Price-Watch’s most active coverage of Red Phosphorus price assessment:

- Phosphorus Content: 98% FOB Shanghai, China

- Phosphorus Content: 98% FOB Nhava Sheva, India

- Phosphorus Content: 98% Ex – Bhiwandi, India

- Phosphorus Content: 98% CIF Jebel Ali (India), United Arab Emirates

- Phosphorus Content: 98% CIF Houston (India), USA

Red Phosphorus Price Trend Q3 2025

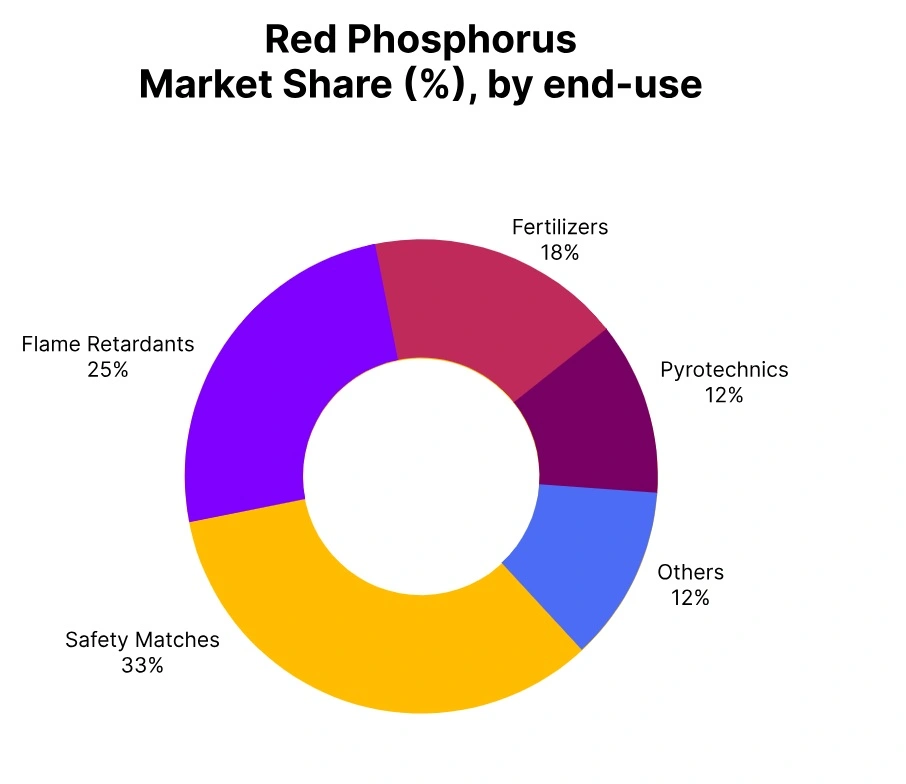

In Q3 2025, the global Red Phosphorus market exhibited a slightly soft to stable trend, shaped by balanced supply and muted downstream demand from flame retardant, fertilizer additive, and chemical intermediate sectors. In East Asia, export prices remained largely steady as production and inventory levels were well-aligned with moderate export inquiries from key destinations.

South Asia experienced mild downward movement in domestic and export markets, with buyers adopting cautious procurement strategies amid sufficient stock availability. The Middle East also saw slight price easing as demand from pigment and flame-retardant industries remained subdued despite consistent supply from South Asia. Overall, the market-maintained equilibrium through the quarter, with stable operations and restrained trading activity keeping price movements limited.

China: Red Phosphorus Exported price in China, Phosphorus Content: 98%.

In Q3 2025, Red Phosphorus prices in China have remained almost flat, pressured by stable downstream demand in flame retardant and chemical intermediate applications. FOB Shanghai prices have ranged between USD 5500–5700 per metric ton, declining marginally by –0.22%.

In September 2025, Red Phosphorus prices in China have decreased by 1.03% compared to August 2025. Suppliers have cited balanced inventory levels and moderate export inquiries from Europe and Southeast Asia. Production rates have held steady, with mills adjusting output minimally to maintain market equilibrium, supporting a stable Red Phosphorus price trend in China.

India: Red Phosphorus Domestically Traded price in India, Phosphorus Content: 98%.

In Q3 2025, Red Phosphorus prices in India have eased slightly amid subdued demand from flame retardant and fertilizer additive sectors. Ex-Bhiwandi prices have fallen by 2.24% to USD 6200–6500 per metric ton, while export-oriented FOB Nhava Sheva values have dropped –2.18% to USD 6400–6800.

In September 2025, Red Phosphorus prices in India have decreased by 0.20% compared to the previous month. Producers have managed stable operating rates, and buyers have maintained cautious procurement amid adequate stocks. Market activity has been measured as both domestic and export buyers have awaited firmer demand signals, reflecting the Red Phosphorus price trend in India.

United Arab Emirates: Red Phosphorus Imported price in UAE from India, Phosphorus Content: 98%.

In Q3 2025, Red Phosphorus prices in the UAE have softened due to weaker buying from flame retardant and pigment manufacturers. CIF Jebel Ali prices have ranged between USD 6500–7400 per metric ton, marking a decline of 6.62%. In September 2025, Red Phosphorus prices in the UAE have declined by 0.69% compared to August 2025.

Importers have noted steady shipments from India, but cautious downstream consumption has limited purchase volumes. Freight and logistics have remained stable, contributing little support to pricing and shaping the Red Phosphorus price trend in UAE.

United States: Red Phosphorus Imported price in USA from India, Phosphorus Content: 98%.

According to PriceWatch, In Q3 2025, Red Phosphorus prices in the USA have declined under pressure from moderate demand in electronics and pigment sectors. CIF Houston prices have ranged from USD 6700–7600 per metric ton, reflecting a quarterly drop of 6.37%. In September 2025, Red Phosphorus prices in the USA have decreased by 1.14% compared to the previous month.

Import availability has stayed consistent, but buyers have maintained selective procurement amid sufficient inventories and subdued end-use consumption. Freight conditions have been stable, resulting in limited price recovery during the period, illustrating the Red Phosphorus price trend in the USA.