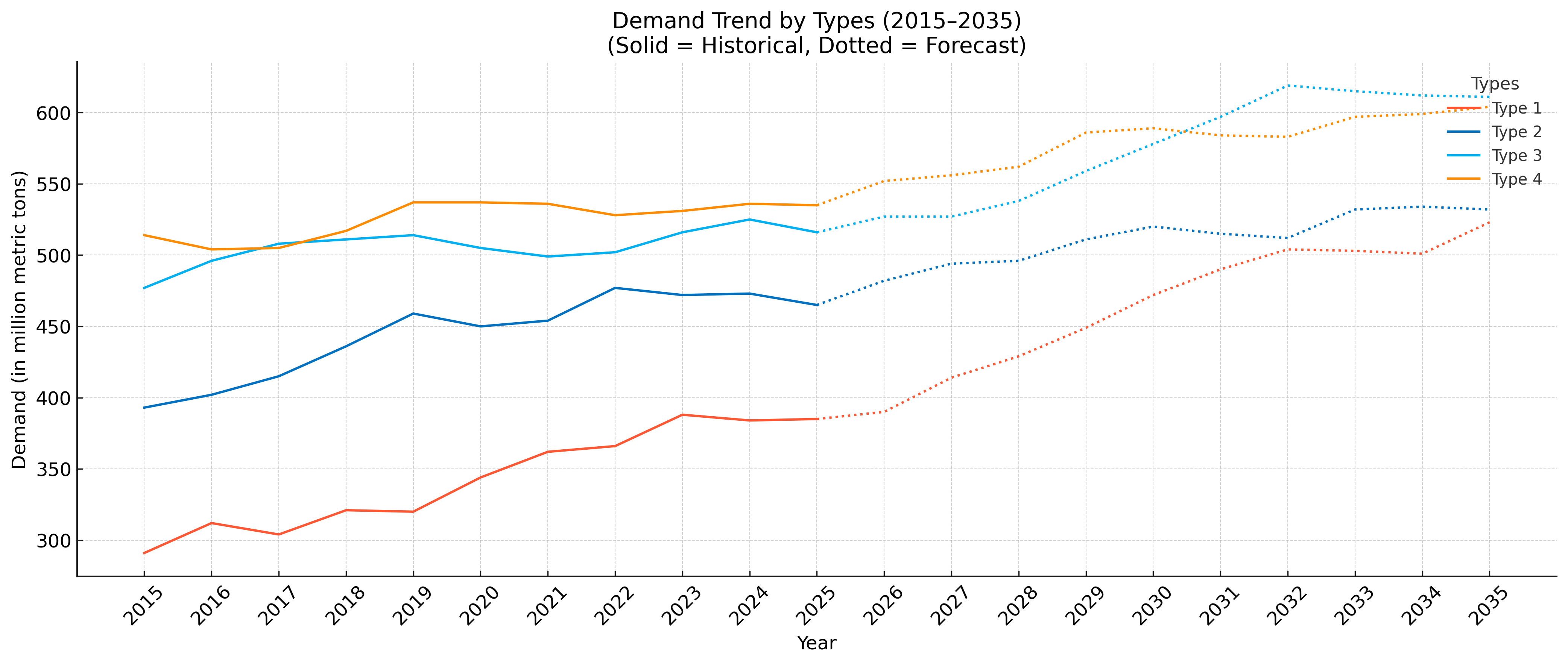

Market demand often splits by product type—even within the same category. Our analysis by type helps you understand which variants are winning and why.

Why It Matters

Whether you’re dealing with resins, lubricants, or alloys—different types serve different needs. Knowing which ones are gaining traction helps you stay one step ahead.

What You’ll Discover

Stop Guessing. Start Segmenting.

Use type-level demand to refine your roadmap, optimize the mix, and sharpen positioning across your portfolio.

