Price-Watch’s most active coverage of Sodium Metabisulfite (SMBS) price assessment:

- IG(96% min) FOB Qingdao, China

- IG(96% min) CIF Santos (China), Brazil

- IG(96% min) CIF Sydney (China), Australia

- IG(96% min) CIF Jakarta (China), Indonesia

- IG(96% min) FD Hamburg, Germany

- IG(96% min) CIF Nhava Sheva (China), India

- IG(96% min) Ex_Gujarat , India

- IG(96% min) FD Rotterdam, Netherlands

- IG(96% min) FD Le Havre, France

Sodium Metabisulfite (SMBS) Price Trend Q3 2025

In Q3 2025, the global Sodium Metabisulfite market showed moderate stability with regional variations. The Sodium Metabisulfite (SMBS) price trend fluctuated by 0-34% during the July-September 2025 quarter, influenced by steady feedstock costs, energy prices, and regional supply chain factors.

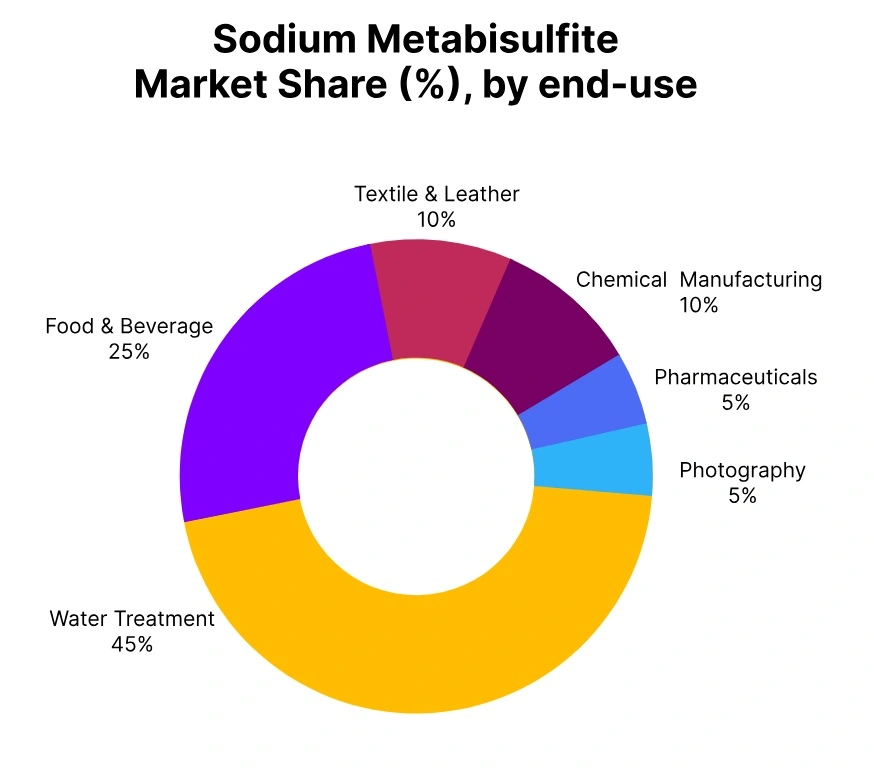

Despite some volatility in upstream elements, strong demand from industries such as water treatment, food preservation, and chemicals helped sustain price stability. Ongoing production capacity expansions and supply chain adjustments are expected to contribute to stable prices in the upcoming quarter.

China: Sodium Metabisulfite (SMBS) Export price from China.

In Q3 2025, the Sodium Metabisulfite price in China experienced a gradual recovery cycle, as downstream demand strengthened. In July, Sodium Metabisulfite price trend in China was supported by peak-season demand from the food preservation and pulp & paper sectors, particularly in warmer regions where consumption was at its highest.

This upward trend continued in August, driven by export recovery to Southeast Asia and Africa, where seasonal consumption in agriculture-related and industrial chemical applications increased. Meanwhile, supply rationalization by Chinese manufacturers in Q2 limited available inventories, allowing suppliers to regain pricing power.

