Price-Watch’s most active coverage of Polyetheramine price assessment:

- Diamine(230) CIF Haiphong (China), Vietnam

- Diamine(230) FOB Shanghai , China

- Diamine(230) CIF Nhava Sheva (Singapore), India

- Diamine(230) CIF Mersin (Singapore), Turkey

- Diamine(230) Ex-Mumbai, India

- Diamine(230) CIF Nhava Sheva (China), India

- Diamine(230) CIF Houston (China), USA

- Diamine(230) FOB Jurong, Singapore

Polyetheramine Price Trend Q3 2025

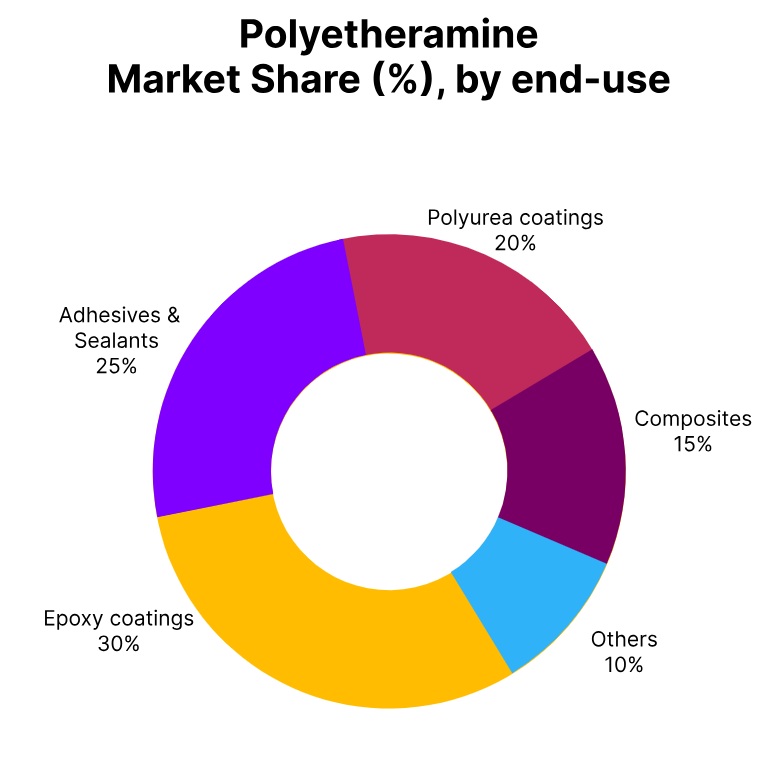

In Q3 2025, the Polyetheramine price trend for global remained largely stable with a slight downward bias, as balanced supply and softening demand from select end-use sectors particularly coatings, adhesives, and composites kept pricing in check. The Polyether amine price showed minimal fluctuations across key regions, with some downward pressure emerging due to subdued industrial activity and cautious purchasing behavior in both Asian and Western markets.

Adequate production levels and smooth supply chains helped prevent any significant volatility, even as feedstock markets remained relatively calm. By September, the Polyether amine price in major markets had eased marginally compared to Q2, reflecting softer sentiment but without sharp corrections. Overall, the Polyether amine price trend showed a stable yet slightly bearish market environment heading into Q4.

China: Polyetheramine Export prices FOB Shanghai, China, Grade-Diamine (230).

In Q3 2025, Polyetheramine price trend in China stayed relatively stable, despite some intermittent ups and downs during the quarter. The Polyetheramine price in the China export market was swayed by moderate fluctuations in raw material costs and shifting demand from downstream sectors such as epoxy curing agents and coatings. However, consistent production levels and manageable inventory positions helped maintain overall Polyetheramine price stability.

In September 2025, Polyetheramine price in China volatility took place due to regional buying activity and feedstock dynamics, these were balanced out over time, resulting in a stable quarterly average. By September, the market had mostly settled, and the price remained close to previous quarter levels, mirroring a steady supply-demand environment.

Vietnam: Polyetheramine Import prices CIF Haiphong, Vietnam, Grade-Diamine (230).

In Q3 2025, Polyetheramine price trend in Vietnam remained relatively stable, supported by steady demand from downstream industries and consistent supply from key exporting countries. The Polyetheramine price in the Vietnam market showed minimal movement throughout the quarter, as both procurement volumes and import availability stayed balanced.

Despite minor fluctuations in upstream costs and freight rates, these factors had limited impact on overall pricing. In September 2025, Polyetheramine price in Vietnam market had maintained a stable tone, with the price holding close to previous levels, reflecting a calm trading environment and stable regional fundamentals.

USA: Polyetheramine Import prices CIF Houston, USA, Grade-Diamine (230).

In Q3 2025, the Polyetheramine price trend in USA, imported from China, declined by approximately 5%, primarily due to a stark drop in freight rates. The Polyetheramine price in USA market eased as lower shipping costs from Asia dipped the overall landed cost, even though Polyetheramine FOB prices from China stayed mostly steady.

This shift in logistics expenses created more competitive pricing for importers, encouraging increased interest in Chinese cargoes. In September 2025, Polyetheramine price in USA had translated into lower CIF values, and the price reflected the downward adjustment without any major change in underlying supply-demand dynamics.

Singapore: Polyetheramine Export prices FOB Jurong, Singapore, Grade-Diamine (230).

In Q3 2025, the Polyetheramine price trend in Singapore declined by around 4%, driven by soft demand and competitive market pressure across Asia. The Polyetheramine price in Singapore weakened as regional buyers adopted a careful purchasing approach amid steady product availability and limited spot activity.

Despite stable production levels, sellers adjusted offers downward to remain competitive, especially as pricing from other main export hubs also showed slight weakness. In September 2025, Polyetheramine in Singapore the market had absorbed these changes, with the price mirroring a moderate but clear downward correction for the quarter.

Turkey: Polyetheramine Import prices CIF Mersin, Turkey, Grade-Diamine (230).

In Q3 2025, Polyetheramine price trend in Turkey dipped by approximately 5%, even though FOB prices from Singapore remained weak. The Polyetheramine price in the Turkey market was pulled downward primarily due to soft regional demand and competitive global offers, with the effect of falling export prices from Asia partially offset by still-elevated freight costs.

However, the overall landed price dropped as sellers adjusted to market conditions and buyers pushed back against higher levels. In September 2025, Polyetheramine price in Tukey hand combined influence of softened fundamentals and adjusted shipping rates resulted in a clear reduction in the price, marking a bearish quarter for imports into Turkey.

India: Polyetheramine Import prices CIF Nhava Sheva, India, Grade-Diamine (230).

According to Price-Watch, In Q3 2025, Polyetheramine price trend in India remained overall stable, despite some variation in import pricing from different origins, particularly Singapore and China. The Polyetheramine price in the Indian market showed slight movement as shipments arrived at slightly different rates depending on source, but the overall impact on landed costs was balanced.

Competitive offers from China were offset by marginally higher prices from Singapore, helping to maintain a stable average across the quarter. In September 2025, Polyetheramine price in India market had settled into a steady range, with no significant shifts in demand or supply, and the price reflected consistent import activity amid diversified sourcing strategies.