Price-Watch’s most active coverage of Polyacrylamide (PAM) price assessment:

- Cationic (High molecular weight) FOB Shanghai, China

- Cationic (High molecular weight) CIF JNPT (China), India

- Cationic (High molecular weight) CIF Chittagong (China), Bangladesh

- Cationic (High molecular weight) CIF Jakarta (China), Indonesia

- Cationic (High molecular weight) CIF Manila (China), Philippines

- Cationic (High molecular weight) CIF Mersin (China), Turkey

- Cationic (High molecular weight) CIF Haiphong (China), Vietnam

- Cationic (High molecular weight) CIF Callao (China), Peru

- Cationic (High molecular weight) Ex-Pune, India

- Cationic (High molecular weight) Ex-West India, India

- Cationic (High molecular weight) Ex-North India, India

- Cationic (High molecular weight) Ex-South India, India

- Cationic (High molecular weight) Ex-East India, India

Polyacrylamide (PAM) Price Trend Q3 2025

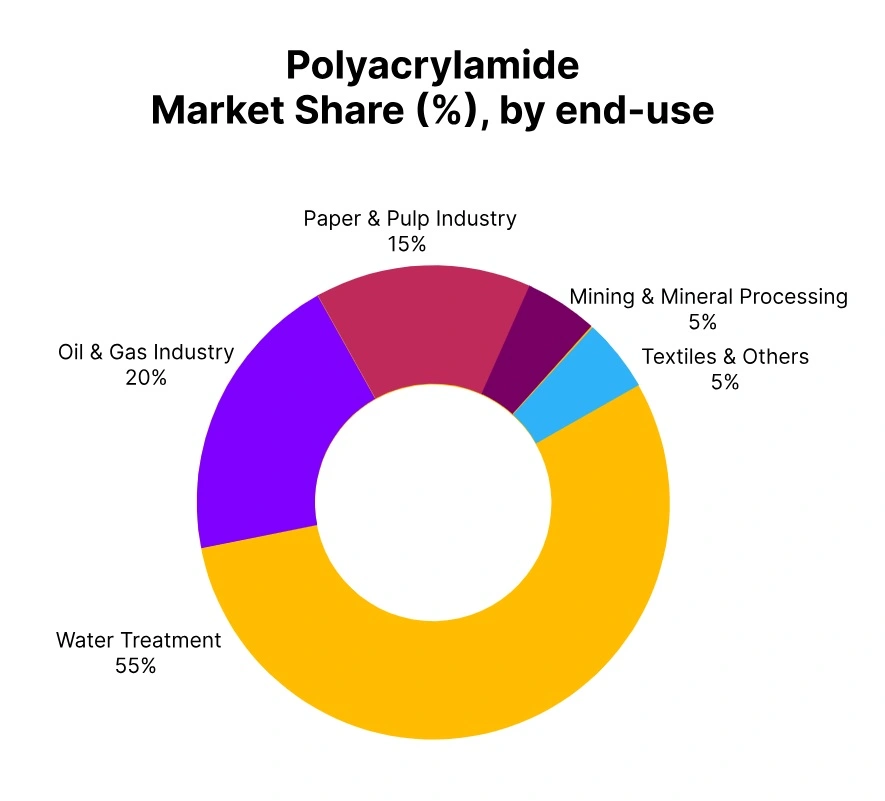

The Global Polyacrylamide (PAM) market experienced slight fluctuations in Q3 2025, with prices moving relatively flat, down approximately 0.5% – 2%. This subtle shift was heavily dependent on stable feedstock costs and balanced consumption from core industries such as water, paper, and oilfield functions.

Overall production in the major manufacturing unit was adequate, and supply chains were operating without any major disruptions. Overall demand from end-users shifted slightly lower amid elevated inventories in some regions and a generally cautious purchasing approach. Prices remained under a minor amount of pressure during the quarter.

China: Polyacrylamide (PAM) Export prices FOB Shanghai, China; Grade- Cationic (High molecular weight)

According to Price-Watch, in Q3 2025, Polyacrylamide (PAM) prices displayed a small decrease in China, with Polyacrylamide price trend in September 2025 landing in a range of USD 2000-2100/MT on an FOB China basis.

The Polyacrylamide price trend also displayed some minor movement from fluctuations in cost for acrylamide feedstocks, while stable operating rates across all significant production facilities in China remained unchanged. Demand from downstream sectors, including water treatment, paper, and oilfield applications, displayed moderate demand which caused a slight negative sentiment.

India: Polyacrylamide (PAM) import prices CIF JNPT, India, Grade- Cationic (High molecular weight).

