Price-Watch’s most active coverage of Paraformaldehyde (PFA) price assessment:

- Industrial Grade Powder(96% purity) FOB Shanghai, China

- Industrial Grade Prills (96% purity) FOB Barcelona, Spain

- Industrial Grade Prills (96% purity) FD Hamburg, Germany

- Industrial Grade Prills (92% purity) FOB Kaohsiung, Taiwan

- Industrial Grade Prills (96% purity) CIF JNPT (Spain), India

- Industrial Grade Prills (96% purity) CIF Houston (Spain), USA

- Industrial Grade Prills (92% purity) CIF Busan (Taiwan), South Korea

- Industrial Grade Powder(96% purity) CIF Busan (China), South Korea

- Industrial Grade Prills (96% purity) CIF Busan (Spain), South Korea

- Industrial Grade Powder(96% purity) CIF Apapa (China), Nigeria

- Industrial Grade Prills (91% purity) FOB Barcelona, Spain

Paraformaldehyde (PFA) Price Trend Q3 2025

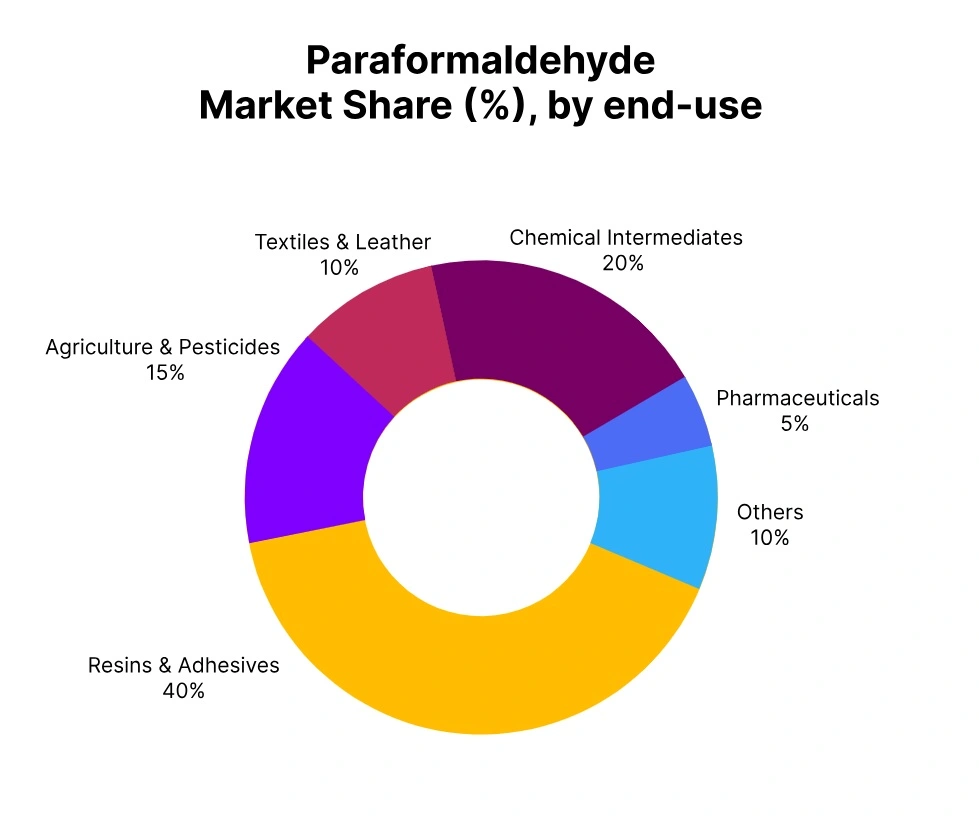

In the third quarter of 2025, the Paraformaldehyde markets around the world experienced varying trends across regions. In Asia, Paraformaldehyde (PFA) prices saw a modest increase of about 1–3%, helped by an uptick in demand from the resin, adhesive and disinfectant industries and tighter inventories in key production regions.

In contrast, the rest of the regions observed price weakening of about 5-10%, influenced by weak downstream consumption and ample inventories in the supply chain. Production levels generally held steady, while cautious buying from end-users and logistical delays in some exporting countries contributed to price moderation outside of Asia.

Moving forward, a slow improvement in demand in certain Asian markets could continue to bolster prices to a small extent, while in a large portion of the markets, if inventories remain plentiful, we will likely see prices decrease further.

China: Paraformaldehyde (PFA) Export prices FOB Shanghai, China, Grade- Industrial Grade Powder (96% purity).

Within the scope of Q3 2025, the Paraformaldehyde price levels in China established a moderately weak market fundamentals primarily due to feedstock prices trend and competitive supply factors in the region. The Paraformaldehyde price trend context continued to be responsive to variances in formaldehyde and methanol prices, yet overall production operating rates were stable for most of the Chinese producer market.

Paraformaldehyde FOB prices were determined to be in the range of USD 600–700/MT in September 2025, with only slight pricing pressure downwards in the context of ample production and steady inventory levels. Volume demand levels from the end use markets for resins, adhesives, and disinfectants remained moderate overall amid balanced availability and consistent shipment schedules which limited any sharp price spikes or dives in pricing levels.

In summary, the Paraformaldehyde price levels in China demonstrated slight moderation levels, with the Paraformaldehyde price levels in China following the general feedstock ambiance closely.

