Price-Watch’s most active coverage of Sodium Chlorite price assessment:

- 31% Industrial Grade FOB Shanghai, China

- 31% Industrial Grade CIF Haiphong (China), Vietnam

- 31% Industrial Grade CIF JNPT (China), India

- 31% Industrial Grade CIF Santos (China), Brazil

- 31% Industrial Grade CIF Houston (China), USA

- 31% Industrial Grade CIF Jakarta (China), Indonesia

- 31% Industrial Grade CIF Manila (China), Philippines

Sodium Chlorite Price Trend Q3 2025

In Q3 2025, global sodium chlorite prices observed mixed trends across key markets. China and Vietnam were both 4% higher as downstream demand improved and supply tightened. India was 7% higher after a previous decline due to monsoon related water treatment requirements that typically takes place during monsoon season. Sodium chlorite price trend in Brazil saw the largest increase of 23% benefit from industrial recovery after elections and the rising cost of imports.

Indonesia had a mild gain of 2% due to stable imports and public sector demand. The USA and the Philippines both declined in price by 1% and 2% respectively because of weaker than anticipated industrial activity and large inventories. Overall, Sodium Chlorite prices were determined by shifts in regional demand, supply, currency fluctuations, and logistical issues.

China: Sodium Chlorite Export Prices FOB Shanghai, China, Grade- (31%) Industrial Grade.

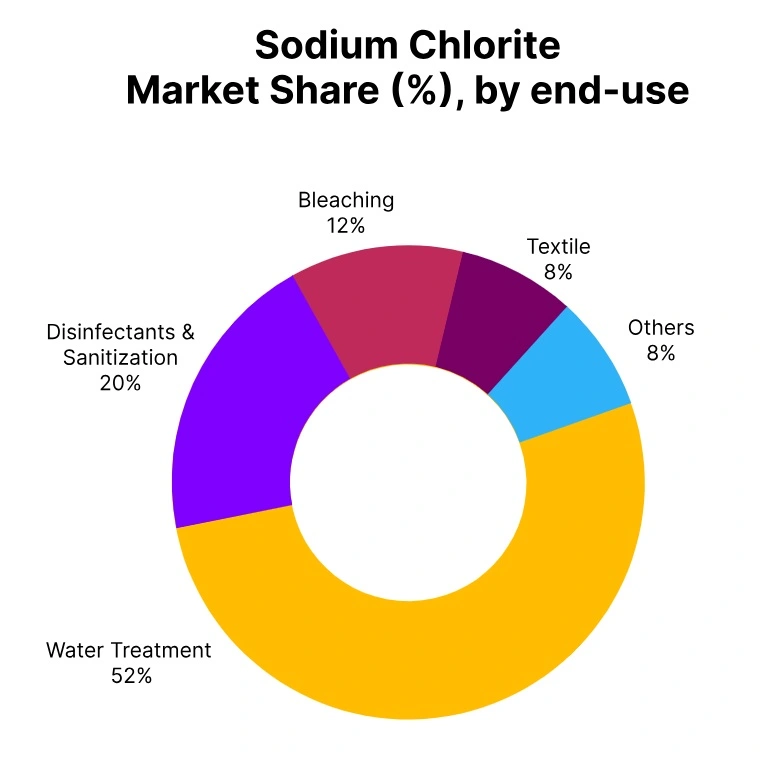

In the third quarter of 2025, sodium chlorite prices in China increased 4% from the prior quarter, reversing the 4% decrease we saw in the previous quarter. Sodium chlorite price trend in China also benefited from a modest recovery in downstream demand from the paper manufacturing, textile, and water treatment sectors. Additionally, improving export activity and a minimal tightening of domestic supply due to increased environmental regulations supported upward pricing momentum.

While raw material costs remained largely stable, diminished operational rates of producers contributed to supply-side pressures. Overall, sodium chlorite prices in September 2025 showed this positive price trend, supporting expectations for a cautiously optimistic assessment of prices. Export performance and industrial consumption will continue to drive prices in the first quarter of 2026.

India: Sodium Chlorite Import prices CIF JNPT, India, Grade- (31%) Industrial Grade.

According to Price-Watch, in the third quarter of 2025, Sodium Chlorite prices in India experienced a positive rebound and retook control following a 7% decline in Q2 as a result of renewed demand from the water treatment industry and paper manufacturing sector. Following stronger monsoon activity, the water purification requirement increased which promoted consumption of Sodium Chlorite.

