Price-Watch’s most active coverage of Platinum price assessment:

- Purity 99.95% Weekly Closing Spot Price, Global

Platinum Price Trend Q3 2025

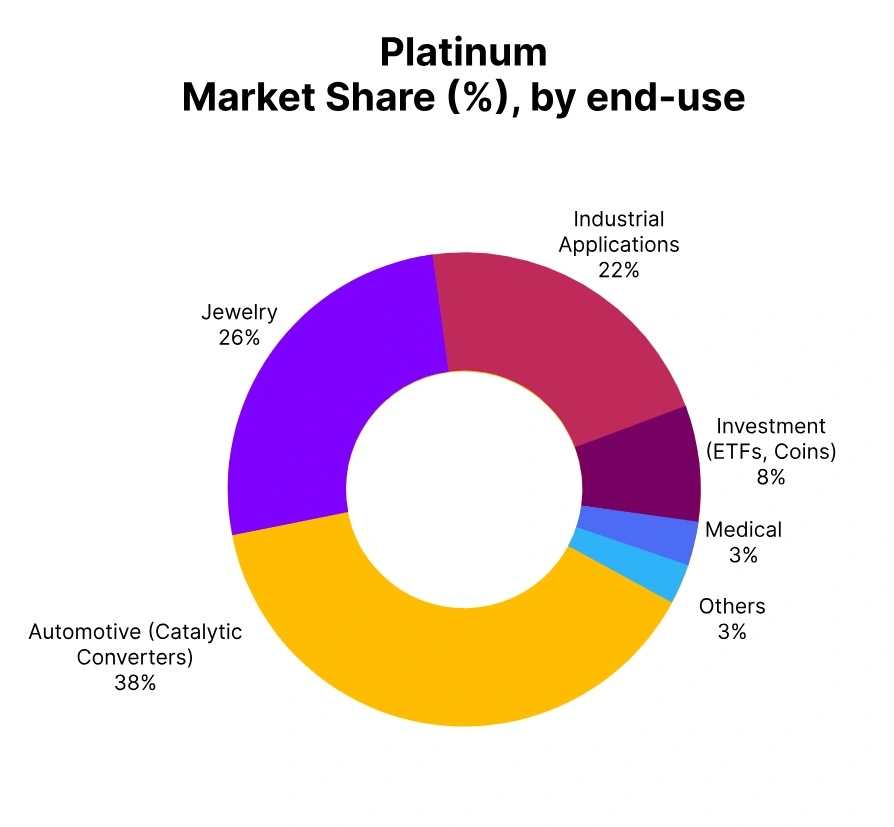

In the third quarter of 2025, the worldwide platinum market saw a significant price rebound, up 30% as compared to the second quarter of 2025. The price increases took place due to a combination of supply tightening and demand increases in key utilization sectors. South African production of platinum, accounting for the largest share of global supply, has been impeded by worker strikers in the mines and ongoing power shortages, constraining production.

Meanwhile, automotive demand had a strong rebound, particularly for hybrid and hydrogen fuel cell vehicles encompassing platinum in their catalytic and fuel cell technologies. Investment demand also increased sharply as investors turn to safe-haven assets amid increasing geopolitical tensions and global economic uncertainty. Lastly, increased regulatory environmental standards in Asia and Europe also contributed to an increasing industrial demand for Platinum.

Global Platinum (XPT/USD)

According to PriceWatch, In Q3 2025, platinum exhibited strong bullish price action, reflecting a substantial recovery in global markets. Platinum prices rose by roughly 30% from Q2, benefiting from tightening supply, an increase in automotive demand, and renewed investor interest amid inflationary pressures. In September 2025, the prices have raised by about 7%, reflecting sustained bullish sentiment, as supply to important mining areas continued to be disrupted due to labor strikes and logistical challenges.

Demand-side support continued to emanate from the green energy transition in hydrogen fuel cell technologies, which, in turn, contributed to the price appreciation. Investor sentiment has been further supported by central banks signaling dovish monetary policy, which provided a basis to shift to safe-haven assets.