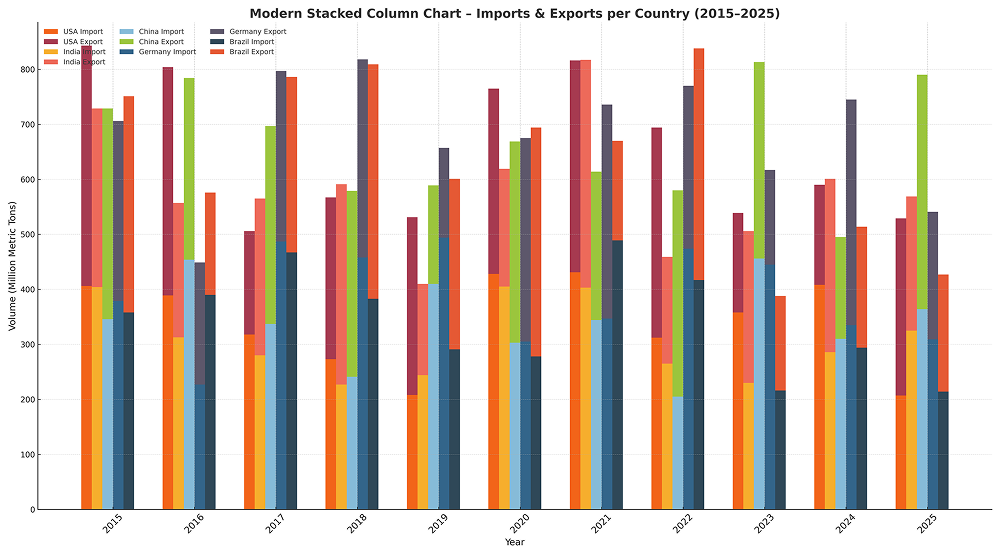

Trade tells you what’s moving—and what’s coming. Our import-export analysis reveals how products flow across borders and how those flows will evolve.

Why It’s Critical

Trade data is a leading indicator of demand shifts, supply stress, and market expansion. Paired with forecast models, it becomes a powerful strategic tool.

What You’ll Access

Move With Market Momentum

Whether you’re expanding markets or hedging against import risk, trade analysis equips you with the foresight to act with speed and strategy.

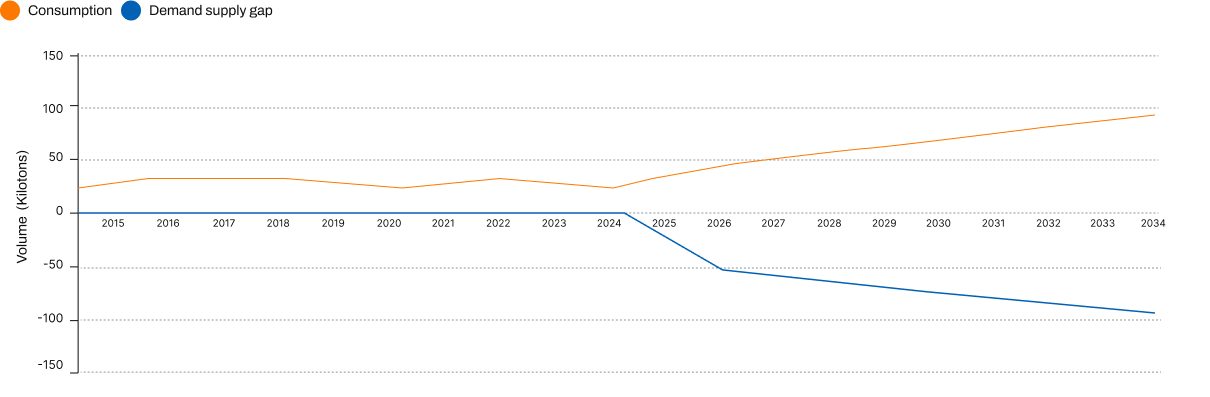

Where’s the imbalance—and where’s the opportunity? Our country-level demand-supply gap analysis highlights over- or under-served markets, giving you a competitive edge in planning, pricing, and production.

Why It Matters

A surplus signals risk. A shortage signals opportunity. Country-level gap data helps you allocate resources with surgical precision.