However, in September, a mild correction was expected, with Sodium Metabisulfite price in China showing a brief pullback as some exporters pushed volumes ahead of Q4 demand, leading to short-term oversupply. Additionally, certain global buyers may defer purchases due to stockpiles accumulated in July and August.

Despite this brief pullback, Q3 was characterized by renewed buying activity, healthy export flows, and tighter inventory management, establishing a steady foundation for growth in the final quarter of the year, with a 0.78% increase compared to Q2.

Brazil: Sodium Metabisulfite (SMBS) import price in Brazil from China.

In Q3 2025, Sodium Metabisulphite price in country saw a sharp rebound in CIF Santos, with a substantial surge in July driven by strong restocking demand from Brazil’s mining and pulp sectors ahead of the Q4 export cycles. This surge was further supported by delayed procurement from earlier quarters finally materializing.

Meanwhile, Sodium Metabisulfite (SMBS) price trend in country saw an upward trajectory as FOB China prices climbed due to higher sulfur feedstock costs and reduced manufacturing output in key Chinese provinces like Shandong and Jiangsu, impacted by stricter environmental inspections.

In August, there was a slight price correction as the market digested the sharp rally in July, with buyers assessing existing contract coverage. By September, Sodium Metabisulphite price in country stabilized, with marginal changes, as demand remained healthy but showed limited growth.

Overall, the quarter reflected a firm recovery phase, backed by robust downstream activity in Brazil, improved supply-demand balance, and global supply adjustments that sustained the upward momentum from the Q2 lows, with a 34.35% increase compared to Q2.

Australia: Sodium Metabisulfite (SMBS) import price in Australia from China.

In Q3 2025, Sodium Metabisulphite price in Australia (CIF Sydney) experienced a sharp rebound from the Q2 trough. July opened the quarter with a strong rally as restocking resumed, driven by higher demand from the mining and water treatment sectors, particularly in New South Wales and Queensland.

This was coupled with price hikes from Chinese exporters, responding to reduced domestic supply and a rebound in sulfur prices. Sodium Metabisulfite (SMBS) price trend in Australia maintained upward momentum in August, supported by increased shipping activity from Chinese ports and higher freight charges impacting landed costs.

September brought stability as Sodium Metabisulphite price in Australia consolidated following rapid gains in the prior months. FOB China export prices stabilized during this period, backed by consistent procurement across Asia-Pacific markets and reduced production in key regions like Shandong and Jiangsu due to ongoing environmental restrictions.

The quarter reflected a strong seasonal recovery, reinforced by supply discipline from Chinese producers and a resurgence in Australian end-user demand, with an 11.52% increase compared to Q2.

Indonesia: Sodium Metabisulfite (SMBS) import price in Indonesia from China.

According to Price-Watch, In Q3 2025, Sodium Metabisulphite price in Indonesia (CIF Jakarta) saw a marginal increase compared to Q2, indicating market stabilization. The quarter began with a rise in July, driven by replenishment orders from Indonesia’s food processing and agricultural chemicals sectors, which experience seasonal growth during the dry months.

Sodium Metabisulfite (SMBS) price trend in Indonesia continued its upward movement in August, supported by firmer FOB China prices as sulfur values rebounded and stricter environmental audits limited factory output in key production regions.

However, September brought a decline in Sodium Metabisulphite price in Indonesia, reflecting cautious sentiment and temporary demand fatigue following two months of gains. Despite mixed month-wise results, Q3 represented a transition from the oversupply conditions in Q2 to more balanced fundamentals.

Stable procurement across downstream sectors and upstream cost recovery helped maintain price resilience. The quarter signaled a gradual return to normal trade flows and healthier demand-supply dynamics in the Indonesian market, with a -13.95% change compared to Q2.

