Price-Watch’s most active coverage of Polylactic Acid price assessment:

- General Purpose FOB Laem Chabang, Thailand

- General Purpose FOB Houston, USA

- General Purpose FOB Rotterdam, Netherlands

- General Purpose FOB Qingdao, China

- General Purpose Ex-Ahmedabad, India

- General Purpose CIF Nhava Sheva (Thailand), India

- General Purpose CIF Busan (China), South Korea

- General Purpose CIF Busan (USA), South Korea

- General Purpose CIF Busan (Thailand), South Korea

- General Purpose CIF Kaohsiung (USA), Taiwan

- General Purpose CIF Kaohsiung (Thailand), Taiwan

- General Purpose CIF Montreal (USA), Canada

- General Purpose CIF Santos (Thailand), Brazil

- General Purpose FD Hamburg, Germany

- General Purpose FD Milano, Italy

- General Purpose FD Antwerp, Belgium

Polylactic Acid (PLA) Price Trend Q3 2025

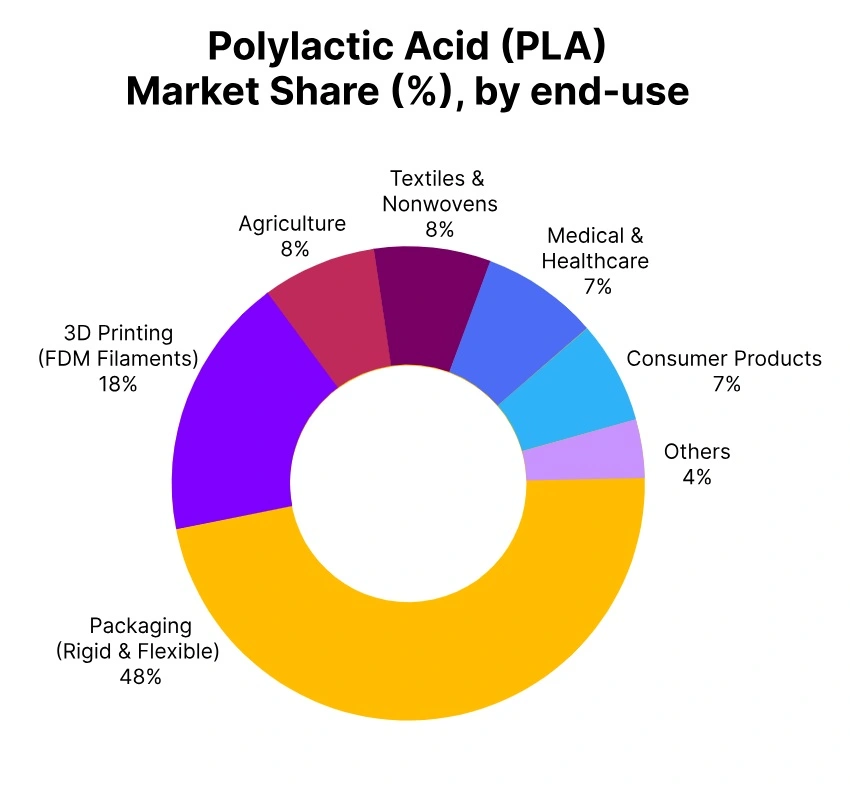

In Q3 2025, the global Polylactic Acid (PLA) market witnessed a marginal decline in prices, fluctuating within a range of 3%-5%, depending on regional demand, logistics, and feedstock dynamics. The polylactic acid price trend reflected subdued performance in key downstream industries like packaging and bioplastics, amid cautious procurement and inventory adjustments.

Market fundamentals were affected by global economic uncertainty, minor shifts in corn-derived lactic acid supply, and competitive pricing from alternative materials. While a few regions such as the USA and Canada saw marginal price upticks driven by steady domestic demand, most markets reported minor declines driven by supply-demand imbalances and feedstock normalization.

Thailand: Polylactic Acid export price from Thailand; General Purpose.

In Q3 2025, Polylactic Acid (PLA) prices in Thailand ranged between USD 2570–2730 per metric ton, registering a 2.78% decrease, as export activity slowed amid weak international demand and competitive market pressure. The Polylactic Acid price trend in Thailand reflected softening global orders and subdued packaging sector performance.

This decline was driven by stable-to-lower Corn feedstock values and weakened export volumes. Domestic production remained steady, though logistical delays and excess inventories weighed on sentiment. Manufacturers managed operations cautiously to stabilize the market.

In Q3 September 2025, Polylactic Acid prices in Thailand weakened slightly as export demand softened and overseas inquiries slowed. Early optimism faded as the month progressed, with consistent pressure from limited orders and cautious procurement. Stable production levels balanced the decline, yet oversupply concerns and fragile trading sentiment maintained downward pressure on overall pricing levels.

