Price-Watch’s most active coverage of Polytetrafluoroethylene (PTFE) price assessment:

- Fine Powder (Emulsion) Ex-Delhi, India

- Fine Powder (Emulsion) FOB Nhava Sheva, India

- Fine Powder (Emulsion) CIF Houston (India), USA

- Fine Powder (Emulsion) CIF Hamburg (India), Germany

Polytetrafluoroethylene (PTFE) Price Trend Q3 2025

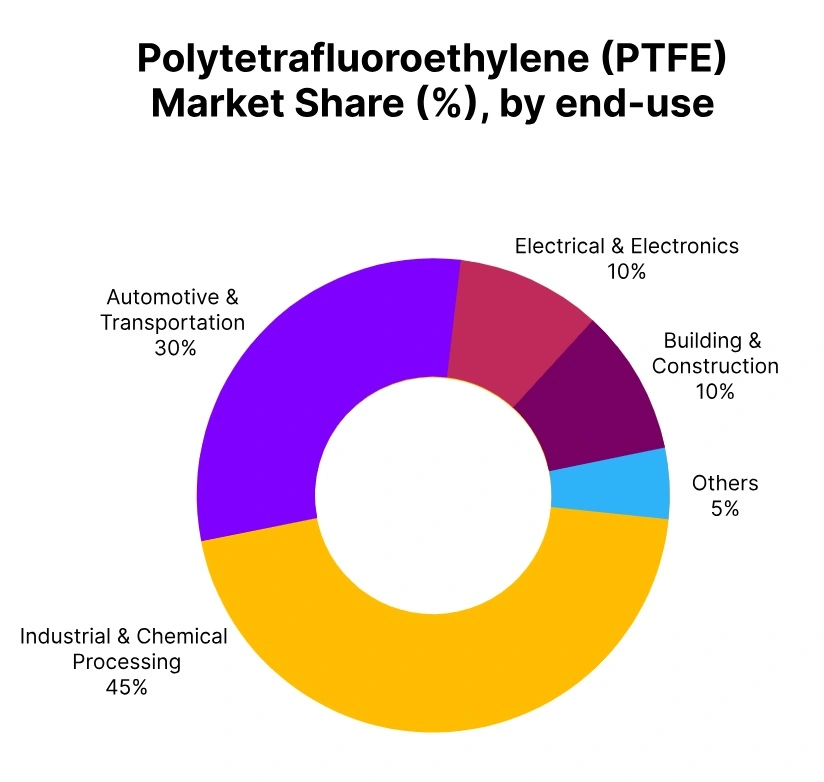

Overall global price trends for PTFE in the 3rd quarter of 2025, have been downward across regions amid broadly soft sentiment. PTFE prices have eased under the APAC regional, as downstream demand from industrial, chemical, and non-stick applications has been moderate, however, adequate supplies from stable imports and inventory restocking applications have weighed on the regional PTFE markets.

The European market has also shown slow downstream consumption and slow-moving prices in sectors such as chemical processing and automotive applications. Similarly, the United States has also seen price declines amid steady supplies and limited demand from industrial end-users.

Mid-way through the quarter, limited logistical interruptions in selected ports have affected short-term flows and have weighed on the overall market downwards trend. Looking ahead into quarter four of 2025, PTFE pricing on semi-annual expectations of continued cautious consumption with stable supply, will keep the downward price pressures on PTFE.

India: Polytetrafluoroethylene (PTFE) Export prices FOB Nhava Sheva, India, Grade Fine Powder (Emulsion).

According to PriceWatch, in India, PTFE saw a decrease in price for Q3 2025 period, averaging around USD 17,000-17,800/MT, which is a 3.7% drop from the previous quarter. PTFE price trend in India have been weak, as downstream consumption from the chemical processing, electrical insulation, and non-stick segments was moderate and the supply was steady.

The prices of PTFE in India in September 2025 showed a further decline of 1.9% from August as muted restocking, and a cautious buying sentiment weighed on the market. Overall supply conditions remained steady for the quarter with little reported disruptions. Demand and availability are expected to maintain a downward pressure on PTFE prices in India during the beginning of Q4 2025.

Germany: Polytetrafluoroethylene (PTFE) Import prices CIF Hamburg (India), Germany, Grade Fine Powder (Emulsion).

In Q3 2025, PTFE price trend in Germany has fallen significantly, with averages around USD 17,540-18,700/MT, a 4.79% fall from the previous quarter. PTFE pricing has been eroded due to lower downstream demand coming from industrial sectors, including chemical processing, automotive applications, and electrical insulation.

PTFE prices in Germany in September 2025 have decreased 2.66% from August, with muted purchase sentiment and stable supply flows also continuing to exert downward pressure in the market. Freight rate fluctuations have also impacted short-term pricing dynamics. In the near term, lower demand recovery and stable imports imply downward pressure on PTFE prices in the German market heading into early Q4 2025.

USA: Polytetrafluoroethylene (PTFE) Import prices CIF Houston (India), USA, Grade Fine Powder (Emulsion).

According to PriceWatch, in the USA, the price trend for PTFE in Q3 2025 has continued to decrease and has averaged around USD 18,480-19,000/MT, which is a decrease of 2.86% from the previous quarter. Continuing softness in PTFE prices is largely due to only moderate downstream consumption from industrial end-use, chemical processing, and non-stick applications, along with steady supply availability.

In September 2025, the PTFE price in the USA continued to ease for this reason, marking a decrease of 3.18% from August, aided by becoming more comfortable in recent freight rate instability and adjusting logistics costs. The lack of restocking or heavy buying has continued to weigh on the market. With stable supply flows and steady demand, PTFE prices in the USA are expected to be suppressed through early Q4 2025.