Price-Watch’s most active coverage of Polycarbonate (PC) price assessment:

- General Purpose (MFI:22) FOB Busan, South Korea

- General Purpose (MFI:22) CIF Nhava Sheva (South Korea), India

- General Purpose (MFI:22) CIF Shanghai (South Korea), China

- General Purpose (MFI:22) CIF Jakarta (South Korea), Indonesia

- General Purpose (MFI:22) CIF Manzanillo (South Korea), Mexico

- General Purpose (MFI:22) Ex-Mumbai, India

- General purpose (MFI: 20-22) Ex-Shanghai, China

Polycarbonate Price Trend Q3 2025

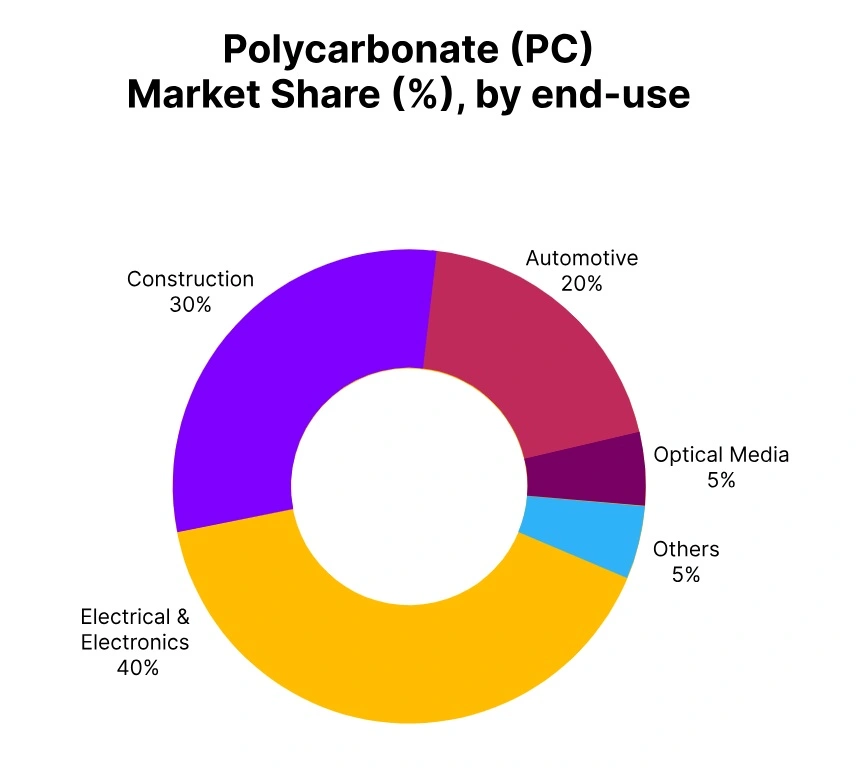

In Q3 2025, the global Polycarbonate price trend has been stable to slightly positive in major regions. Prices at major ports, like Busan and Shanghai in the Pacific Rim, have slightly improved due to steady consumption from automotive, electronics, and construction demand. Southeast Asian markets also saw small improvements due to healthy demand from optical and consumer goods. In India, prices increased more noticeably due to moderate restocking and steady downstream demand.

In regions such as Latin America (Mexico), prices remained broadly stable as trade activity balanced out. In summary, steady feedstock bisphenol A prices and consistent end-user consumption have contributed to price stability with slightly positive price development expected into the start of Q4 2025.

South Korea: Polycarbonate Export prices FOB Busan, South Korea, Grade General Purpose (MFI:22).

According to PriceWatch, the Polycarbonate (PC) price trend at an FOB Busan basis in South Korea has remained mostly firm through Q3 2025, averaging around USD 1,570-1,590/MT. This reflects a slight rise of 0.1% from the previous quarter. The South Korean Polycarbonate market has been relatively balanced with continued steady demand from automotive, electrical and construction segments along with stable downstream processing rates.

