Price-Watch’s most active coverage of Palm Oil price assessment:

- Grade: Crude Palm Oil (CPO) FOB Port Kelang, Malaysia

- Grade: Crude Palm Oil (CPO) CIF Houston (Malaysia), USA

- Grade: Crude Palm Oil (CPO) CIF Shanghai (Malaysia), China

- Grade: Crude Palm Oil (CPO) CIF Tokyo (Malaysia), Japan

- Grade: Crude Palm Oil (CPO) CIF Sharjah (Malaysia), United Arab Emirates

- Grade: Crude Palm Oil (CPO) CIF Nhava Sheva (Malaysia), India

Palm Oil Price Trend Q3 2025

During Q3 2025, the international Palm Oil market witnessed sustained price rises of 5-8% in major regions, indicating a balance between supply constraints and robust demand. In producing nations such as Malaysia, seasonal declines in production and export policy changes tightened supplies, sustaining firm prices.

Major import market destinations like the USA, China, Japan, United Arab Emirates, and India each experienced significant palm oil price trend increases fueled by factors like Biofuel demand, import competition, and pre-holiday stockpiling buying. Shipping costs tended to be steadily or modestly higher in most areas, contributing to moderate upward pressure.

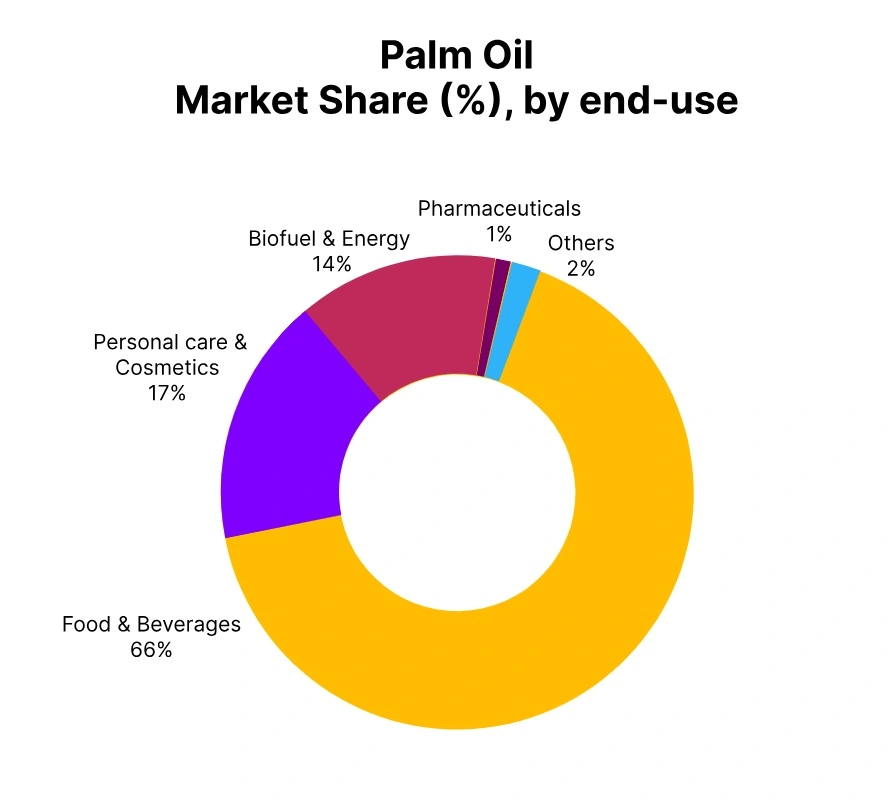

Despite some supply issues and economic volatility, overall demand was firm, particularly for Food and Biodiesel applications. This tentative increase in price indicates a market adapting to changing production circumstances and ongoing international consumption, with projections for ongoing modest increases in the next quarter.

Malaysia: Palm Oil Export prices FOB Port Kelang, Malaysia, Grade Crude Palm Oil (CPO).

In Q3 2025, Palm Oil prices in Malaysia registered a 5.73% increase over the prior quarter. Crude Palm Oil (CPO) prices averaged between USD 950-1065 per metric ton. The uptick on the palm oil price trend in Malaysia was prompted by seasonally declining production and firmer export demand, which cut local supplies. Export policy changes further cut back volumes, underpinning firm prices.

Domestic weather interruptions in key plantation belts further clipped near-term supplies. Furthermore, the decline in the value of the Malaysian ringgit further increased the appeal of Palm Oil to international consumers, driving export demand higher.

