Price-Watch’s most active coverage of Palm Olein price assessment:

- Grade: Crude Palm Oil FOB Port Kelang, Malaysia

- Grade: Crude Palm Oil CIF Houston (Malaysia), USA

- Grade: Crude Palm Oil CIF Shanghai (Malaysia), China

- Grade: Crude Palm Oil CIF Tokyo (Malaysia), Japan

- Grade: Crude Palm Oil CIF Sharjah (Malaysia), United Arab Emirates

- Grade: Crude Palm Oil CIF Nhava Sheva (Malaysia), India

Palm Olein Price Trend Q3 2025

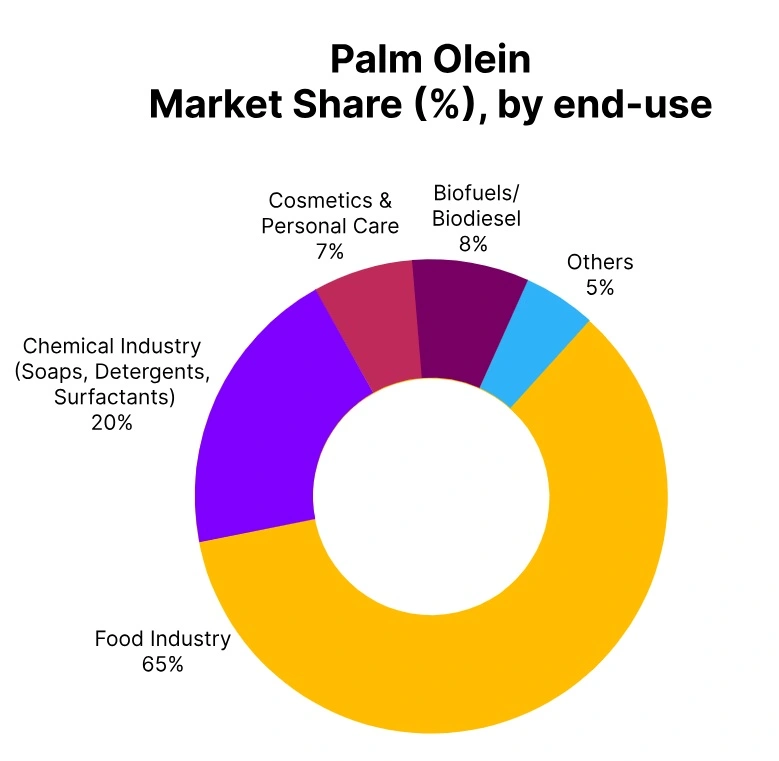

In Q3 2025, the Palm Olein market globally witnessed robust price increases of 6–9% in major regions due to persistent supply tightness and solid demand. In Malaysia, lower production and export limitations maintained high prices, solidifying its benchmark position. Major importers such as the USA, China, Japan, UAE, and India witnessed significant price rises primarily owing to increased Food industry requirements, Biofuel application, and pre-holiday stockpiling.

Shipping prices stayed flat to slightly up, putting moderate added pressure. Despite financial and weather pressures, food and Biodiesel demand for Palm Olein remained strong, and sentiment favored forecasts of additional slight Palm Olein price trend hikes in the next quarter.

Malaysia: Palm Olein Export prices FOB Port Kelang, Malaysia, Grade- RBD Palm Olein.

In Q3 2025, RBD Palm Olein prices in Malaysia posted a 6.47% increase from the earlier quarter as prices were between 1025–1115 USD per metric ton. The growth came because of seasonally low domestic output and strong export demand, which depleted local stocks and raised Palm Olein price trend in Malaysia. Export policy adjustments were the foundation behind the tight supply scenario, while weather-related disruption further cut output.

In September 2025, Palm Olein prices rose by 2.04%, with pricing stability expected to remain fragile soon. The weakening Malaysian ringgit continued to render Palm Olein more competitive for overseas buyers. Through market diversification and sustainability, Malaysia maintained its position as the world benchmark for RBD Palm Olein, even amid continued competition and supply-side pressure.

