Price-Watch’s most active coverage of Silver price assessment:

- Purity: 99.9% Spot Price Weekly Closing, Global

Silver Price Trend Q3 2025

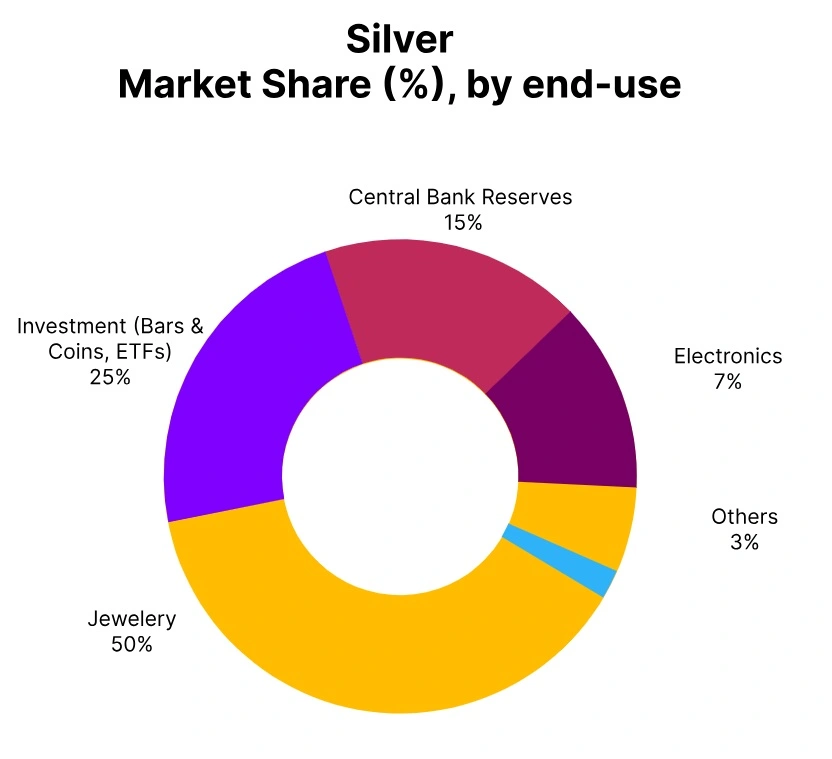

According to PriceWatch, Silver experienced approximately a 20% increase in price in Q3 of 2025, primarily due to robust industrial demand and investment demand in light of uncertainty surrounding the economic outlook. Industrial silver demand significantly increased as a result of growth in renewable energy, particularly manufacturing solar panels and batteries for electric vehicles. The investment segment, comprised of silver ETFs and coins, saw significant inflows, with investors seeking a hedge against inflation and currency devaluation.

Ongoing inflationary pressures and a weaker dollar also made silver attractive as a value store. Furthermore, increasing geopolitical tensions has resulted in further risk aversion, adding to the demand for precious metals. The combination of these factors all contributed to the upside price momentum experienced in the third quarter.

Global (XAG/USD)

XAG/USD price movements in the third quarter of 2025, an increase in silver prices of 20% has been observed compared to the second quarter of 2025. The price increase of silver has been spurred by a strong recovery in industrial demand from the electronics and renewable energy sector, in addition to stronger demand from investments. Inflationary pressures and a softer U.S. dollar also served to make silver an attractive option.

In September 2025, XAG USD rose more sharply by 11% (higher than the average), as safe-haven buying swelled in reaction to growing geopolitical tensions and weaker broader economic readings globally. These factors enhanced silver’s dual role as both an industrial metal and as a precious metal investment, leading to the strong upward momentum of the price in Q3.