Price-Watch’s most active coverage of Selenium price assessment:

- Purity: 99.5%min. FD Rottterdam, Netherlands

- Purity: 99.9%min. Del Alabama, USA

Selenium Price Trend Q3 2025

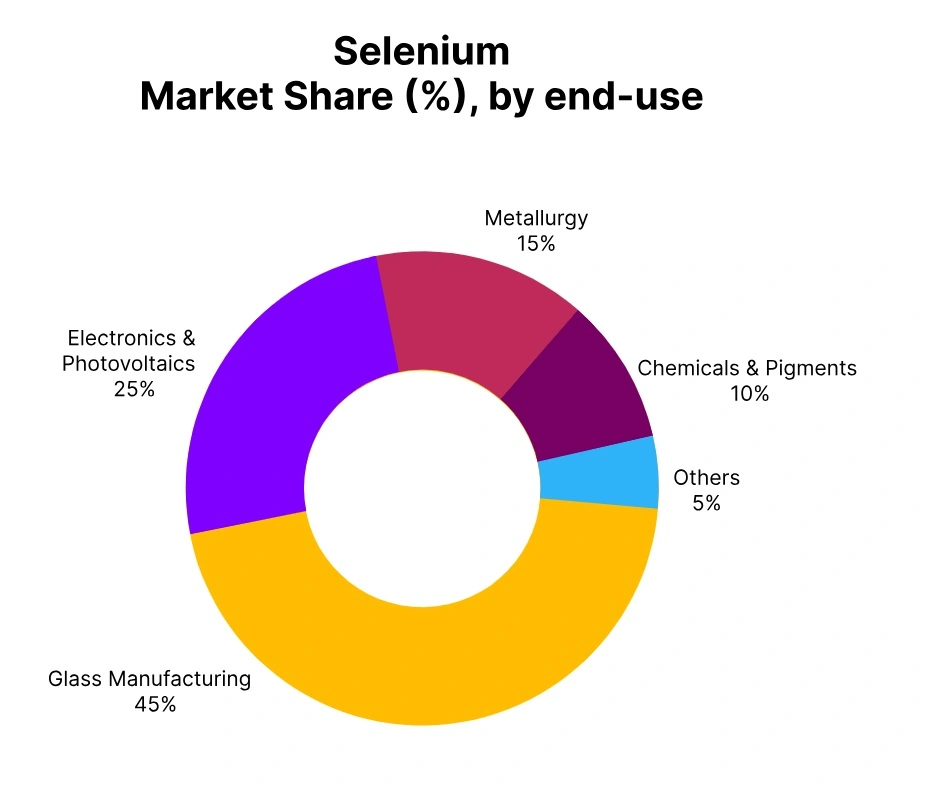

In the third quarter of 2025, the global market for selenium is down a bit, with overall prices falling around 0.12% over the previous quarter. The small decline in price has largely been due to a softening demand from the electronics, photovoltaic, and chemical industries, which represent the main end-use sectors of selenium.

In key producing regions such as Australia and South Africa, steady supply levels kept the market from sharper declines, while cautious procurement by downstream users limited immediate price recovery. Supply-side stability, coupled with moderate inventory levels, contributed to localized fluctuations in trade. Overall, the market remained relatively stable with limited volatility, reflecting a minor correction phase after previous price adjustments.

USA: Selenium Domestically traded prices Del Alabama, USA, Purity: 99.5%min.

According to Price-Watch, in Q3 2025, selenium price trend in the U.S. market have decreased a little by 0.21% compared to the previous quarter as demand from the electronics, glass, and chemical manufacturing sectors softened modestly. Downstream buyers have curtailed purchases when inventories were adequate and raw material costs were stable, exerting mild downward pressure on prices.

While domestic supply remains sufficient, ample imports from major producers have increased competition, contributing to the slight decline. Overall, the market has displayed a mildly bearish sentiment, with producers managing output and inventories cautiously to maintain balance.

In September 2025, selenium prices in the U.S. have remained unchanged, showing 0% movement, as stable demand has been matched by adequate domestic supply and consistent import flows, keeping market sentiment neutral.

Netherlands: Selenium Domestically traded prices FD Rotterdam, Netherlands, Purity: 99.5%min.

According to Price-Watch, In Q3 2025, the selenium price trend in the Netherlands decreased slightly by 0.04% from the prior quarter, reflecting an overall stable market. The electronics, glass, and chemical industries experienced stable demand, and supply from domestic producers and imports satisfied consumption levels.

Minor movement in procurement and competition amongst suppliers resulted in very slight downward pressure. Overall, market sentiment has been neutral to slightly bearish with pricing not dramatically moving in either direction, and the market experienced a balance of supply and demand for the entire quarter.

Selenium price in the Netherlands decreased by 1% in September 2025, driven primarily by softer demand from the electronics, glass, and chemical manufacturing sectors with slower industrial activity. Domestic production continued to supply steady amounts of selenium, supplemented by consistent imports ahead of production demand for Q4, also contributing to downward pressure on prices.