Price-Watch’s most active coverage of Sodium Lauryl Ether Sulfate (SLES) price assessment:

- Active Matter (70%) Ex-Gujrat, India

- Active Matter (70%) FOB JNPT, India

- Active Matter (70%) FOB Qingdao, China

- Active Matter (70%) CIF Penang (India), Malaysia

- Active Matter (70%) CIF Jebel Ali (India), United Arab Emirates

- Active Matter (70%) CIF Haiphong (China), Vietnam

- Active Matter (70%) CIF Houston (China), USA

- Active Matter (70%) Ex-West India, India

Sodium Lauryl Ether Sulfate (SLES) Price Trend Q3 2025

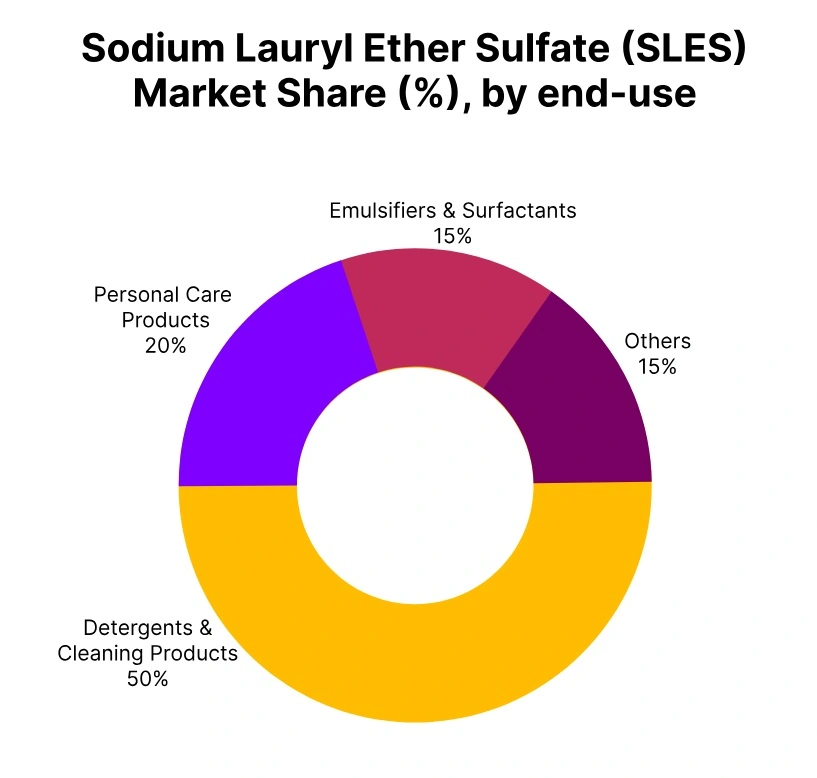

In Q3 2025, the global Sodium Lauryl Ether Sulfate (SLES) market showed mixed price trends across regions. Countries like India and Vietnam saw price increases, while regions such as Malaysia, the UAE, and the USA experienced slight declines. The price changes were influenced by demand in industries such as cosmetics, personal care, and detergents.

In September 2025, Sodium Lauryl Ether Sulfate (SLES) prices in India and Vietnam continued to show upward trends, reflecting consistent industrial demand. Meanwhile, regions like the USA and the UAE saw reductions in prices due to lower consumption. The Sodium Lauryl Ether Sulfate (SLES) price trend in Q3 2025 highlighted regional market differences and demand shifts across key sectors.

India: Sodium Lauryl Ether Sulfate (SLES) Export prices FOB Nhava Sheva, India, Grade- Active Matter (70%).

Sodium Lauryl Ether Sulfate (SLES) prices in India increased by 1.0% in Q3 2025. This rise was driven by stable demand from the personal care, household products, and detergent industries, all of which rely heavily on SLES. India’s strong production capacity and industrial activity helped sustain the price growth. By September 2025, Sodium Lauryl Ether Sulfate (SLES) prices in India remained steady, supported by consistent demand from these key sectors.

