Price-Watch’s most active coverage of Silica price assessment:

- Silica sand (Industrial Grade) Ex-Bhuj, India

Silica Price Trend Q3 2025

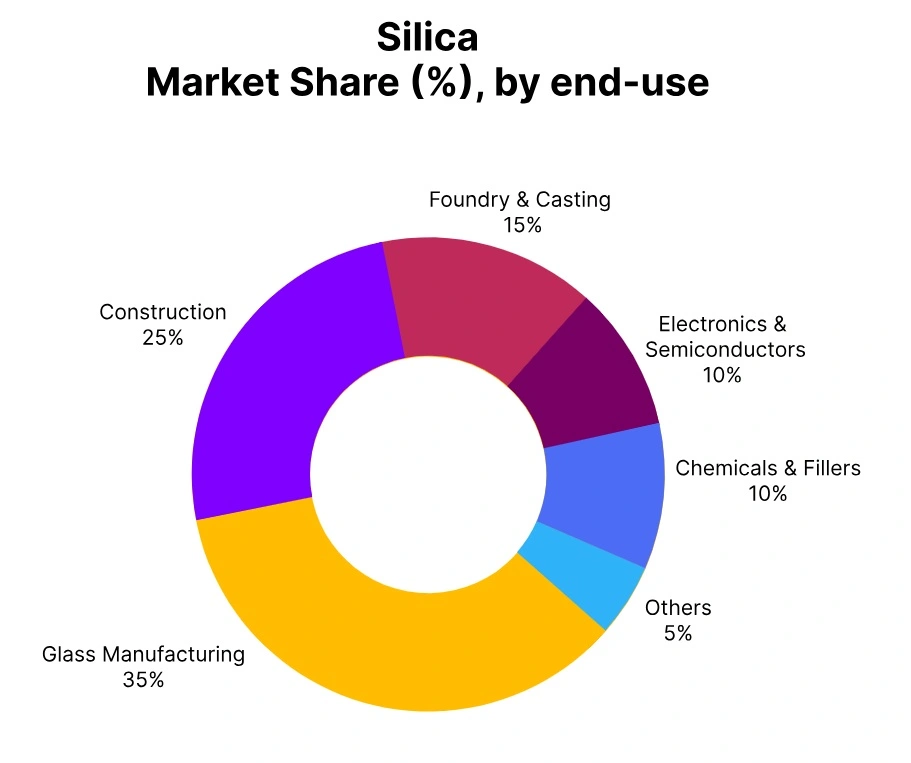

According to PriceWatch, The global Silica market demonstrated an upward projection during Q3 2025, underpinned by stable demand from the construction, glass, and foundry industries. In India, increased infrastructure spending and strong projected activity in the real estate sector helped lift consumption. The paints, coatings & ceramics segments also saw significant demand, supporting the steady market sentiments.

Energy & logistics cost had some minor fluctuations, however, ongoing steady production and balanced inventories kept prices trending positively. Overall, the market generated a gradual, but steady positive trend during the quarter, aided by strong downstream industries and continued regional demand growth.

India: Silica Export prices Ex-Bhuj, India, Industrial Grade.

In the third quarter of 2025, Silica price trend in India increased by 1.49% from the previous quarter, driven by consistent demand in glass, construction and foundry sectors. The momentum has been supported by the recovery of infrastructure improvement and manufacturing activities, while with consistent costs for raw materials and energy costs, producers have been able to retain a level of profitability.

Higher demand of high-purity silica has also been noted in industrial applications such as electronics and chemicals, which boosted sentiment. Overall, the market maintained a firm and slightly bullish tone, with prices showing a moderate incline through the quarter. Silica price trend in India declined by 1.03% in September 2025, mainly due to reduced offtake from the construction, glass, and foundry sectors as project activity slowed amid monsoon conditions.

Adequate domestic supply and muted export demand further weighed on market sentiment. Overall, the silica market in India during Q3 2025 remained under mild downward pressure, with expectations of improvement in Q4 as infrastructure and industrial operations regain momentum post-monsoon.