Price-Watch’s most active coverage of Sodium Formate price assessment:

- Industrial grade(98% min) FOB Shanghai, China

- Industrial grade(98% min) CIF Manzanillo (China), Mexico

- Industrial grade(97% min) FOB Jeddah, Saudi Arabia

- Industrial grade(97% min) FOB Barcelona, Spain

- Industrial grade(97%) FOB Kaohsiung, Taiwan

- Industrial grade(97% min) CIF Houston (Spain), USA

- Industrial grade(98% min) CIF Houston (China), USA

- Industrial grade(98% min) CIF Haiphong (China), Vietnam

- Industrial grade(98% min) CIF Nhava Sheva (China), India

Sodium Formate Price Trend Q3 2025

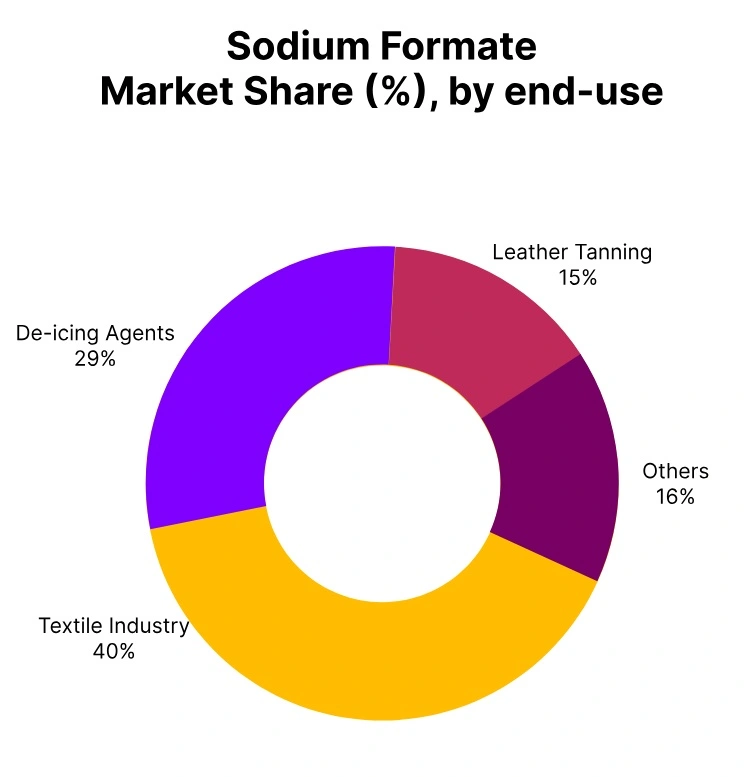

In the third quarter of 2025, prices for Sodium Formate decreased in several regions including China, Taiwan, Saudi Arabia, Spain, the USA, Vietnam, Mexico, and India. The declines in pricing came together with demand losses in significant end-use sectors such as leather goods, textiles, and chemicals, where manufacturing continues to slow.

Sodium Formate Price trends were further impacted by continuing supply chain disruptions, higher logistics costs, and inconsistent feedstock pricing. While imports in some regions remained stable, oversupplied markets were more problematic.

The price expectation moving into the fourth quarter of 2025 remains cautious or conservative, as prices could fluctuate without support from recovering industrial demand or alleviating supply chain conditions in key markets and sectors.

China: Sodium Formate Export prices FOB Shanghai, China, Grade- Industrial Grade (98% min).

During the third quarter of 2025, Sodium Formate prices in China decreased by 17.85%, following a decline of 4.55% in the second quarter. The downward sodium formate price trend in the third quarter was attributed to weak demand from the leather tanning and textile sectors and increased supply in the domestic market.

In addition, several producers ran operations at reduced levels due to maintenance and temporary shutdowns, resulting in supply volatility. Additionally, rising raw material prices, particularly for derivatives of formic acid, weighed heavily on overall market pricing.

Pricing levels for Sodium Formate in September 2025 were based on much lower than pricing levels previously established in the second quarter of 2025. The outlook for the fourth quarter of 2025 remains uncertain, and there is risk for additional decline in the next quarter, especially if demand does not materialize from the primary downstream sectors of usage.

Taiwan: Sodium Formate Export prices FOB Kaohsiung, Taiwan, Grade- Industrial Grade (97%).

In Q3 2025, Sodium Formate prices in Taiwan experienced a 19.13% decrease, building on a reduction of 3.47% in Q2. The declining Sodium Formate price trend in Taiwan was mostly conditioned by extremely weak demand from leather, textile, and chemicals production. Slow production and an accumulation of inventory in these areas created a lack of downstream orders.

Additional price pressure resulted from supply disruptions in China as well as escalating costs of freight and feedstock. While imports were generally consistent, the increased levels of oversupply found in the domestic market resulted in a more intense price pressure.