Polyacrylamide (PAM) imports into India from China exhibited stable market responses in Q3 2025 as influenced by fluctuations in the FOB pricing in China, and stable supply from the region. Polyacrylamide price trend movement was driven by minor changes in acrylamide feedstock costs and steady operating rates for Chinese producers.

Polyacrylamide import prices from China were in the range of USD 2500–2600/MT (CIF India). Domestic Polyacrylamide prices in India remained largely stable over the quarter supported by balanced demand from domestic end-use markets, including water treatment, paper and oilfield applications.

As a result, the overall market signals remained steady, and increased availability prevented any notable changes to price. Moreover, continued stability in Chinese FOB pricing and moderately stable regional supply is expected to yield a balanced price trend for Polyacrylamide in India into the next quarter.

Bangladesh: Polyacrylamide (PAM) import prices CIF Chittagong, Bangladesh, Grade- Cationic (High molecular weight).

In the third quarter of 2025, Bangladesh’s imports of Polyacrylamide (PAM) continued to reflect stable market sentiment largely driven by the behavior of FOB price levels out of China, coupled with steady supply in the rest of the region. Polyacrylamide (PAM) Price movement was largely dictated by very slight changes in acrylamide feedstock costs, and the operating rates across Chinese producers remained stable.

Again, net import prices into Bangladesh, based on a CIF basis, for PAM were in the range of USD 2100–2250/MT. As established domestic demand from the important sectors (for the country) such as water treatment, paper, and textile applications – remained stable, consumption levels remained balanced as well.

Indonesia: Polyacrylamide import prices CIF Jakarta, Indonesia, Grade- Cationic (High molecular weight).

In the third quarter of 2025, Polyacrylamide (PAM) imports from China into Indonesia indicated modestly weak market sentiment. It is primarily reflected by FOB Polyacrylamide price trends in China and stable supply in the region.

Polyacrylamide (PAM)Price movement was impacted by small changes in acrylamide feedstock prices and stable operating rates in China. Polyacrylamide import prices from China varied from USD 2050 to 2150/MT CIF Indonesia. Domestic demand signals in water treatment, paper, and textiles were both balanced, resulting in steady import volumes.

Philippines: Polyacrylamide (PAM) import prices CIF Manila, Philippines, Grade- Cationic (High molecular weight).

In the third quarter of 2025, Polyacrylamide (PAM) imports from China into Indonesia indicated modestly weak market sentiment. It is primarily reflected by FOB price trends in China and stable supply in the region. Polyacrylamide price trend was impacted by small changes in acrylamide feedstock prices and stable operating rates in China.

Polyacrylamide prices in September 2025 import prices from China varied from USD 2050 to 2150/MT CIF Indonesia. Domestic demand signals in water treatment, paper, and textiles were both balanced, resulting in steady import volumes.

Turkey: Polyacrylamide (PAM) import prices CIF Mersin, Turkey, Grade- Cationic (High molecular weight).

In the third quarter of 2025, Turkish imports of Polyacrylamide (PAM) from China experienced a slight downturn in market sentiment, influenced mainly by FOB price trends in China and consistent local supply flows. Polyacrylamide price trend was attributed mainly to some variation in acrylamide feedstock prices and stable operating rates at several major producers in China.

Polyacrylamide prices imported from China settled in the USD 2150–2250/MT range on a CIF Turkey basis. While Turkish demand was stable from the water treatment, paper and textile segments and there were no major supply disruptions in terms of incoming volumes.

Vietnam: Polyacrylamide (PAM) import prices CIF Haiphong, Vietnam, Grade- Cationic (High molecular weight).

In Q3 2025, the Polyacrylamide (PAM) imports into Vietnam from China experienced a slightly soft market sentiment, influenced mainly by FOB price trends from China and steady freight inflows. Polyacrylamide (PAM) price trend was influenced by only slight changes in the acrylamide feedstock costs and steady operating rates at the key production facilities in China.

Polyacrylamide import prices in September 2025 from China were reported between USD 2100–2200/MT, CIF Vietnam. Domestic demand from the water treatment, paper, and textiles sectors remained stable and absorbed incoming shipments.

Peru: Polyacrylamide import prices CIF Callao, Peru, Grade- Cationic (High molecular weight).

In the third quarter of 2025, Polyacrylamide (PAM) imports to Peru from China displayed a soft market sentiment largely attributable to FOB price movements from China and steady freight movement. Polyacrylamide (PAM) price trend was influenced by minor movement in acrylamide feedstock costs and stable operating rates at major Chinese production facilities.

Prices of polyacrylamide in September 2025 imported from China were CIF Peru ranging from USD 2150–2250/MT. Domestic demand for product from the water treatment, mining and paper sectors also held steady and absorbed incoming product.