Price-Watch’s most active coverage of Soda Ash (Sodium Carbonate) price assessment:

- Light (>98%) FOB Qingdao, China

- Dense (>98%) FOB Mersin, Turkey

- Dense (>98%) FOB Houston, USA

- Dense (>98%) CIF Melbourne (USA), Australia

- Dense (>98%) CIF Santos (USA), Brazil

- Dense (>98%) CIF Santos (Turkey), Brazil

- Dense (>98%) CIF Nhava Sheva (Turkey), India

- Dense (>98%) CIF Genoa (Turkey), Italy

- Dense (>98%) CIF Manzanillo (USA), Mexico

- Dense (>98%) CIF Rotterdam (Turkey), Netherlands

- Dense (>98%) CIF Busan (USA), South Korea

- Dense (>98%) CIF Barcelona (Turkey), Spain

- Light (>98%) CIF Bangkok (China), Thailand

- Light (>98%) Ex-Ahmedabad, India

- Dense (>98%) Ex-Ahmedabad, India

- Light (>98%) Ex-West India, India

- Dense (>98%) Ex-West India, India

- Light (>98%) Ex-North India, India

- Dense (>98%) Ex-North India, India

- Light (>98%) Ex-East India, India

- Dense (>98%) Ex-East India, India

Soda Ash (Sodium Carbonate) Price Trend Q3 2025

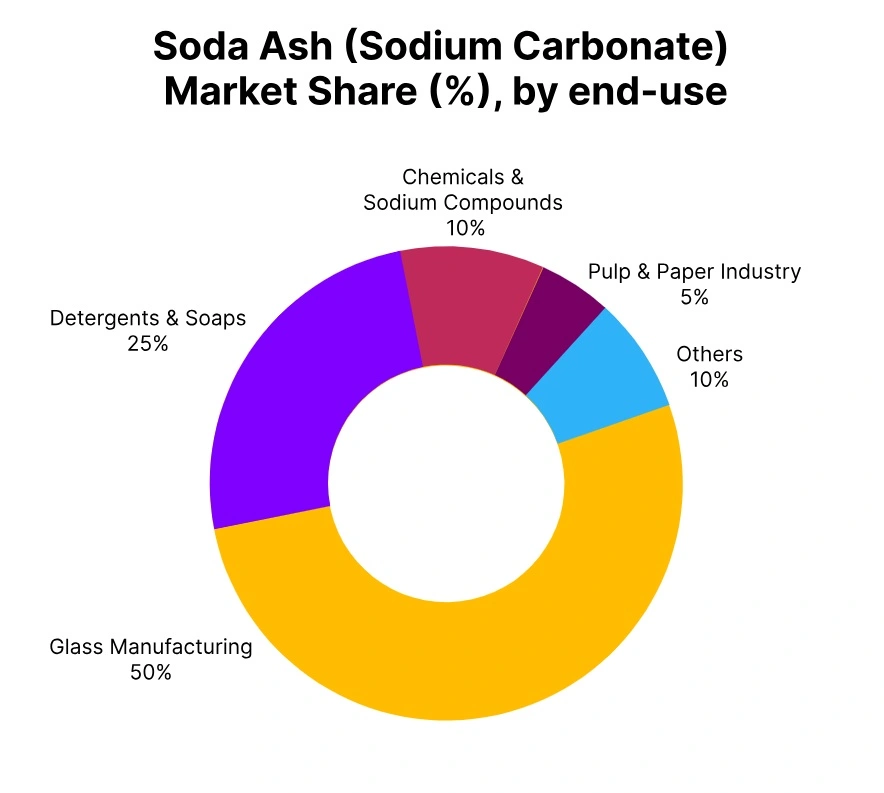

In Q3 2025, the global Soda Ash (Sodium Carbonate) market exhibited mixed performance with notable regional divergence. Price trends for Soda Ash fluctuated during the July-September 2025 quarter, shaped by excess production capacity in China and India, supply disruptions in Turkey driven by geopolitical tensions, and steady demand from glass and chemical manufacturing sectors.

Export competition from major producers and freight cost variations in key trade routes influenced regional price movements. Despite moderate volatility, consistent industrial consumption and balanced supply conditions in developed markets supported overall market stability.

Netherlands: Soda Ash (Sodium Carbonate) import price in Netherlands from Turkey, Dense (Purity: >98%)

In Q3 2025, Soda Ash (Sodium Carbonate) prices in the Netherlands market exhibited positive momentum, reflecting robust demand from European glass and chemical sectors. Freight costs declined modestly, contributing to improved competitive positioning of regional suppliers.

Soda Ash price trend in the Netherlands increased by 5.32% during the quarter, supported by consistent industrial consumption and supply availability from Turkish sources. Soda Ash price trend in the Netherlands ranged between USD 280-290 per metric ton, strengthened by steady downstream demand and regional market activity.

Industrial sectors maintained healthy operational levels, providing stable demand support throughout the quarter. In September 2025, Soda Ash (Sodium Carbonate) prices in the Netherlands increased by 1.26%, supported by stable consumption and slight tightening in supply. Sellers maintained firm quotations throughout the month.

