Price-Watch’s most active coverage of Para Nitro Toluene (PNT) price assessment:

- Technical Grade (>99%) Ex-Bharuch, India

- Technical Grade (>99%) FOB Nhava Sheva, India

- Technical Grade (>99%) FOB Hamburg, Germany

Para Nitro Toluene (PNT) Price Trend Q3 2025

In Q3 2025, the global Para Nitro Toluene (PNT) market showed uneven performance across regions. Western markets such as Germany showed slight price softness due to weak demand from pharmaceutical and specialty chemical sectors amid subdued industrial activity. European regions were comparatively stable with minimal downward pressure, as consistent product quality and reliable supply offset cautious procurement.

Nevertheless, Asia-Pacific markets experienced mixed trends with India recording a marginal decline in domestic prices due to balanced supply and moderate downstream demand, while export prices from India showed slight strength supported by steady overseas orders from Europe and Southeast Asia.

In general, the market remained reasonably balanced underpinned by stable industrial activity, stable feedstock supply, and moderate freight conditions. Regional supply chain fundamentals and disparate downstream consumption trends continued to drive pricing during the quarter.

India: Para Nitro Toluene (PNT) Domestically Traded Price in India, Technical Grade (>99%) Ex-Bharuch.

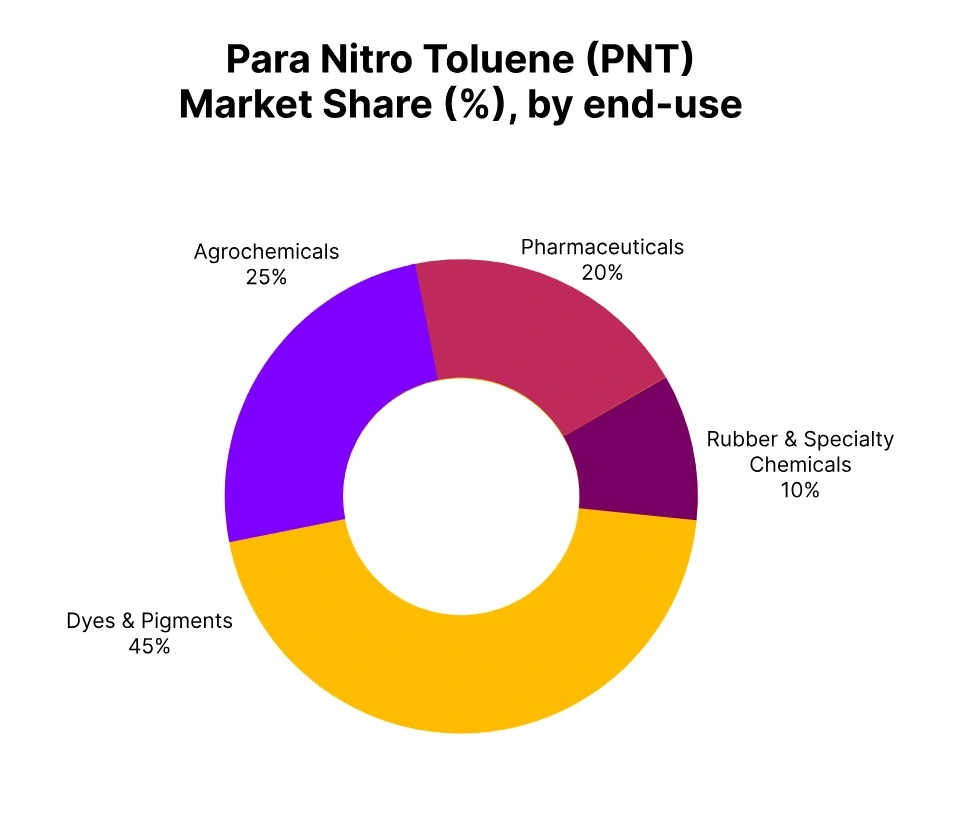

According to Price-Watch, in Q3 2025, Para Nitro Toluene (PNT) price in India has shown slight softness, reflecting balanced supply and moderate demand from downstream dye, pigment, and agrochemical sectors. Ex-Bharuch prices ranged between USD 580–620 per metric ton, marking a quarterly decline of –1.17%.

Production from Gujarat-based chemical clusters remained stable, with no major disruptions reported. In September 2025, PNT prices in India have risen by 0.56% from the previous month, indicating modest buying activity amid steady industrial operations.

The Para Nitro Toluene (PNT) price trend in India has been influenced by limited feedstock Toluene and Nitric Acid volatility, supporting stable production margins. Local buyers maintained steady procurement, particularly in textile and specialty chemicals sectors. Overall, the market remained balanced, with pricing influenced by consistent supply and moderate domestic demand.

Germany: Para Nitro Toluene (PNT) Export Price from Germany, Technical Grade (>99%) FOB Hamburg.

In Q3 2025, Para Nitro Toluene (PNT) price in Germany has shown slight softness, reflecting weak demand from downstream specialty chemical and pharmaceutical intermediate sectors in Europe. FOB Hamburg prices ranged between USD 460–480 per metric ton, marking a slight quarterly decline. German producers maintained high product purity and reliable supply, but subdued industrial output continued to limit offtake.

In September 2025, Para Nitro Toluene (PNT) prices in Germany have eased by 0.95% from the previous month, reflecting cautious procurement amid soft regional manufacturing activity. The Para Nitro Toluene (PNT) price trend in Germany has been influenced by mildly softened feedstock Toluene costs, supporting stable production margins. Overall, the market remained balanced, with pricing underpinned by quality differentials despite weak demand momentum.