Sodium Chlorite price trend in India showed an overall stable supply and moderate logistical efficiencies within the upstream supply chains out of China. However, minor delays in inland distribution did create some intermittent pricing pressure.

The price for Sodium Chlorite remained firm as the quarter closed in September 2025 which indicated sustained demand. Looking ahead into fall, downstream recovery in the textile and processing sectors could help provide further direction for pricing through Q4.

USA: Sodium Chlorite Import Prices CIF Houston, USA, Grade- (31%) Industrial Grade.

In Q3 2025, the Sodium Chlorite price in the United States declined slightly from the previous quarter, down 1% before taxes and shipping. In the context of domestic service contracts, purchasers cited weakened purchasing activity from the mild seasonal downturn in the textile and paper manufacturing industries. Sodium Chlorite price trends in Q3 were also exacerbated by high inventory levels and cautious restocking by import purchases.

While citing stable CIF price levels from Chinese market sources, domestic demand was soft, resulting in mild pricing adjustments. September 2025 marked a monthly Sodium Chlorite price low in the US marketplace coinciding with downstream demand.

The water treatment sector nevertheless provided a consistent baseline of support. In Q4, with improved public sector procurement and expected increases in industrial usage, slight price adjustments would be anticipated.

Vietnam: Sodium Chlorite Import prices CIF Haiphong, Vietnam, Grade- (31%) Industrial Grade.

In Q3 2025, Sodium Chlorite prices in Vietnam increased by 4%. This upward price movement was attributed to consistent import demand and strong activity in the textile and water treatment industries. During Q3, pricing activity improved compared to Q2’s pricing, where prices were relatively stagnant.

In Q3, more projects for water treatment came online, which improved market activity. Sodium Chlorite price trend in Vietnam continued to be supported by steady CIF values received from China and healthy distributor margins. Supply remains tight despite the strengthening of the Vietnamese dong against the yuan, due to limited Chinese production.

In September 2025, the price of Sodium Chlorite was consistent with a high for the quarter, indicating a flattening of cost increases. In the future, the direction of prices for Q4 will depend on further reliance on imports and how well projects in infrastructure are implemented.

Brazil: Sodium Chlorite Import prices CIF Santos, Brazil, Grade-(31%) Industrial Grade.

In the third quarter of 2025, Brazil experienced a sizable increase in the price of Sodium Chlorite, which rose by 23% from second quarter levels. The increase in Sodium Chlorite price was a consequence of higher industrial consumption, particularly in paper and textile manufacturing, which recovered following the stability created by the elections to increase activity.

Additionally, shipping costs increased due to both higher prices and fewer vessels coming from China, resulting in higher costs for imported Sodium Chlorite. Also relevant to the price trends for Sodium Chlorite in Brazil were currency volatility and changes in import policies.

The price of Sodium Chlorite in Brazil ground to a quarterly high in September 2025, reflecting tightening supply and increasingly active buyers. If inventory shortages continue, producers in Brazil are likely to sustain elevated prices in quarter 4 unless imports pick up significantly.

Indonesia: Sodium Chlorite Import prices CIF Jakarta, Indonesia, Grade-(31%) Industrial Grade.

In Q3 2025, Sodium Chlorite price in Indonesia increased moderately by 2%, supported by steady demand from water treatment and paper manufacturing industries. Imports from China remained consistent, maintaining cost competitiveness despite currency fluctuations. The Sodium Chlorite price trend in Indonesia was shaped by strong public sector orders for sanitation and water purification initiatives.

Additionally, seasonal monsoon-related concerns drove preventative stockpiling. Sodium Chlorite price in September 2025 reflected these dynamics, closing the quarter on a firm note. While local demand showed resilience, logistical delays at ports briefly disrupted supply continuity. Market participants expect Q4 to remain balanced with moderate price support from industrial buyers.

Philippines: Chlorite Import prices CIF Manila, Philippines, Grade-(31%) Industrial Grade.

In Q3 2025, Sodium Chlorite price in the Philippines declined slightly by 2% compared to Q2, amid softer buying activity in the textile and paper processing segments. The Sodium Chlorite price trend in the Philippines followed a downward trajectory as distributors faced excess inventory carried over from the previous quarter. Import costs from China remained stable, but local demand contraction influenced margins.

Sodium Chlorite price in September 2025 dipped further due to aggressive destocking by regional suppliers. The water treatment sector provided moderate support; however, overall consumption was lackluster. Looking forward, price stability in Q4 will depend on infrastructure funding and industrial output recovery.