Price-Watch’s most active coverage of Jute Fibre price assessment:

- Raw Jute TD-5 Ex-Nadia, India

Jute Fibre Price Trend Q3 2025

In Q3 2025, the raw jute price trend in India (Ex-Nadia) has exhibited a strong upward movement, increasing by approximately 15–20%. The rise has been primarily driven by limited supply caused by government-imposed stock restrictions and strong demand from the textile and packaging sectors. Additional constraints from import and export regulations with Bangladesh have further tightened availability. Overall, the market reflects a bullish sentiment, with prices expected to remain volatile in the near term.

India: Jute Fibre Domestically traded prices Ex-Nadia, India, Grade- TD-5 Grade.

According to Price-Watch, in Q3 2025, jute fibre prices in India demonstrated a strong upward trend, rising approximately 23% from the previous quarter to reach USD 820–825/MT. The price trajectory has continued its upward momentum, with September 2025 prices reaching around USD 910–920/MT, reflecting a 15% month-on-month increase. The surge has been largely driven by restricted supply due to government-imposed stock limits on balers, stockists, and mills.

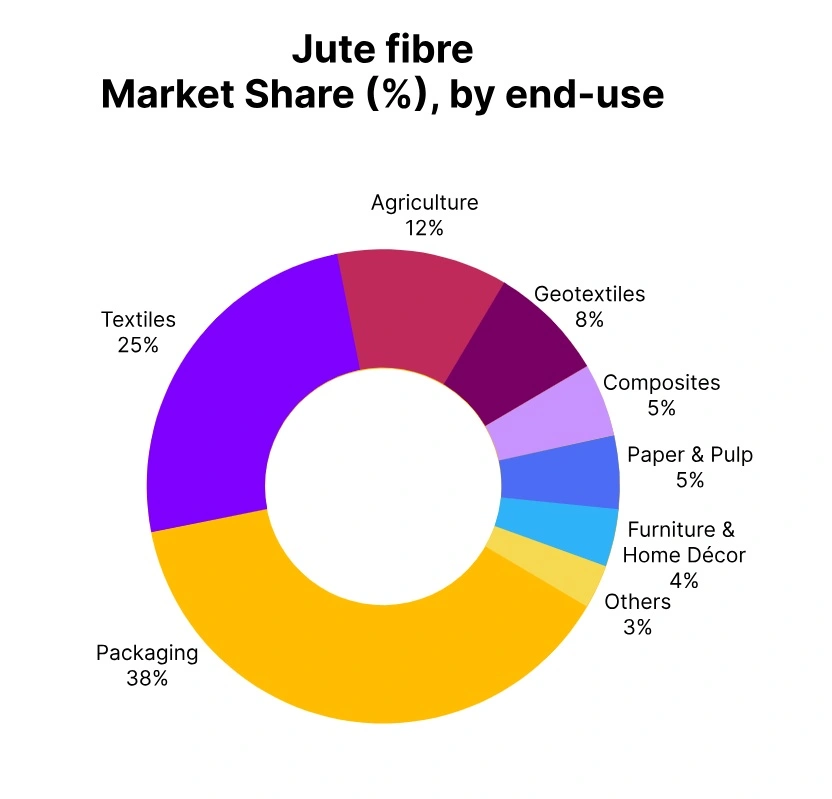

Robust demand from the textile and packaging industries has further supported the price rise. Additionally, export regulations and constraints on jute imports from Bangladesh have tightened market availability. Overall, the quarter exhibits a bullish price trend for raw jute in India, with expectations of continued price volatility in the near term.