Spain: Soda Ash (Sodium Carbonate) import price in Spain from Turkey, Dense (Purity: >98%).

In Q3 2025, Soda Ash (Sodium Carbonate) prices in the Spain demonstrated positive performance, supported by strong demand from European glass and construction sectors. Freight costs remained relatively stable with minimal seasonal variations, supporting predictable pricing dynamics.

Soda Ash price trend in Spain increased by 6.13% during the quarter, driven by consistent industrial consumption and supply support from Turkish and Mediterranean sources. Soda Ash prices in Spain ranged between USD 290-320 per metric ton, strengthened by robust downstream demand and regional market activity.

European industrial operations remained active, providing sustained demand support throughout the quarter. In September 2025, Soda Ash (Sodium Carbonate) prices in Spain rose by 1.81%, aided by controlled supply and mild improvement in procurement activity. Sellers maintained firm positions amid balanced stocks.

USA: Soda Ash (Sodium Carbonate) Export price from USA, Dense (Purity: >98%).

According to Price-Watch, in Q3 2025, Soda Ash (Sodium Carbonate) prices in the USA market displayed moderate softness, influenced by balanced supply-demand conditions within the American industrial chemical landscape.

Soda Ash price trend in the United States declined by 2.96% throughout the quarter, reflecting adequate production capacities and stable feedstock availability from domestic trona reserves. The market-maintained equilibrium as glass manufacturing demand and chemical industry consumption patterns remained steady.

Soda Ash price trend in the United States ranged between USD 195-225 per metric ton, supported by robust domestic production capabilities and efficient logistics infrastructure. However, in September 2025, Soda Ash (Sodium Carbonate) prices in the USA dropped sharply by 6.34%, pressured by weak consumption and elevated stock levels. Producers adjusted offers downward to sustain sales flow.

Italy: Soda Ash (Sodium Carbonate) import price in Italy from Turkey, Dense (Purity: >98%).

In Q3 2025, Soda Ash (Sodium Carbonate) prices in the Italy demonstrated relative stability with incline pressure towards the later stages of the quarter, indicating the balance between supply and demand in various industrial sectors across Europe. Freight costs eased on the quarter, providing downward pressure to the overall logistics costs whilst maintaining supportive market pricing.

Italian Soda Ash price performance increased by 1.15% on the quarter, as glass manufacturers and construction activity continued to indicate stability in demand. In Italy, upfront Soda Ash prices ranged from USD 290-320 per metric ton, as regional availability remained constant with universal downstream consumption bearish market pressure.

Overall industrial activity remained neutral, as operations stabilized around normality throughout the quarter. In September 2025, Soda Ash (Sodium Carbonate) prices in the Italy increased by 2.15% as moderate re-stocking and limited availability emerged. Market sentiment improved slightly on strength of firmer regional offers.

Turkey: Soda Ash (Sodium Carbonate) Export price from Turkey, Dense (Purity: >98%).

In Q3 2025, Soda Ash (Sodium Carbonate) prices in Turkey exhibited robust performance, reflecting sustained demand from the glass and construction sectors across the Eastern European and Middle Eastern regions. Soda Ash price trend in Turkey increased by 7.76% during the quarter, underpinned by supply disruptions stemming from regional geopolitical tensions and conflict-related production constraints.

The market benefited from tight supply conditions coupled with consistent downstream demand, creating upward pricing momentum. Soda Ash price trend in Turkey ranged between USD 230-255 per metric ton, maintaining resilience through strategic supply management and export competitiveness amid supply limitations.

In September 2025, Soda Ash (Sodium Carbonate) prices in Turkey increased by 3.12%, supported by firm export demand and tighter domestic availability. Sellers maintained higher offers to preserve margins.

China: Soda Ash (Sodium Carbonate) Export price from China, Light (Purity: >98%).

Overall, the prices for Soda Ash (Sodium Carbonate) in China in Q3 2025 showed considerable easing characteristics as the market adjusted to rapidly changing demand trends from the glass and chemicals manufacturing industries.

For the quarter, the price trend of Soda Ash in China has decreased, down by 10.84%, which has been illustrative of oversupply conditions in the marketplace attributable to excess manufacturing capacity and weak domestic consumption patterns.

Manufacturing output remained high relative to actual demand and downward pricing pressure has necessarily felt in the market throughout Q3. Overall, based on US dollar pricing, estimates of Soda Ash prices for the quarter have been in the USD 160-175 per metric ton range.

The downward pricing pressure has been necessitated by competitive pressure in the market and the inventory positions of industrial consumers. For September 2025 and resulting from continued sluggish trading, as well as sufficient inventory levels across market sectors, Soda Ash (Sodium Carbonate) prices in China fell another 2.78%.

South Korea: Soda Ash (Sodium Carbonate) import price in South Korea from USA, Dense (Purity: >98%).

In Q3 2025, Soda Ash (Sodium Carbonate) prices in the South Korea faced downward pressure, responding to weakened regional demand from automotive and electronics manufacturing sectors. Freight costs experienced significant reductions.