In September 2025, prices rose by 0.87%, with buying interest expected to stay muted in the near term. Despite some geopolitical tariff issues, Malaysia’s industry concentrated on market diversification and sustainable production to remain competitive.

USA: Palm Oil Import prices CIF Houston, Malaysia, Grade Crude Palm Oil (CPO).

According to PriceWatch, in Q3 2025, Palm Oil prices in the USA recorded a steep growth of 6.09% from the last quarter. Prices of Crude Palm Oil (CPO) Prices floated around USD 1130-1195 per metric ton. Freight charges increased notably, adding upward pressure to the overall palm oil price trend in the USA. It was then fueled by robust Biofuel demand and constricting global vegetable oil supplies. Competitive importers bidding for short Malaysian cargoes supported firmer prices.

Sellers adopted conservative price policies under tight supply conditions. In September 2025, prices rose sharply by 1.78%, with market sentiment remaining cautious in the near term. The USA continued to be one of the largest importers of Palm Oil from Malaysia, supporting its position in international price trends. Optimism in the market was balanced by uncertainties regarding geopolitical trade policy and domestic economic considerations.

China: Palm Oil Import prices CIF Shanghai, Malaysia, Grade Crude Palm Oil (CPO).

According to PriceWatch, in Q3 2025, Palm Oil price trend in China rose by 5.74% quarter-on-quarter. Malaysian Crude Palm Oil (CPO) prices were between USD 973-1080 per metric ton. Small freight charge hikes and logistic tightening contributed to positive price trend in China. The upward price was boosted by firm Malaysian export volumes, even as local demand softened. Malaysian supply restrictions imposed a strong market tone, while tentative buying contained sharper price increases.

In September 2025, prices rose by 1.09%, with overall market sentiment likely to remain guarded in the near term. China remained an important regional market, balancing the needs of demand with supply constraints. Policy initiatives and future fiscal stimulus packages were seen to be supporting demand in the months ahead.

Japan: Palm Oil Import prices CIF Tokyo, Malaysia, Grade Crude Palm Oil (CPO).

In Q3 2025, Palm Oil price trend in Japan recorded a solid 6.19% increase from the previous quarter. The prices offered for Crude Palm Oil (CPO) were between USD 1005-1110 per metric ton. Firm Malaysian benchmark prices and stable freight rates underpinned this rise. Export volumes were restricted, though firm importer demand ensured strong positive price trend in Japan. In September 2025, prices increased by 0.95%, with pricing stability expected to remain fragile soon.

Japan’s increasing demand for sustainably produced Palm Oil introduced complexity into price dynamics. In spite of positive price movement, market players observed that price stability was still weak on account of uncertainties in the global economy and volatile trade patterns. This guarded optimism characterized the Japanese market mood in the quarter.

United Arab Emirates: Palm Oil Import prices CIF Sharjah, Malaysia, Grade Crude Palm Oil (CPO).

In Q3 2025, Palm Oil price trend in the United Arab Emirates increased moderately by 5.99%. Crude Palm Oil (CPO) prices were between USD 1060-1170 per metric ton. Freight charges stabilized, and cautious seller actions checked against more aggressive price trends in the UAE. The growth was underpinned by well-balanced supply and demand fundamentals. In September 2025, prices declined slightly by 0.76%, with buying interest likely to remain limited in the near term.

The UAE remained dependent on Malaysian Palm Oil imports, which maintained steady trade volumes. But the modest price adjustment relative to the previous quarter indicated a cautious buying attitude. Market players were observing global supply dynamics and regional demand shifts underpinning price directions in the Gulf closely.

India: Palm Oil Import prices CIF Nhava Sheva, Malaysia, Grade Crude Palm Oil (CPO).

In Q3 2025, Palm Oil price trend in India witnessed the quarterly rise of 8.50%. Crude Palm Oil (CPO) prices were in the range of USD 991-1120 per metric ton. Increased freight rates contributed to the upward pressure on the palm oil price trend in India. The steep upsurge was led by the Malaysian supply being tight and Palm Oil becoming more expensive vis-a-vis alternative oils due to firm global demand.

Government policies reducing import duties added to the heightened import volumes in spite of the tight supply. In September 2025, prices rose by 1.27%, with market conditions expected to remain firm soon. India’s festive season requirements and Biofuel blending obligations also fortified the bullish price climate. Purchasers struggled to procure adequate quantities, maintaining high prices throughout the quarter.