United States: Polylactic Acid export price from USA, General Purpose.

According to PriceWatch, in Q3 2025, Polylactic Acid (PLA) prices in the USA ranged between USD 2350–2500 per metric ton, marking a 0.92% increase, supported by steady domestic demand from the sustainable packaging and 3D printing sectors. The Polylactic Acid price trend in the USA indicated stable market sentiment with producers passing on minor cost increases amid consistent lactic acid availability. Global demand remained mixed, but regional cost competitiveness and stable logistics supported slight price gains.

Favourable energy prices and local production strength underpinned this modest upward movement. In Q3 September 2025, Polylactic Acid prices in the United States experienced slight softness throughout the month due to weak export demand and restrained domestic activity. Buying interest remained limited as producers navigated cautious sentiment. Consistent inventory levels and sufficient feedstock availability stabilized supply but failed to lift overall pricing momentum in the regional market.

Netherlands: Polylactic Acid export price from Netherlands, General Purpose.

In Q3 2025, Polylactic Acid (PLA) prices in the Netherlands ranged between USD 2540–2700 per metric ton, reflecting a 1.33% decrease, due to softer export activity and moderated demand in the European bioplastics sector. The Polylactic Acid price trend in the Netherlands showed cautious sentiment driven by moderate inventory buildup and weak biodegradable packaging orders.

Stable feedstock costs and limited industrial activity further dampened market dynamics, while competition from Asia added to pricing pressure across the quarter. In Q3 September 2025, Polylactic Acid prices in the Netherlands declined modestly under continued pressure from weaker export operations and slow order volumes.

Despite steady supply and feedstock consistency, downbeat sentiment persisted as buyers avoided speculative purchases. Prices reflected cautious market behaviour with stability remaining uncertain amid sustained European consumption weakness through the month.

China: Polylactic Acid export price from China, General Purpose.

According to PriceWatch, in Q3 2025, Polylactic Acid (PLA) prices in China ranged between USD 2180–2310 per metric ton, recording a 3.18% drop, due to persistent supply surplus and moderate demand from the packaging and fiber sectors. The Polylactic Acid price trend in China highlighted ongoing pressure from inventory buildup and slow downstream offtake.

Stable feedstock supply and localized logistical ease couldn’t offset weak consumption. Despite recovery in EV and electronics sectors, limited spillover reduced overall price stability across Q3. In Q3 September 2025, Polylactic Acid prices in China faced mild downward pressure initially before stabilizing later in the month.

Softened export activity and reduced international orders dampened price confidence, although steady domestic demand limited further declines. Balanced supply conditions and cautious trading sentiment prompted sellers to adopt conservative pricing strategies to maintain liquidity.

India: Domestically traded Polylactic Acid price in Ahmedabad, General Purpose.

According to PriceWatch, in Q3 2025, domestic Polylactic Acid (PLA) prices in India averaged between USD 2880–3060 per metric ton, down by 0.66% as demand growth slowed across key industries including packaging and textiles. The Polylactic Acid price trend in India reflected subdued procurement behavior and slight weakness induced by currency volatility.

While production and raw material availability stayed consistent, imported competition from Southeast Asia pressured domestic margins. Overall, balanced supply-demand dynamics helped maintain stability within a mildly declining environment.

In Q3 September 2025, Polylactic Acid prices in India recorded modest improvement supported by steady local demand from packaging and industrial sectors. Sellers adopted a guarded pricing approach as weekly momentum strengthened slightly. Stable feedstock sourcing and balanced inventories maintained measured confidence, allowing prices to reflect controlled upward adjustments across the month.

South Korea: Polylactic Acid import price in South Korea from China, General Purpose.

In Q3 2025, Polylactic Acid (PLA) prices into South Korea from China averaged between USD 2210–2350 per metric ton, showing a 3.15% decrease, as regional oversupply weighed on pricing. The Polylactic Acid price trend in South Korea illustrated a clear imbalance between supply and demand due to high export availability.

Tepid domestic demand from packaging and electronics further restrained recovery. Local converters adopted lean procurement schedules while importers adjusted strategies to offset ongoing price fluctuations. In Q3 September 2025, Polylactic Acid prices in South Korea weakened moderately due to higher regional availability and slower procurement by converters.

Increased shipments from neighboring countries pressured domestic values. Market sentiment turned cautious as buyers delayed purchases, keeping overall price movement subdued while oversupply persisted through the latter half of the month.

Taiwan: Polylactic Acid import price in Taiwan from USA, General Purpose.

In Q3 2025, Polylactic Acid (PLA) prices from the USA into Taiwan ranged between USD 2410–2560 per metric ton, with a 0.84% increase, supported by steady demand in the medical and 3D printing sectors. The Polylactic Acid price trend in Taiwan emphasized consistent consumption despite regional weakness.