In September 2025, the South Korean Polycarbonate price exhibited a 0.57% increase on a month-on-month basis relative to August prices. This shift was primarily driven by steady input costs for Bisphenol-A along with improved regional converters’ buying sentiment. Supply conditions have generally remained steady for the entire quarter without any significant production disruptions. As for the outlook, strengthened end-use demand and steady operating rates are likely to sustain support for moderate PC pricing for the early Q4 2025.

China: Polycarbonate Import prices CIF Shanghai (South Korea), China, Grade- General Purpose (MFI:22).

According to PriceWatch, during Q3 2025, Polycarbonate price levels in China were stable to slightly up by averaging around USD 1,600 – 1,620/MT, reflecting minor gain of 0.11% from the previous quarter. The China Polycarbonate market has been supported by steady consumption from the automotive, electronics and optical sectors. In the meantime, downstream manufacturing activity has been moderated in improvement.

Polycarbonate prices in China increased by 0.56% in September 2025 compared with August levels, supported by strong Bisphenol-A feedstock costs and ongoing re-stocking from processors in anticipation of the Golden Week holiday. Supply remains adequate, with stable operating rates among domestic producers. Going forward, continuing demand from both electronics and automotive sectors would continue to provide potential mild upward support for polycarbonate pricing levels in early Q4 2025.

India: Polycarbonate Domestically traded prices Ex-Mumbai, India, Grade General Purpose (MFI:22).

According to PriceWatch, during the third quarter of 2025, the price trend of Polycarbonate in the Indian domestic market (Ex-Mumbai) has remained largely stable, averaging around USD 1,760-1,770/MT. The India Polycarbonate market has seen steady demand from downstream automotive, electronics, and appliance sectors. Likewise, total available supply from key import sources has generally remained adequate even if there were some logistics-related, short-lived tightness in the markets.

As of September 2025, Polycarbonate prices in India showed a marginal 0.8% decrease compared to August levels as slower import arrivals and logistics-related issues have temporarily dampened purchasing interest. Looking ahead, steady demand for end usage and slow rebound in imports should keep the PC market relatively stable-to-moderately supported in early Q4 2025.

Indonesia: Polycarbonate Import prices CIF Jakarta (South Korea), Indonesia, Grade- General Purpose (MFI:22).

During Q3 2025, the Polycarbonate (PC) price trend in Indonesia at CIF Jakarta stayed mostly stable to slightly positive with an average price of USD 1,640-1,660/MT, reflecting a small increase of 0.10% from the prior quarter. Stable demand met with continued automotive and consumer goods consumption has supported the Indonesia Polycarbonate market, and downstream manufacturing activity remains steady.

Polycarbonate prices in Indonesia have increased 0.52% in September 2025 compared to August driven by solid regional buying interest and with Bisphenol-A feedstock prices steady as well. Supply conditions were balanced across the quarter with steady inflows of imports partially contributing to the local demand. Moving forward, steady downstream consumption and inventories should continue to modestly support polycarbonate prices in early Q4 2025.

Mexico: Polycarbonate Import prices CIF Manzanillo (South Korea), Mexico Grade General Purpose (MFI:22).

In Mexico, the Polycarbonate price trend has remained fairly steady throughout Q3 2025, averaging about USD 1,690-1,710/MT, which reflects a slight decrease from Q2 2025 of 0.03%. Demand from construction, electronics, and automotive sectors has remained steady, with moderate downstream activity. Following modest price declines earlier in the quarter, Polycarbonate prices in Mexico have risen by 1.70% in September 2025 versus August 2025, supported by improved restocking activity and firm regional buying sentiment.

Supply has been decent throughout the quarter, although minor fluctuations in freight rates have impacted short-term cost dynamics. Moving into early Q4 2025, demand will remain stable and import flows should balance market supply and keep prices moderately firm.