Price-Watch’s most active coverage of Sodium Aluminosilicate (4A Zeolite) price assessment:

- 4A Zeolite Powder FOB Shanghai, China

- 4A Zeolite Powder CIF Manzanillo (China), Mexico

- 4A Zeolite Powder CIF Haiphong (China), Vietnam

Sodium Aluminosilicate (4A Zeolite) Price Trend Q3 2025

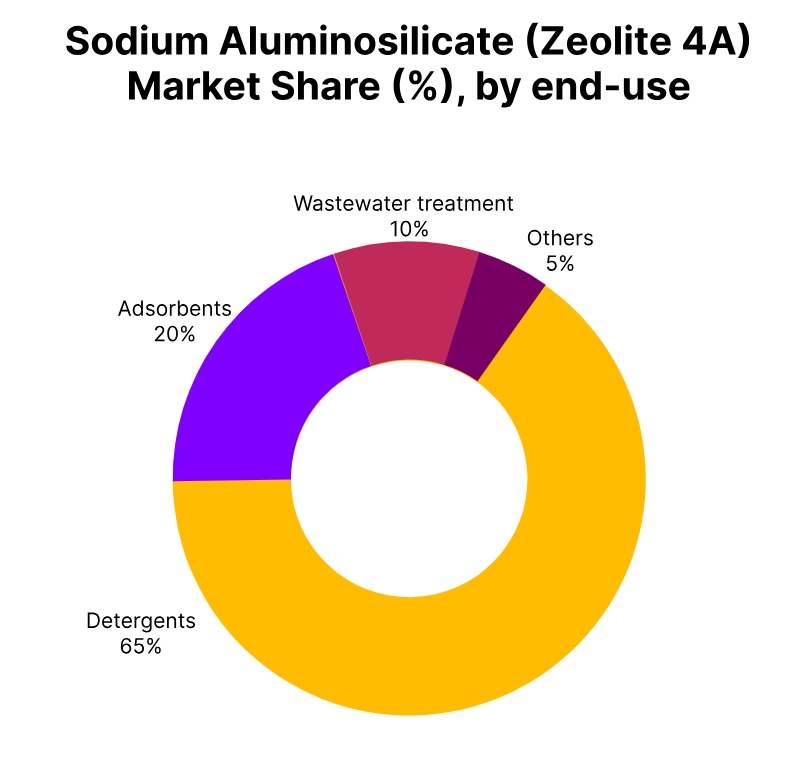

In Q3 2025, the Sodium Aluminosilicate (4A Zeolite) price trend demonstrated a pronounced increase worldwide, attributed to escalating prices for raw materials, energy costs, and firm demand from the detergent and cleaning sectors. The Sodium Aluminosilicate price in key production and export regions, such as China, exhibited a steady increase through the quarter, with the pace of the price increase accelerating in September.

This was primarily due to increased alumina and sodium silicate costs, as well as reduced supply for market purchases, impacted by increased environmental regulations in China limiting production capacity. Buyers in markets globally experienced higher procurement costs and, in some cases, locked in volumes at higher prices in anticipation of further price increases. Consequently, 4A Zeolite prices remained stable with continued upward pressure around the world, and expectations remained for continued firm prices heading into Q4 if feedstock costs and energy prices are sustained.

China: Sodium Aluminosilicate Export prices FOB Shanghai, China, Grade-4A Zeolite Powder.

According to Price-Watch, in the third quarter of 2025, the Sodium Aluminosilicate (4A Zeolite) price trend in China showed some price pressure up about 4% on an FOB Shanghai, China basis. Mild upward price pressure was attributed to fluctuating input costs in addition to steady export demand. Sodium Aluminosilicate (4A Zeolite) price remained stable over the quarter, particularly with firmer costs for sodium silicate, alumina, and slight upward pressure in energy and labor costs among producers.

Exporters, in particular, indicated improving inquiries from overseas despite a largely balanced domestic supply, especially from Southeast Asia and the Middle East, which continued to support firmer offer levels of Sodium Aluminosilicate (4A Zeolite) in September 2025.

Overall, the Sodium Aluminosilicate (4A Zeolite) price trend in Q3 suggested modest price pressure with a steadily firmer price sentiment, observing closely on upstream cost pressures and environmental compliance factors which could change over time and impact production levels.

Mexico: Sodium Aluminosilicate import prices CIF Manzanillo, Mexico, Grade-4A Zeolite Powder

In Q3 2025, Sodium Aluminosilicate (4A Zeolite) price trend in Mexico recorded a decline of approximately 5%, primarily driven by a sharp reduction in international freight charges. The Sodium Aluminosilicate (4A Zeolite) price in Mexico moved lower despite relatively stable FOB values from key exporting regions like China, as logistics costs particularly container rates from Asia to Latin America fell significantly throughout the quarter. This drop in freight translated directly into lower landed costs for Mexican importers.

By September 2025, Sodium Aluminosilicate (4A Zeolite) price in market fully reflected this adjustment, with traders and buyers securing more competitive offers amid steady demand from the detergent and chemical manufacturing sectors. While the core material costs remained unchanged, the overall Sodium Aluminosilicate (4A Zeolite) price was influenced heavily by external logistics dynamics, leading to temporary relief in import pricing. Barring any reversal in freight trends, the market is expected to remain soft in the near term.

Vietnam: Sodium Aluminosilicate Import prices CIF Haiphong, Vietnam, Grade-4A Zeolite Powder

According to Price-Watch, In Q3 2025, the Sodium Aluminosilicate (4A Zeolite) price trend in Vietnam recorded a 4% increase, supported by rising production costs and consistent demand from the domestic detergent and chemical sectors. The Sodium Aluminosilicate (4A Zeolite) price in Vietnam moved upward steadily throughout the quarter, with the trend becoming more evident in September, as suppliers from key origins, particularly China, adjusted offer levels in response to higher raw material and energy costs.

While freight rates remained relatively stable, the increase was mainly attributed to firm export pricing and limited availability in the spot market. By the end of the quarter, Vietnamese importers were paying noticeably higher prices, reflecting tight supply conditions and supplier pricing discipline. By the end in September 2025, Sodium Aluminosilicate (4A Zeolite price in Vietnam remained on a mildly bullish trajectory, with expectations of continued firmness if upstream pressures persist into Q4.