Price-Watch’s most active coverage of Recycled Polypropylene (R-PP) price assessment:

- Natural Pellets FD Hamburg, Germany

- Natural Granules Ex-Delhi, India

- Natural Granules FOB Shanghai, China

- Natural Granules (White) Ex-Jeddah, Saudi Arabia

Recycled Polypropylene (R-PP) Price Trend Q3 2025

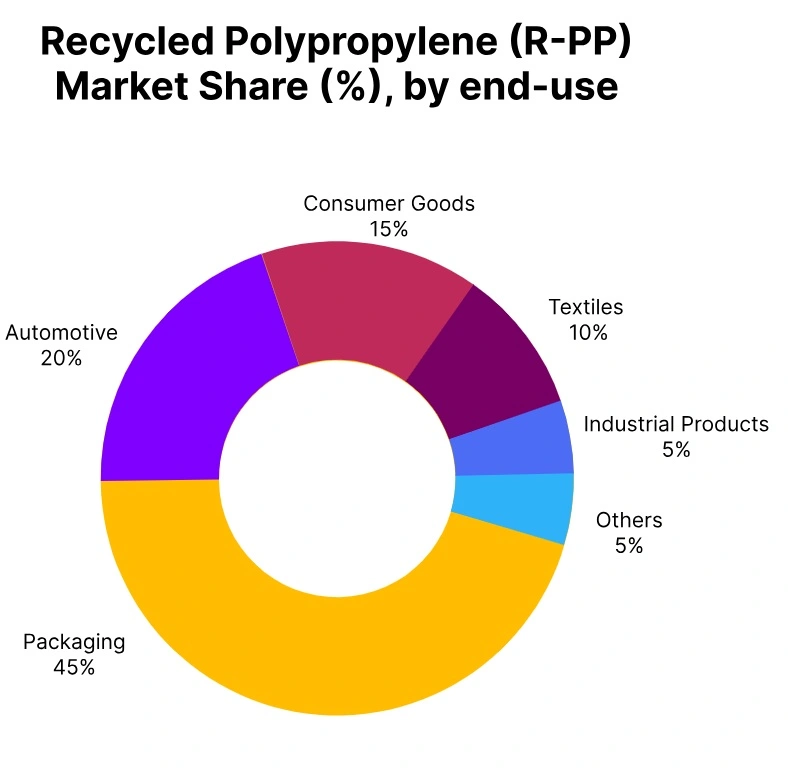

In the third quarter of 2025, the recycled polypropylene price trend has been mixed between regions. While the recycled polypropylene price trend has declined in Germany and China because of lower demand from the automotive and packaging industries, the price trend has been stabling in Saudi Arabia and India because of higher regional demand and limitations on supply.

In Germany, there has been continued softening of the marketplace, with a downward trend sustained, while in Saudi Arabia, demand from the Middle East and Africa has maintained a steady price trend that is even trending upward.

Similarly, in India, demand from the packaging sector has caused a slight upward trend for the R-PP price trend despite minor ups and downs. Overall, across the globe, there have been a combination of softened markets and growing in others in the R-PP price trend due to varying supply-demand implications.

Germany: Recycled PP Domestically Traded prices FD Hamburg, Germany, Natural Pellets.

In Q3 2025, the R-PP price trend in Germany has declined by 1.7%, as weak demand from the automotive and packaging sectors has been affecting procurement. The R-PP price trend has been pressured by competitive imports from Asia, which have limited local price increases. Despite stable supply levels, the recycled polypropylene price trend has reflected overall market softness, as buyers have been delaying purchases and inventories have been building up.

In September 2025, the recycled polypropylene prices in Germany have continued to soften, falling by 0.6%, driven by slow downstream consumption and cautious buying. Suppliers have been adjusting prices to accelerate sales, which has further influenced the R-PP price trend, maintaining a bearish sentiment in the German market throughout the quarter.

Saudi Arabia: Recycled polypropylene Domestically Traded Ex-Jeddah, Saudi Arabia, Natural Granules (White).

In Q3 2025, the R-PP price trend in Saudi Arabia has increased by 5.0%, supported by strong regional demand from the Middle East and African markets. The R-PP price trend has been reinforced by limited supply of high-quality recycled material and growing interest in sustainable products. Export and domestic demand have positively affected the R-PP price trend, keeping prices firm throughout the quarter.

In September 2025, the R-PP prices in Saudi Arabia have remained stable, as supply and demand have been balanced, and procurement levels have been steady. Overall, the recycled polypropylene price trend in Saudi Arabia has shown strength and resilience during Q3 2025, supported by favorable market conditions and consistent buyer interest.

India: Recycled Polypropylene Domestically Traded Ex-Delhi, India, Natural Granules.

In Q3 2025, the R-PP price trend in India has increased by 1.3%, driven by steady demand from the packaging sector and limited local supply. The R-PP price trend has been supported by buyers prioritizing domestic procurement over imports to secure material promptly. Despite some competition from imports, the R-PP price trend has maintained a positive trajectory.

However, in September 2025, the R-PP prices in India have slightly decreased by 0.1%, as slower demand from consumer goods manufacturers temporarily softened the market. Overall, the R-PP price trend in India has reflected moderate growth, with steady procurement and the ongoing emphasis on recycled materials supporting prices through Q3 2025.

China: Recycled PP Export prices FOB Shanghai, China, Natural Granules.

According to PriceWatch, In Q3 2025, the R-PP price trend in China has declined by 0.4%, with a price range of USD 750-770 per metric ton. This trend has been primarily influenced by weak demand in the packaging and automotive industries. The R-PP price trend has been affected by cautious buying, as market participants have delayed purchases expecting further price corrections. Competitive pricing from imports has also pressured the R-PP price trend downward, despite stable supply conditions.

In September 2025, the recycled polypropylene prices in China have been moderate to slightly increased by 0.1%, driven by higher demand from Southeast Asia and other key import markets. Overall, the R-PP price trend in China has shown minor fluctuations, reflecting a soft market that has gradually responded to regional demand improvements.