The Sodium Lauryl Ether Sulfate (SLES) price trend in India reflected the resilience of its manufacturing and consumer goods sectors, which contributed to the moderate price increases observed throughout the quarter. India’s industrial strength and consumption patterns kept prices steady during this period.

China: Sodium Lauryl Ether Sulfate (SLES) Export prices FOB Shanghai, China, Grade- Active Matter (70%).

Sodium Lauryl Ether Sulfate (SLES) prices in China increased by 0.9% in Q3 2025, primarily driven by consistent demand from the detergent and personal care industries, which showed steady consumption of SLES. Despite global economic uncertainty, China’s domestic market continued to support price growth due to this ongoing demand. According to Price-Watch, by September 2025, Sodium Lauryl Ether Sulfate (SLES) prices in China stayed stable, reflecting the continued consumption from key sectors.

The Sodium Lauryl Ether Sulfate (SLES) price trend in China showed moderate growth, sustained by steady industrial output and consumption in the domestic market. This stability in prices showed that key industries in China were maintaining their demand despite broader economic challenges.

Malaysia: Sodium Lauryl Ether Sulfate (SLES) Import prices CIF Penang, Malaysia, Grade- Active Matter (70%).

According to Price-Watch, Sodium Lauryl Ether Sulfate (SLES) prices in Malaysia, importing from India, saw a decrease of 0.2% in Q3 2025. This reduction was due to lower demand from key industries like personal care and detergents, which experienced slower production during the period. Malaysia’s import prices were influenced by fluctuations in the Indian market, which impacted the overall pricing dynamics.

In September 2025, Sodium Lauryl Ether Sulfate (SLES) prices in Malaysia went on to reflect a downward trend, driven by weaker demand for consumer products and detergents. The Sodium Lauryl Ether Sulfate (SLES) price trend in Malaysia showed slight reductions during global economic challenges, signaling less consumption of SLES in the region.

UAE: Sodium Lauryl Ether Sulfate (SLES) Import prices CIF Jebel Ali, United Arab Emirates, Grade- Active Matter (70%).

Sodium Lauryl Ether Sulfate (SLES) prices in the UAE, importing from India, dropped by 0.6% in Q3 2025. This decline was mainly due to reduced demand from the personal care and detergent industries in the region. Slower industrial activity in the UAE, along with weaker consumption of SLES, contributed to the price reduction.

By September 2025, SLES prices in the UAE remained under pressure, following the downward trend seen earlier. The Sodium Lauryl Ether Sulfate (SLES) price trend in the UAE mirrored the global slowdown in demand, leading to a slight decrease in prices during the quarter. This reflected a weaker industrial landscape in the UAE for consumer products.

Vietnam: Sodium Lauryl Ether Sulfate (SLES) Import prices CIF Haiphong, Vietnam, Grade- Active Matter (70%).

Sodium Lauryl Ether Sulfate (SLES) prices in Vietnam, importing from China, rose by 1.0% in Q3 2025. This was driven by strong demand from the personal care and detergent industries, which rely on SLES for manufacturing. Vietnam’s growth in industrial output and consumption further supported the price rise.

By September 2025, Sodium Lauryl Ether Sulfate (SLES) prices in Vietnam continued to show upward momentum, reflecting ongoing demand in these key sectors. The Sodium Lauryl Ether Sulfate (SLES) price trend in Vietnam mirrored the positive growth in the Chinese market, with ongoing demand helping to support higher prices. This indicated continued industrial activity and consumption in Vietnam’s key sectors.

USA: Sodium Lauryl Ether Sulfate (SLES) Import prices CIF Houston, USA, Grade- Active Matter (70%).

Sodium Lauryl Ether Sulfate (SLES) prices in the USA, importing from China, dipped by 1.4% in Q3 2025. This reduction was due to lower demand in key industries such as personal care, cleaning products, and detergents. Despite stable import activity, reduced consumption in these sectors led to the price decline.

By September 2025, SLES prices in the USA stayed subdued, continuing the downward trend. The Sodium Lauryl Ether Sulfate (SLES) price trend in the USA reflected weaker consumption in many key industrial sectors, contributing to the slight price decrease observed throughout the quarter. This downward movement indicated challenges in the USA’s demand for SLES.