Price-Watch’s most active coverage of Pig Iron price assessment:

- Steel Grade FOB Santos, Brazil

- Steel Grade CIF Houston (Brazil), USA

- Steel Grade EX-Bhilai, India

- L8-10 Ex-Shanghai, China

Pig iron Price Trend Q3 2025

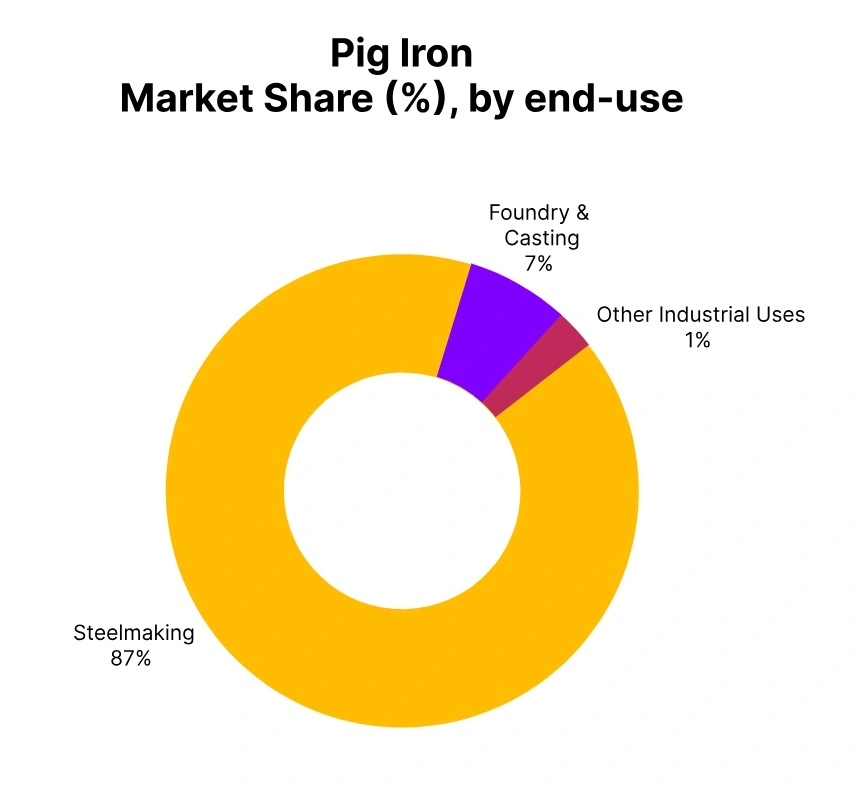

In the third quarter of 2025, the global pig iron market exhibited a general bearish sentiment, with prices in most regions declining modestly to moderately due to cooling demand and balanced supply. Steel production growth remained limited, resulting in lower pig iron consumption in key end-use markets.

At the same time, raw material costs for pig iron remained stable while the lack of a strong post-downstream recovery limited any price momentum. Exports faced logistical and pricing challenges that dampened the volume of global trade.

However, some short-term mid-Q3 support with some mild restocking and regional supply adjustments have allowed for some modest positioning of pig iron prices. Thus, this quarter generally exhibited cautious sentiment coupled with unchanged pricing activity, putting price movements into the final months leading into 2025 subdued.

Brazil: Pig Iron Export prices FOB Santos, Brazil, Grade- Steel Grade.

The Pig iron price trend in Brazil declined slightly by 0.40% in Q3 2025, mainly due to moderate export demand and balanced domestic consumption. Although Brazilian mills maintained stable production levels, global pig iron trade experienced limited activity as buyers remained cautious amid softer steel market conditions.

Freight stabilization and currency fluctuations reduced export competitiveness, keeping pricing sentiment weak. Demand from major importers in Asia and Europe showed only marginal improvement, insufficient to lift overall prices.

On a monthly basis, Pig iron prices in Brazil inched up marginally by 0.03% in September 2025, supported by short-term restocking from select overseas buyers and slight tightening in availability due to brief logistical slowdowns, though overall market conditions stayed largely muted.

USA: Pig Iron Import prices CIF Houston (Brazil), USA, Grade- Steel Grade.

The Pig iron price trend in the USA eased by 0.28% in Q3 2025, as domestic demand from steelmakers remained subdued and inventory levels adequate. Lower scrap prices reduced mills’ reliance on pig iron procurement, while steady import flows from Brazil and CIS countries ensured stable supply.

Soft downstream manufacturing activity and conservative procurement strategies kept demand quiet throughout the quarter. Despite stable energy and freight costs, weak consumption prevented any price recovery.

However, Pig iron prices in the USA rose marginally by 0.04% in September 2025, driven by limited replenishment purchases by mills seeking to maintain consistent feedstock supply, although overall trade activity remained thin as buyers awaited clearer signals from steel prices in the later stages of the quarter.

China: Pig Iron Domestic Prices EX Shanghai, China, Grade- L8-10.

According to Price-Watch, The Pig iron price trend in China decreased by 1.97% in Q3 2025, as steady output and weak steel production limited upward potential throughout the quarter. Sluggish downstream demand from the construction and automotive industries pressured market sentiment, leading producers to maintain competitive offers.

Imports from nearby Asian markets added further supply-side competition, curbing domestic price recovery. Raw material cost stability offered little incentive for higher pricing, and exports stayed limited due to global softness.

However, Pig iron prices in China edged up by 0.30% in September 2025, supported by mild restocking ahead of seasonal construction demand and traders’ efforts to take advantage of short-term buying momentum before the market slowed toward quarter-end.

India: Pig Iron Domestic Prices EX Bhilai, India, Grade- Steel Grade.

In the third quarter of 2025, there has been a 1.78% drop in India’s Pig iron price trend, due to reduced domestic demand from foundries and secondary steel makers amidst declining industrial activity. There has been adequate supply in the market due to plentiful availability and steady production, and with soft global demand and an unfavorable exchange rate, there have been few export opportunities.

Mills have been put under pressure to reduce prices to overcome sluggish demand and prevent inventory accumulation. The slowdowns in the construction and automotive sectors have also been impacting consumption.

In September 2025, India’s Pig iron declined by 0.49%, as buyers have been waiting to buy in the hope of getting greater discounts. Although raw material costs remained stable, limited demand from end users continued to contribute to negative price sentiment across the Indian market.