USA: Palm Olein Import prices CIF Houston, Malaysia, Grade- RBD Palm Olein.

In Q3 2025, RBD Palm Olein prices in the USA showed a strong 6.99% increase over Q2 at 1160–1255 USD per metric ton. Palm Olein price trend in the USA was driven by steep freight hikes, the heavy demand from the US Biofuel market, and diminishing global inventories of vegetable oils. US purchasers had to fiercely compete for Malaysian deliveries as suppliers had fixed pricing strategies in the face of tight supplies.

In September 2025, Palm Olein prices increased by 2.80%, with buying interest likely to remain limited in the near term. Although the USA remained an important Palm Olein importer, shifting trade talks and macroeconomic volatilities necessitated flexible sourcing strategies and proactive market risk management.

China: Palm Olein Import prices CIF Shanghai, Malaysia, Grade- RBD Palm Olein.

During Q3 2025, RBD Palm Olein prices in China recorded a 6.37% quarterly growth, with prices between 1040–1130 USD per metric ton. An increase in freight prices by a small margin was also responsible for the offered Palm Olein price trend in China, buoyed by robust demand from China’s Food and processing sectors. Importing behavior was influenced by competition from other edible oils as well as conservative inventory management.

In September 2025, Palm Olein prices rose by 3.05%, with overall market sentiment likely to remain guarded in the near term. Malaysian RBD Palm Olein remained to be in demand based on its stability, quality, and flexibility to adjust to shifting logistic needs, with Chinese buyers remaining active in procurement despite the dynamic changes in supply chains.

Japan: Palm Olein Import prices CIF Tokyo, Malaysia, Grade- RBD Palm Olein.

In Q3 2025, RBD Palm Olein prices in Japan grew 6.67% from Q2, with Prices ranging from 1070–1165 USD per metric ton. The market was hit by steep rises in freight rates, making costs heavier amid worldwide supply pressures and steeper alternative Palm Olein price trend in Japan. Japanese firms retaliated with robust logistics strategies and smart supplier tactics, obtaining regular Malaysian supplies to ensure supply.

In September 2025, Palm Olein prices rose by 2.09%, with market conditions expected to stay firm soon. Stable pricing and reliability of RBD Palm Olein further consolidated Malaysia’s role as a favorite supplier to Japan’s edible oil market during the quarter.

United Arab Emirates: Palm Olein Import prices CIF Sharjah, Malaysia, Grade- RBD Palm Olein.

During Q3 2025, RBD Palm Olein prices in the United Arab Emirates experienced growth by 6.85% from Q2 levels, with prices between 1125–1220 USD per metric ton. Modest freight hikes added a further positive Palm Olein price trend in the UAE, but importers reacted through variegated procurement and stock management strategies to ensure flexibility and inflation.

In September 2025, Palm Olein prices increased slightly by 0.38%, with pricing stability expected to remain fragile in the near term. Malaysian RBD Palm Olein was kept as a preferred option with punctual delivery and consistent quality. Sharp procurement strategies and forward contracts ensured that UAE buyers were able to tackle moderate inflation and ensure market stability.

India: Palm Olein Import prices CIF Nhava Sheva, Malaysia, Grade- RBD Palm Olein.

According to Price-Watch, in Q3 2025, RBD Palm Olein prices in India saw the sharpest quarterly growth across key importing nations, with prices up 8.93% from the last quarter and cargoes valued between 1085–1170 USD per metric ton. The strong growth in the Palm Olein price trend in India was spurred by steeply escalating freight costs and high demand from the food industry, particularly in the hospitality and packaged foods segments.

Indian consumers applied adaptable sourcing and flexible procurement strategies to offset exchange rate and tariff volatility. In September 2025, Palm Olein prices rose by 2.39%, with buying interest likely to remain limited in the near term. Stable Malaysian supply contributed to India’s stable edible oil demand, giving it its crucial position amidst turbulent global price and availability dynamics.