Sodium Formate prices in September 2025 were substantially lower than the prices observed in Q2. The market outlook for Q4 2025 is uncertain; recovery potential will depend on either improved industrial activity or stabilization of the oversupply situation.

Saudi Arabia: Sodium Formate Export prices FOB Jeddah, Saudi Arabia, Grade- Industrial Grade (97% min).

Sodium Formate prices in Saudi Arabia saw a decrease of 16.93%, following a negligible decline of 0.43% in Q2 2025. Sodium Formate price trend in Saudi Arabia was underpinning demand reduction from the leather and textile industry that selectively idled to align their productions seasonally and economically. In addition to demand-side effects, there has been oversupply from local and regional producers in the market, pressuring prices downward.

Rising transportation and logistics cost combined with volatility in crude derivatives used in feedstock were also a factor in pricing. The Sodium Formate price in September 2025 was significantly lower than it was in Q2 2025. The outlook for Q4 2025 is cautious, with trends potentially stabilising only alongside some recovery of industrial consumption and supply levels.

Spain: Sodium Formate Export prices FOB Barcelona, Spain, Grade- Industrial Grade (97% min).

In the third quarter of 2025, the Sodium Formate price in Spain fell significantly at 12.30%, following a reduction of 8.12% in the previous quarter. Sodium formate price trend in Spain reflected lackluster industrial use, especially in leather and textiles, which suffered a slowdown in production and decline in exports. In conjunction with oversupply from producers in Europe, this added downward price pressure.

Furthermore, an increase in logistic costs and sporadic supply burdens from China has also affected pricing. In September of 2025, Sodium Formate prices were lower when compared to prices from quarter two. Price stabilization is uncertain for Q4 of 2025, and any price stabilization will be dependent on recovery of European manufacturing and increased demand from downstream buyers.

USA: Sodium Formate Import prices CIF Houston, USA, Grade- Industrial Grade (97% min).

Sodium Formate price in the USA fell by 9.20% in Q3 2025, after a 6.40% decline in Q2. Weak demand from end-use sectors of leather, textiles, and chemicals facing production slowdowns and reduced consumption, have been the major driver for the sodium formate price trend in the USA. Although import volumes from Spain remained unchanged, rising freight and shipping costs due to global logistics issues continued to add pressure on pricing.

Additionally, currency fluctuations and rising feedstock costs contributed to the price decline. Sodium Formate prices in September 2025 were markedly lower than in Q2. The outlook in Q4 2025 is cautious, with any possibility of price stabilization driven by a resumption of industrial demand and upgrades in supply chains.

Vietnam: Sodium Formate Import prices CIF Haiphong, Vietnam, Grade- Industrial Grade (98% min).

In Q3 2025, Sodium Formate price in Vietnam reduced by 15.85% after a 4.63% reduction in the previous quarter. Sodium Formate price trend in Vietnam was affected by decreased demand from the leather, textile, and chemical industries, which all experienced reduced production and consumption as well as higher import prices from China due to higher freight prices.

The pricing remained under pressure from oversupply in the country market. The pricing of sodium formate was lower in September 2025 than in Q2. The outlook for Q4 2025 is cautious as availability stabilizes with improvement in industrial demand and import logistics.

Mexico: Sodium Formate Import prices CIF Manzanillo, Mexico, Grade- Industrial Grade (98% min).

Sodium Formates prices slipped down 15.62% in Quarter 3 2025, after a slight increase of 1.15% in Quarter 2. The downward trend in prices of Sodium Formate from Quarter 2 to Quarter 3 was primarily due to lessened consumption from construction, leather, and food processing companies, which slowed their operations during the quarter.

While Chinese Sodium Formate imports continued at a consistent volume, increased freight costs and reduced value of the Mexican Peso increased landed costs, contributing to price reductions. Sodium Formate Market price levels in September 2025 were markedly lower than Quarter 2 2025 levels.

The Sodium Formate market outlook for Quarter 4 2025 is uncertain, although there is potential for price adjustments both up and down, depending on the pace of demand growth from industrial customers and improvements in the supply chain.

India: Sodium Formate Import prices CIF Nhava Sheva, India, Grade- Industrial Grade (98% min).

According to Price-Watch, In Q3 2025, Sodium Formate prices in India decreased by 4.18%, following a -3.72% decline in Q2. The Sodium Formate price trend in India was influenced by a combination of weaker demand from key sectors such as textiles and automotive, which faced production slowdowns.

Additionally, Ex-Kandla Sodium Formate prices experienced a more significant drop of 8.51%, compared to a smaller -0.63% decrease in Q2. Rising logistics costs and fluctuating import prices from South Korea contributed to the price decline.

Sodium Formate prices in September 2025 were lower than in Q2, with both domestic and Ex-Kandla prices experiencing significant decreases. The outlook for the next quarter will depend on the recovery of demand from key industrial sectors and supply chain stabilization.