Price-Watch’s most active coverage of Polyol price assessment:

- Molecular weight: 3000, Viscosity: 530 mPa.s, Hydroxyl no: 54.5-58.5 _FOB Jurong, Singapore

- Molecular weight: 3000, Viscosity: 550-650 mPa.s, Hydroxyl no: 53-59 FOB Jeddah, Saudi Arabia

- Molecular weight: 3000, Viscosity: 530 mPa.s, Hydroxyl no: 54.5-58.5 CIF Nhava Sheva (Singapore), India

- Molecular weight: 3000, Viscosity: 530 mPa.s, Hydroxyl no: 54.5-58.5 Ex- Mumbai, India

- Polymer Polyol, Molecular weight: 6000, viscosity: <5000 (mPa.s) FOB Qingdao, China

- Flexible Polyol, Molecular Weight: 2500-2800, viscosity: 450-750 (mPa.s) FOB Qingdao, China

Polyol Price Trend Q3 2025

Polyol product prices in Q3 2025 showed mixed trends across major producers. Singapore recorded slight softness with a 0.86% decline, while Saudi Arabia saw a 2.80% rise amid stronger regional demand. India’s import and domestic Polyol prices remained mostly stable, showing minor fluctuations of 0.74% increase and 0.46% drop respectively. In China, Polymer Polyol and Flexible Polyol prices fell sharply by 8.62% and 4.35%, driven by weak export activity and subdued consumption.

Singapore: Polyol Export prices FOB Jurong, Singapore, Molecular weight 3000, Viscosity 530 mPa.s, Hydroxyl no 54.5–58.5.

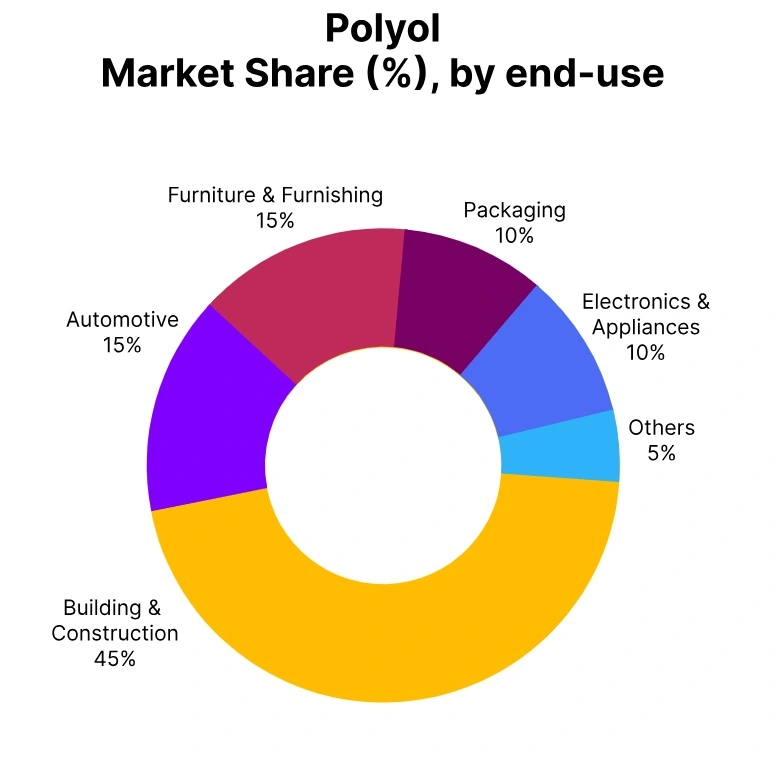

In Q3 2025, Polyol prices in Singapore showed slight softness amid stable regional demand from furniture and insulation industries. Polyol price trend in Singapore was influenced by moderate feedstock cost variations, currency movement, and contract negotiations with Southeast Asian buyers. Market participants noted steady consumption in polyurethane applications, though international trade flow remained subdued.

According to the Price-Watch, product prices in Q3 for Polyol in Singapore decreased by 0.86%. Polyol product prices in Singapore continued to reflect cautious procurement strategies among buyers. Despite easing raw material costs, manufacturers-maintained production discipline to optimize margins. Polyol prices in September 2025 signaled continued market balance supported by consistent downstream activity and controlled inventories.