What You’ll Learn

Build Where It’s Needed Most

This analysis turns market imbalance into business intelligence—so you can lead with logic, not lag with hindsight.

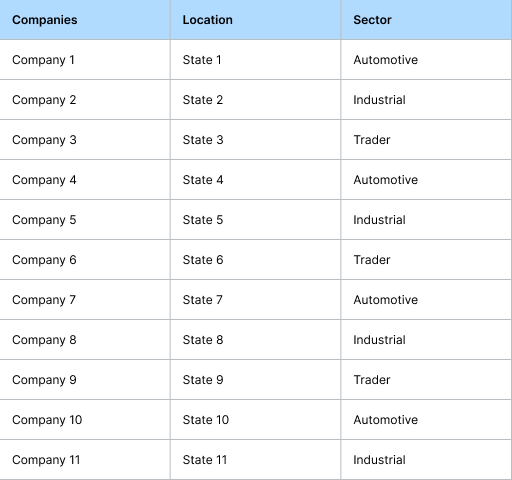

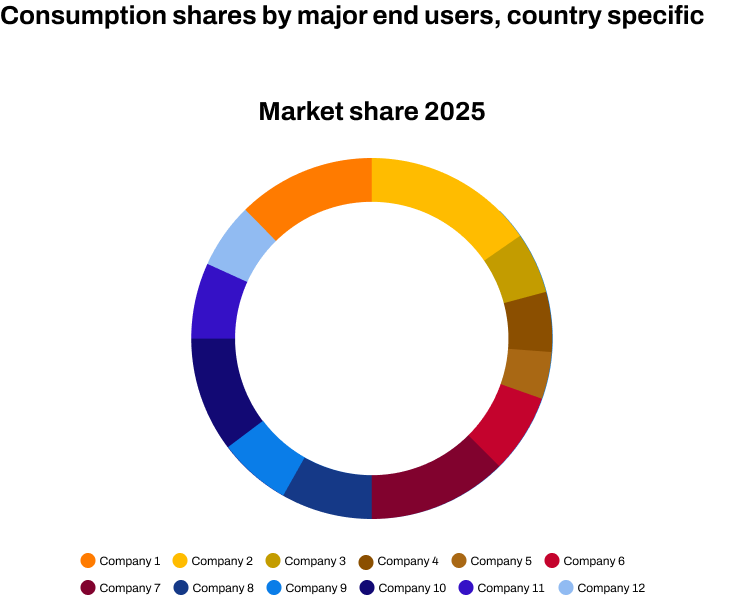

Get to know the real buyers. Our end-user consumption breakdown shows which industries within each country are driving demand—so you can target the right sectors with confidence.

Why End-User Insight Matters

National-level demand is only half the story. You need to know who’s using what—and where—to land the right customers and scale strategically.

What You’ll See

Sector Deep-Dives, Market by Market

We help you go from national macro trends to in-country micro-strategy.

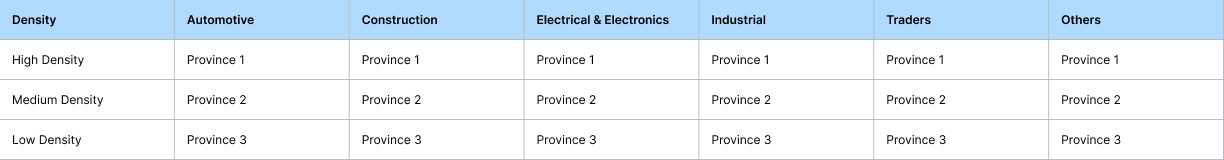

Zoom into customer behavior at the zone level to unlock sales efficiency and sharpen distribution strategy. From metro hubs to industrial clusters—this is how you win regionally.

Why It’s Powerful

Even within a single country, demand intensity, preferences, and purchase behavior vary by zone. Hyperlocal insight means you market smarter and deliver faster.

What You’ll Gain

Regional Precision, National Impact

Don’t just go to market—go to the right part of the market. Our zone-wise analysis turns regional insights into real sales wins.