Soda Ash price trend in South Korea declined by 6.86% throughout the quarter, reflecting reduced consumption patterns and competitive import pricing from North American suppliers. Soda Ash prices in South Korea ranged between USD 240-270 per metric ton, pressured by soft demand conditions and increased price competition.

Industrial activity remained subdued as regional manufacturers exercised caution in purchasing decisions during the quarter. In September 2025, Soda Ash (Sodium Carbonate) prices in South Korea declined by 5.23%, reflecting slower exports and abundant domestic inventories. Weak sentiment from regional markets added pressure.

Thailand: Soda Ash (Sodium Carbonate) import price in Thailand from China, Light (Purity: >98%).

Soda Ash (Sodium Carbonate) price trend in the Thailand market experienced a downward trajectory in Q3 2025 due to a weaker regional demand from the glass, and in the chemical processing sectors. Although freight costs have been increasing, however the prices decreased across the region primarily due to slow downstream consumption and competitive pressure from Chinese suppliers. There has been a 7.51% decrease in the quarter due to lacklustre consumption and competitive pressure from Chinese suppliers.

The prices traded in the USD 200-220 per metric ton range throughout the quarter due to the sluggish demand of soda ash across Southeast Asia, where industrial manufacturers exhibited conservative market strategies and focused mostly on managing inventory during the Quarter.

The prices of Soda Ash (Sodium Carbonate) in Thailand settled lower in September 2025, with a 2.20% decline, as sturdy availability and a moderate level of trading inhibited prices from any upward movement.

India: Domestically Traded Soda Ash (Sodium Carbonate) (Light) price in Ahmedabad, Light (Purity: >98%).

According to Price-Watch, In Q3 2025, Soda Ash (Sodium Carbonate) prices in India faced downward pressure, responding to subdued demand conditions across the glass and chemical processing sectors. Soda Ash price trend in India declined by 9.63% during the quarter, driven by ample stock availability and competitive pricing pressures in the domestic market.

The market experienced significant pricing compression as abundant inventory levels of constrained pricing power among suppliers and distributors. Soda Ash prices in India ranged between USD 280-320 per metric ton, with downward movement driven by oversupply relative to consumption.

Industrial consumers capitalized on favorable purchasing conditions amid excess stock availability, resulting in sustained competitive pressure throughout the quarter. In September 2025, Soda Ash (Sodium Carbonate) prices in India declined sharply by 8.12%, driven by oversupply and subdued procurement activity. Market participants reported aggressive pricing from local producers.

Australia: Soda Ash (Sodium Carbonate) import price in Australia from USA Dense (Purity: >98%).

In Q3 2025, Soda Ash (Sodium Carbonate) prices in Australia declined notably. Regional supply has been adequate with lower freight, which supported distributor inventory strategies across the country. The price trend for Soda Ash in Australia dropped 9.75% through the quarter, due to weak downstream consumption by the glass and chemicals manufacturing.

Soda Ash prices across Australia ranged from USD 310-340 per metric ton, pressured by weak demand and competitive pricing. Market sentiment remained cautious through the quarter, as a continued uncertain economic environment caused industrial end-users to continue to defer purchasing decisions. In September 2025, Soda Ash (Sodium Carbonate) prices in Australia dropped 6.08% amid steady imports and buyer sentiment.

Brazil: Soda Ash (Sodium Carbonate) import price in Brazil from USA, Dense (Purity: >98%).

In the third quarter of 2025, Soda ash price trend in the Brazil market showed relative stability with limited price movement due to steady domestic demand for glass and chemical products. Transportation costs increased substantially, but the demand from manufacturing levels, or related industries, helped minimize the cost of transportation.

The price of Soda Ash in Brazil decreased marginally by 1.34% during the course of the quarter, indicating a balanced market with steady consumption. Prices for Soda Ash in Brazil have been seen in a range of USD 240-275 per metric ton and remained similarly strong during the quarter and despite some regional economic activity.

As regards industrial consumption, patterns remained at levels to support price during the quarter. In September 2025, prices for Soda Ash (Sodium Carbonate) in Brazil were down by 4.78% as sellers reported limited price inquiries and stable domestic inventories.

Mexico: Soda Ash (Sodium Carbonate) import price in Mexico from USA, Dense (Purity: >98%).

In Q3 2025, Soda Ash (Sodium Carbonate) prices in the Mexico displayed moderate softness, influenced by cautious purchasing patterns from regional industrial consumers. Freight costs remained relatively stable with minimal volatility, supporting consistent import pricing dynamics.

Soda Ash price trend in Mexico declined by 2.12% throughout the quarter, reflecting competitive pricing pressures and adequate supply availability from North American sources. Soda Ash prices in Mexico ranged between USD 250-285 per metric ton, maintained by balanced regional supply conditions and steady downstream demand.

Industrial consumption patterns remained consistent as manufacturing sectors continued normal operational levels during the quarter. In September 2025, Soda Ash (Sodium Carbonate) prices in Mexico dropped by 5% due to limited buying interest and steady supply levels. Traders reduced offers to clear excess inventory.