Spain: Paraformaldehyde (PFA) Export prices FOB Barcelona, Spain, Grade- Industrial Grade Prills (96% purity).

In the third quarter of 2025, Paraformaldehyde prices in Spain portrayed a mildly soft market as the situation was largely influenced by feedstock cost trends and subtle regional supply adjustments. Paraformaldehyde (PFA) price trends were driven primarily by moderate fluctuations in formaldehyde and methanol prices, with usual stable operating rates among regional producers.

For September 2025, Paraformaldehyde FOB prices were in the range of USD 650 – 750/metric tonne (MT), with mild downward pressure from stable production levels as well as moderate inventories. Domestic demand from downstream resin, adhesive, disinfectant, etc., sectors remained particularly cautious for the period, while adequate availability and stable shipment schedules kept any price activity in check.

Germany: Paraformaldehyde (PFA) import prices FOB Hamburg, Germany, Grade- Industrial Grade Prills (96% purity).

In the third quarter of 2025, paraformaldehyde prices in Germany exhibited a slightly softer tone, driven by the trends in feedstock costs and adjustments in local supply. Paraformaldehyde (PFA) price trend was impacted by gentle shifts in formaldehyde and methanol price changes and stable operating rates amongst German producers.

In September 2025, paraformaldehyde FOB prices were assessed in the realm of USD 700-800/MT, indicating some mild downward pressure in the marketplace during balanced production and inventories. Domestic demand from downstream sectors such as resins, adhesives, and disinfectants had a muted tone, but sustained availability and consistent shipments prevented the occurrence of sharp price changes.

Taiwan: Paraformaldehyde (PFA) import prices FOB Kaohsiung, Taiwan, Grade- Industrial Grade Prills (92% purity).

In Q3 2025, Paraformaldehyde prices in Taiwan demonstrated an easing of market conditions, led by trends in feedstock costs and variations in regional supply. Paraformaldehyde (PFA) Price trends were influenced by mild daily fluctuations in formaldehyde and methanol prices, with the operating rates for Taiwanese producers remaining relatively stable overall.

Paraformaldehyde FOB prices in the September timeframe were assessed to be approximately in the range of USD 600–700/MT, showing mild softening for the month. Domestic demand from resins, adhesives, and disinfectants remained weak or cautious, but sufficient supply and steady shipping patterns limited movement in prices.

India: Paraformaldehyde import prices CIF JNPT, India, Grade- Industrial Grade Prills (96% purity).

According to Price-Watch, in the third quarter of 2025, the market sentiment for Paraformaldehyde imports into India appeared to be mildly soft, reflecting market developments on the prices calculated from supplier countries as well as changes to global supply, and in turn influencing price movement on paraformaldehyde in the Indian market. The Paraformaldehyde (PFA) Price trend was affected by moderate swings in the price reports for formaldehyde and methanol. European producers generally experienced stable operating rates at this time.

The paraformaldehyde CIF price levels reported for September 2025 were in the range of USD 700-800/MT and were at the low end due to limited supply availability from steady volumes having been received and available port inventories. Domestic demand was still considered weak but continued to be supported by deliveries from downstream demand pullers, namely resins, adhesives, and disinfectants.

USA: Paraformaldehyde (PFA) import prices CIF Houston, USA, Grade- Industrial Grade Prills (96% purity).

In Q3 2025, Paraformaldehyde imports into the USA from Spain reflected a moderately soft market sentiment, largely influenced by FOB price trends and supply adjustments in Europe. The Paraformaldehyde (PFA) price trend movement was shaped by fluctuations in formaldehyde and methanol costs in Spain, along with generally stable operating rates among European producers.

Paraformaldehyde CIF prices in September 2025 were assessed in the range of USD 800–900/MT, reflecting mild downward pressure amid steady shipments and sufficient port inventories. Although domestic demand from downstream sectors such as resins, adhesives, and disinfectants remained cautious, timely imports and balanced stock levels helped prevent sharp price changes.

South Korea: Paraformaldehyde (PFA) import prices CIF Busan, South Korea, Grade- Industrial Grade Prills (92% purity), Industrial Grade Powder (96% purity).

In Q3 2025, Paraformaldehyde CIF imports into South Korea from Spain, China, and Taiwan showed a mixed trend, influenced by FOB price movements and regional supply. September 2025 prices ranged between USD 650–800/MT, with Chinese shipments remaining competitive, Taiwanese slightly higher, and Spanish origin at the upper end due to FOB and freight costs.

Moderate downstream demand and adequate inventories limited sharp changes, keeping the Paraformaldehyde price in South Korea stable, with the Paraformaldehyde price trend in South Korea closely following FOB developments.

Nigeria: Paraformaldehyde (PFA) import prices CIF Apapa, Nigeria, Grade- Industrial Grade Powder (96% purity).

In Q3 2025, Paraformaldehyde imports into Nigeria from China reflected a softening market sentiment, primarily influenced by FOB Paraformaldehyde price trends and steady regional supply. Paraformaldehyde CIF prices in September 2025 were assessed in the range of USD 750–850/MT, with moderate downstream demand from resins, adhesives, and disinfectants and sufficient port inventories limiting sharp price movements. Consequently, Paraformaldehyde price trend in Nigeria showed slight moderation, with the Paraformaldehyde price trend in Nigeria closely tracking developments in the Chinese FOB market.