Price-Watch’s most active coverage of Raw Silk price assessment:

- Mulberry Raw Silk 3A (20/22D) FOB Shanghai, China

- Mulberry Raw Silk 3A (20/22D) CIF Houston (China), USA

- Mulberry Raw Silk 3A (20/22D) CIF Haiphong (China), Vietnam

- Mulberry Raw Silk 3A (20/22D) CIF Hamburg (China), Germany

- Mulberry Raw Silk 3A (20/22D) CIF Nhava Sheva (China), India

Raw Silk Price Trend Q3 2025

In Q3 2025, Raw Silk prices across key markets, including China, the U.S., Germany, Vietnam, and India, have recorded a steady increase of around 2–3% during the quarter. The upward Raw Silk price trend has been driven by consistent seasonal demand, limited availability of premium-grade silk, and strategic adjustments in supply chains. Higher logistics and freight costs also have contributed to elevated import prices in international markets.

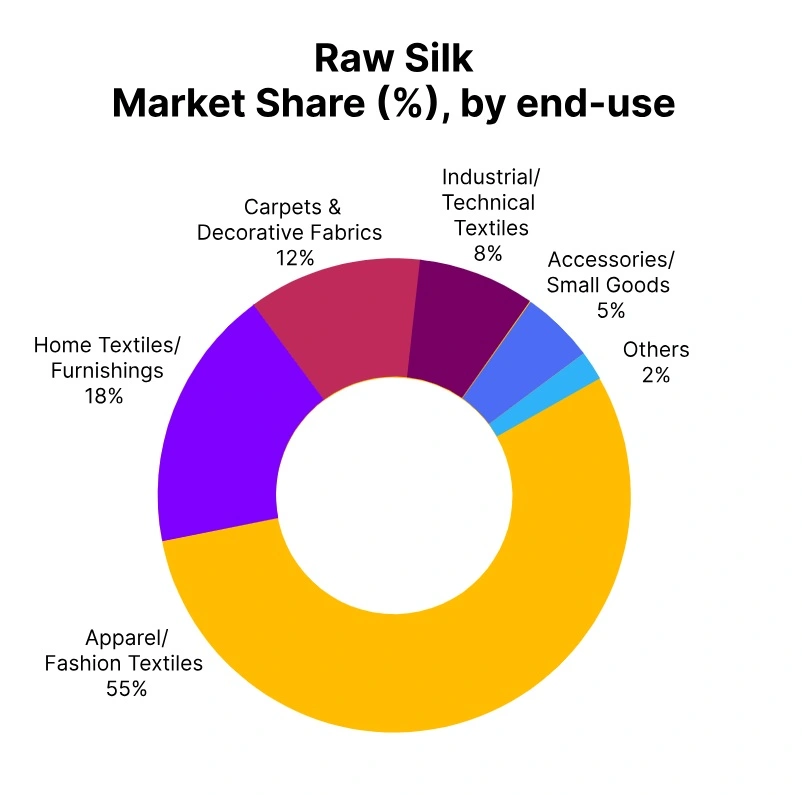

Overall, the global silk market has demonstrated resilience and moderate growth, supported by strong demand from fashion, luxury apparel, and home textile sectors, with positive near-term prospects despite potential macroeconomic and logistical challenges.

USA: Raw Silk import prices CIF Houston, USA, Grade- 3A (20/22D) Grade.

In Q3 2025, Raw Silk imports from China to the U.S. have recorded a steady increase of around 2% over the previous quarter. The raw silk price trend in the U.S. has been upward. In September 2025, raw silk prices in the U.S. have been assessed approximately USD 60,000/MT, marking a 0.2% month-on-month rise from August. This growth has been driven by sustained demand from U.S. textile and luxury apparel manufacturers and limited availability of premium-grade silk.

Higher logistics and freight costs from China to Houston also have contributed to the firmness in CIF values. Overall, the market has remained stable to bullish, supported by ongoing demand from high-end fashion and home textile sectors, although short-term fluctuations in import pricing may occur due to variations in freight rates and currency movements.

Germany: Raw Silk import prices CIF Hamburg, Germany, Grade- 3A (20/22D) Grade.

In Q3 2025, Raw Silk imports from China to Germany have recorded a steady increase of around 2% over the previous quarter. The raw silk price trend in Germany has been upward. In September 2025, raw silk prices in Germany have been assessed approximately USD 60,000 /MT, marking a 0.2% month-on-month rise from August. This growth has been supported by strong and consistent demand from European textile and luxury apparel manufacturers, active restocking ahead of the winter production season, and limited availability of premium silk.

Higher freight and insurance costs from China to Hamburg also have contributed to elevated CIF values. Overall, the market has remained positive and bullish, underpinned by sustained demand for high-quality and sustainable silk products across Europe, although short-term fluctuations may occur due to logistics costs and macroeconomic uncertainties.

China: Raw Silk Export prices FOB Shanghai, China, Grade- 3A (20/22D) Grade.

In the third quarter of 2025, China’s raw silk price trend saw a modest quarter-on-quarter increase of approximately 2%. Prices of raw silk in China have increased steadily. Prices of raw silk in China reached approximately USD 59,600-59,800/MT in September 2025, representing a month-on-month increase of 0.2% compared to August. This growth has been facilitated by continued seasonal demand from many of the main export markets including the USA and the EU and China’s continued focus on improving production efficiency and scale.

Growth in mulberry cultivation and improvements in silkworm strains have underscored China’s strong position as the world’s largest supplier, accounting for the bulk of global cocoon and raw silk production. The sustained rise in the global market for high-quality and sustainable textiles suggests that pricing will remain stable. Continued strong demand and supply strategies stem the effect of any short-term supply and or pricing changes.

Vietnam: Raw Silk import prices CIF Haiphong, Vietnam, Grade- 3A (20/22D) Grade.

During the third quarter of 2025, Raw Silk imports from China to Vietnam experienced a consistent uptick of about 2% compared to the prior quarter. In Vietnam, the Raw silk price trend showed an upward trajectory. The pricing for raw silk in Vietnam reached an approximate range of USD 59,700 – 59,900/MT in September 2025, with an increase of about 0.2% when compared to August. Early in Q3, the continued growth in prices can be attributed to many factors, such as seasonal demand in advance of production, strategic supply chain work by exporters and importers, and beneficial currency movement.

Vietnam has maintained a strong role in the raw silk market, exporting large volumes of high-quality silk to countries, such as India. Overall, Q3 2025 showed a resilient silk market, with slight growth, and if domestic consumption remains stable, and supply is managed throughout production, the upward pricing trend from Q3 into Q4 may continue to develop.

India: Raw Silk import prices CIF Nhava Sheva, India, Grade- 3A (20/22D).

According to Price-Watch, during the third quarter of 2025, raw silk imports from China to India have experienced a positive trend of around 4% from the previous quarter. The Raw Silk price trend in India has also been positive in Q3 2025. In September 2025, the raw silk price in India assessed in the range of USD 60,200–60,500/MT, representing an increase of 1% month-over-month. The price increase has been driven by consistent demand from textile mills, organized port supply in addition to seasonal demand as well as supply chain management.

Although there has been slightly decreased production of domestic raw silk, imports from China have played a pivotal role in meeting market requirements. Overall, the Indian silk import market has demonstrated stability and resilience during Q3 2025 showing moderate growth and stability, with the continued sales price increase trend expected to continue in the near term.