Importers preferred U.S.-origin materials owing to quality reliability and smooth logistics. Niche industrial strength allowed Taiwan to maintain moderate gains despite wider Asian pricing pressure. In Q3 September 2025, Polylactic Acid prices in Taiwan moved lower as sluggish demand from downstream processors constrained buying interest.

Declining imports and weaker sentiment limited price support. Despite stable supply operations, buyers stayed cautious, reflecting the influence of subdued regional consumption and muted industrial activity throughout the month.

Canada: Polylactic Acid import price in Canada from USA, General Purpose.

In Q3 2025, Polylactic Acid (PLA) prices in Canada ranged between USD 2490–2650 per metric ton, marking a 1.05% rise, due to steady demand and logistical efficiency in North America. The Polylactic Acid price trend in Canada showed firm sentiment supported by compostable packaging expansion and sustainability projects. Supply chains operated consistently with minimal disruptions, while steady regional trade flows reinforced stable to firm pricing throughout the quarter.

In Q3 September 2025, Polylactic Acid prices in Canada softened slightly, mirroring weaker regional sentiment linked to easing USA prices. Procurement slowed as downstream industries moderated consumption. Stable import flows maintained supply balance, while cautious purchasing kept pricing momentum subdued and prevented significant upward corrections during the period.

Brazil: Polylactic Acid import price in Brazil from Thailand, General Purpose.

In Q3 2025, imported Polylactic Acid (PLA) prices in Brazil averaged between USD 2740–2910 per metric ton, reflecting a 1.41% decrease, as demand weakened and Asian exporters offered competitive rates. The Polylactic Acid price trend in Brazil depicted cautious buying amid reduced industrial activity and currency-driven cost fluctuations. Despite stable freight routes, sufficient Southeast Asian supply limited price resilience, keeping Brazil’s market buyer-oriented.

In Q3 September 2025, Polylactic Acid prices in Brazil showed noticeable softness driven by lower freight costs and weak export-linked activity. Import volumes remained steady, but tepid regional consumption contributed to gradual price easing. Conservative interest from buyers and moderate supply levels left prices stable at a lower range throughout the month.

Germany: Domestically Traded Polylactic Acid price in Germany, General Purpose.

In Q3 2025, domestic Polylactic Acid (PLA) prices in Germany stood between USD 2580–2740 per metric ton, decreasing by 1.40%, amid sluggish industrial performance and conservative demand recovery. The Polylactic Acid price trend in Germany showed restrained activity as buyers slowed orders and producers maintained steady pricing. Lacklustre consumption in packaging and consumer goods coupled with Asian competition sustained mild price correction.

In Q3 September 2025, Polylactic Acid prices in Germany experienced slight weakening influenced by lower Rotterdam-linked quotations. Domestic consumption remained slow as industrial demand in packaging and consumer goods softened. Consistent supply conditions provided stability, yet muted purchasing behavior limited any opportunity for recovery across the latter part of the month.

Italy: Domestically Traded Polylactic Acid price in Italy, General Purpose.

In Q3 2025, Polylactic Acid (PLA) prices in Italy ranged between USD 2630–2800 per metric ton, falling by 1.03%, amid subdued demand from bioplastics and packaging applications. The Polylactic Acid price trend in Italy displayed soft consumer outlook and selective buying, influenced by Asian price competition. Stable feedstock access and organized supply chains prevented deeper declines, maintaining balanced but cautious sentiment across the period.

In Q3 September 2025, Polylactic Acid prices in Italy displayed modest decline amid weaker demand and competitive offers aligned with Rotterdam pricing levels. Slowed industrial consumption, especially in bioplastic applications, kept trading subdued. Stable feedstock support prevented deeper losses, but cautious buying patterns ensured a subdued tone through the period.

Belgium: Domestically Traded Polylactic Acid price in Belgium, General Purpose.

In Q3 2025, domestic Polylactic Acid (PLA) prices in Belgium averaged between USD 2570–2730 per metric ton, decreasing by 1.39%, as modest demand met increased import competition. The Polylactic Acid price trend in Belgium underscored stable but slow-moving market sentiment, constrained by cheaper Asian inflows. Consistent feedstock and smooth logistics kept activity balanced, though producers resorted to mild markdowns to protect market share amid tepid industrial demand.

In Q3 September 2025, Polylactic Acid prices in Belgium recorded mild weakening linked to lower Rotterdam market performance. Export interest remained limited, while domestic demand offered minimal support. Producers maintained consistent operations to manage inventories, yet fragile sentiment and modest supply-side adjustments resulted in continued price softness through the month.