Price-Watch’s most active coverage of Potassium Iodate price assessment:

- >99% Ex-Mumbai, India

- >99% CIF Surabaya (India), Indonesia

- >99% CIF Port Kelang (India), Malaysia

- >99% CIF Antwerp (India), Belgium

- >99% FOB Nhava Sheva, India

Potassium Iodate Price Trend Q3 2025

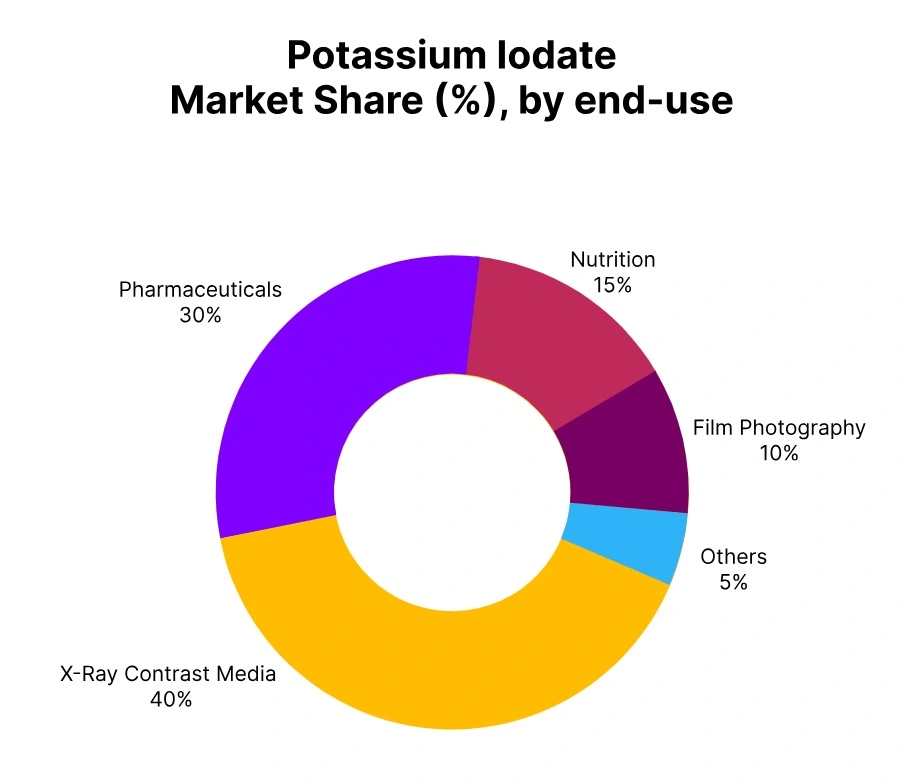

The global Potassium Iodate market exhibited sporadic regional performance during Q3 2025. Export prices in India were increased by 7.28% on robust demand from pharmaceuticals and the chemical sector, while an undersupplied market and improved logistics supported those price increases.

Import markets like Indonesia and Belgium showed moderate Potassium Iodate price trend increases supported by consistent purchasing levels and freight costs that were in balance. Malaysia decreased in price, largely a result of weak demand and decreased freight.

Generally, the market remained relatively balanced with consistent industrial activity, manageable inventory levels, and continued dependable supply chains. Regional supply chain fundamentals and diverse downstream consumption trends continued to affect pricing trends throughout the quarter.

India: Potassium Iodate Export prices FOB Nhava Sheva, India, Grade- Purity (>99%).

According to Price-Watch, In the third quarter of 2025, Potassium Iodate price in India increased by 7.28% and was reported to vary between USD 50,600–52,000 per MT for the quarterly offer period. The Potassium Iodate price trend in India was driven by sustained domestic and export demand from the pharmaceuticals, chemical, and specialty manufacturing end-market segments.

Supply constraints, steady production rates, and optimized logistics continued to maintain firm conditions in the market, while buyers continued to buy cargoes proactively to support their downstream needs.

The Potassium Iodate price trend increased again in September 2025, increasing by 1.40%, indicating bullish price sentiment from the market’s point of view, continued good buying dynamics, and demand conditions that persisted throughout the quarter, with general supply-demand fundamentals balanced with subdued trading pace conditions both domestically and internationally.

Indonesia: Potassium Iodate Import prices CIF Surabaya, Indonesia, Grade- Purity (>99%).

In the third quarter of 2025, Potassium Iodate price in Indonesia rose by 3.58%, with a price range of USD 51,650–53,525 per metric ton (MT) throughout the quarter. The upward Potassium Iodate price trend in Indonesia was supported by moderate quarterly increases in freight costs from Q2, as well as consistent demand from the pharmaceutical, chemical, and specialty manufacturing sectors.

To maintain production requirements, importers continued to procure Potassium Iodate consistently, balancing inventory replenishment while being cautious with buying amid uncertain global markets. In September 2025, Potassium Iodate prices in Indonesia continued their modest upward trajectory by 0.6%, which was confirmed by reliable supply chains, consistent downstream usage, and overall market stability during the quarter. All contributed to a favorable balance of supply-demand fundamentals and stable trading conditions throughout the regional market.

Malaysia: Potassium Iodate Import prices CIF Port Kelang, Malaysia, Grade- Purity (>99%).

During the third quarter of 2025, Potassium Iodate price in Malaysia experienced a decrease of -5.89%, with a quarterly price range of USD 51,140–52,300 per MT. The Potassium Iodate prices trend in Malaysia continued to trend downward given moderate freight declines from Q2 and accompanied by cautious demand from pharmaceutical, specialty chemical, and industrial buyers.

Given a stable flow of imports from India, the market, however, saw some measured degree of excess inventory as end-users were fairly conservative with their consumption patterns. With respect to Potassium Iodate prices in Malaysia during the month of September 2025, prices increased slightly (0.58%).

The modest price increase is likely the result of more measured price adjustments taking into consideration a balanced supply side situation, cautious consumption behaviors, procurement practices throughout the quarter, and overall market stability while transactions across the regional market remained relatively stable in magnitude.

Belgium: Potassium Iodate Import prices CIF Antwerp, Belgium, Grade- Purity (>99%).

In Q3 2025, The Potassium Iodate prices in Belgium increased by 5.93%, with a quarterly price range of USD 51,190–52,360 per MT. The Potassium Iodate price trend in Belgium was supported by stable freight costs, firm demand from pharmaceutical and specialty chemical manufacturers, and consistent import flows that ensured steady availability for downstream users. Buyers maintained active stock replenishment to meet anticipated consumption needs and smooth procurement schedules.

In September 2025, Potassium Iodate prices in Belgium continued their stable movement by 0.50%, reflecting positive market sentiment, balanced supply-demand dynamics, and proactive purchasing strategies, which together contributed to overall market stability and reliable trading activity throughout the quarter.