Saudi Arabia: Polyol Export prices FOB Jeddah, Saudi Arabia, Molecular weight 3000, Viscosity 550–650 mPa.s, Hydroxyl no 53–59.

In Q3 2025, Polyol prices in Saudi Arabia recorded a mild increase amid sustained demand from construction and automotive sectors. Polyol price trend in Saudi Arabia was supported by resilient domestic consumption and steady feedstock availability. Export volumes to GCC regions showed marginal recovery as polyurethane foam makers resumed operations.

According to the Price-Watch, product prices in Q3 for Polyol in Saudi Arabia rose by 2.80%. Improved downstream sentiment and logistical efficiency contributed to stronger market performance. Polyol product prices in Saudi Arabia reflected stable cost structures and balanced supply conditions. The Polyol prices in September 2025 indicated firm regional buying interest and inventory restocking, paving the way for steady pricing outlook into Q4 2025.

India: Polyol Import prices CIF Nhava Sheva, India, Molecular weight 3000, Viscosity 530 mPa.s, Hydroxyl no 54.5–58.5.

In Q3 2025, Polyol prices in India showed minor fluctuations amid steady consumption in construction, automotive, and furniture segments. Polyol price trend in India remained supported by consistent imports from Southeast Asia despite limited container availability. Market participants observed balanced supply-demand dynamics across key polyurethane end‑use industries.

According to the Price-Watch, product prices in Q3 for Polyol in India increased by 0.74%. Polyol product prices in India remained close to prior quarter levels with minor procurement adjustments. Domestic blending activity and gradual industry recovery helped maintain price stability. Polyol prices in September 2025 pointed toward a cautious market sentiment with buyers maintaining lean inventories to manage cost risks effectively.

India: Polyol domestic prices Ex‑Mumbai, India, Molecular weight 3000, Viscosity 530 mPa.s, Hydroxyl no 54.5–58.5.

In Q3 2025, Polyol prices in India’s domestic market slightly declined amid ongoing production optimization and steady downstream operations. Polyol price trend in India’s local industry was affected by lower feedstock costs and moderate export inflows. Regional demand from furniture and insulation manufacturers sustained consumption during the quarter.

According to the Price-Watch, product prices in Q3 for Polyol in India declined by 0.46%. Product prices in India reflected balanced supply conditions and consistent operational throughput. Currency movement and global freight adjustments also shaped domestic pricing behavior. Polyol prices in September 2025 held steady, indicating continued market equilibrium influenced by cautious buying and regional cost management.

China (Polymer Polyol): Polyol Export prices FOB Qingdao, China, Polymer Polyol (Molecular weight 6000, Viscosity <5000 mPa.s).

In Q3 2025, Polymer Polyol prices in China declined sharply due to slower domestic demand and export contraction. Polymer Polyol price trend in China reflected weakened feedstock support, subdued polyurethane consumption, and reduced downstream orders. Market conditions were influenced by oversupply and limited recovery in industrial foam applications.

According to the Price-Watch, product prices in Q3 for Polymer Polyol in China fell by 8.62%. Product prices in China continued to exhibit downward momentum driven by reduced construction activity and cautious overseas buying.

Manufacturers in China operated at reduced output rates to stabilize inventories and manage excess supply pressure. Polymer Polyol prices in September 2025 suggested ongoing softness with limited prospects for a near‑term rebound.

China (Flexible Polyol): Polyol Export prices FOB Qingdao, China, Flexible Polyol (Molecular weight 2500‑2800, Viscosity 450‑750 mPa.s).

In Q3 2025, Flexible Polyol prices in China weakened moderately amid declining export demand and competitive regional supply. Flexible Polyol price trend in China was shaped by lower feedstock costs and inventory adjustments within foam production units. Market participants witnessed declining quotations as manufacturers aimed to retain export orders through price incentives.

According to the Price-Watch, product prices in Q3 for Flexible Polyol in China decreased by 4.35%. Product prices in China reflected sustained softness across furniture and insulation applications. Steady raw material inflows and muted consumption continued to pressure local producers. Flexible Polyol prices in September 2025 highlighted market restraint and cautious procurement behavior among major downstream buyers.