India: Sodium Metabisulfite (SMBS) import price in India from China, Domestically Traded SMBS price in Mumbai.

In Q3 2025, Sodium Metabisulphite price in India (CIF Nhava Sheva) recovered compared to Q2, with a rebound beginning in July as importers-initiated replenishment ahead of the festive season and Q4 industrial activity. Industries like mining and pulp & paper, particularly in Gujarat and Maharashtra, revived orders during this period.

Sodium Metabisulfite (SMBS) price trend in India continued its upward movement in August, supported by improved port operations and forward purchases from chemical blenders and exporters. However, September experienced a slight pullback in Sodium Metabisulphite price in India, reflecting mild demand fatigue and higher inventory levels among mid-sized traders.

On the export side, FOB China prices firmed up due to increased sulfur costs and reduced manufacturing hours from environmental restrictions. In Ex-Gujarat, prices firmed as well, with notable gains in July driven by increased consumption from water treatment and packaging industries. August saw further upward movement, supported by strong demand from food processing and pulp & paper sectors.

September brought a correction due to production slowdowns during the Ganesh Chaturthi holiday and disruptions from flooding, though sulfur costs remained elevated and soda ash prices lent stability. The overall tone for both markets was one of recovery and steady growth compared to Q2, despite short-term slowdowns. CIF India prices increased by 9.62%, while Ex-Gujarat prices declined by 2.49%.

Germany: Sodium Metabisulfite (SMBS) Free delivered price within the Germany.

In Q3 2025, Sodium Metabisulphite price in Germany began to recover, driven by renewed demand and market realignment. July saw a sharp uplift as the food preservation, pulp & paper, and water treatment sectors increased consumption during peak summer. Industrial buyers also took advantage of the relatively lower Q2 prices to strategically rebuild stocks.

Sodium Metabisulphite price trend in Germany experienced a slight decline in August, attributed to summer holidays and planned shutdowns in several Western European markets, which temporarily slowed manufacturing activity and reduced short-term demand.

However, September marked another recovery phase as seasonal demand picked up from the agrochemical and beverage industries, alongside procurement planning for Q4. Local supply conditions may tighten, while elevated sulfur prices and higher energy costs in Germany lent additional upward pressure.

Overall, Q3 signaled a demand-driven rebound after the softness of Q2, though the momentum was briefly moderated by seasonal production slowdowns in August, with a 10.87% increase compared to Q2.

Netherlands: Sodium Metabisulfite (SMBS) Free delivered price within the Netherlands.

In Q3 2025, Sodium Metabisulphite price in the Netherlands is expected to stabilize and gradually improve, starting with a modest upward movement in July, supported by rising temperatures and increased demand from the food preservation and beverage bottling sectors. While the growth will be measured, it reflects a more balanced demand-supply scenario after the softness in Q2.

Sodium Metabisulfite (SMBS) price trend in the Netherlands eases slightly in August as seasonal slowdowns take hold. Summer shutdowns in Dutch industries, as well as across the broader EU, particularly in textiles and specialty chemicals, limit consumption.

However, the quarter closes on a stronger note in September, as pre-Q4 industrial restocking begins, and higher operating rates return across chemical processing, pulp & paper, and food sectors. Seasonal demand recovery, coupled with steady upstream cost support, helps the market regain momentum.

Overall, Q3 is characterized by mid-quarter softness but a strong finish, driven by renewed procurement activity and the approach of peak seasonal consumption periods, with a 10.64% increase compared to Q2.

France: Sodium Metabisulfite (SMBS) Free delivered price within the France.

In Q3 2025, the Sodium Metabisulphite price in France experienced a gradual recovery and seasonal realignment. July began on a positive note, supported by steady demand from beverage bottling, food preservation, and textile industries, which operated at higher capacities during the warmer months. This provided moderate but sustained momentum in the early part of the quarter.

However, Sodium Metabisulphite price trend in France saw a temporary slowdown in August, as many French and broader European manufacturers implemented seasonal shutdowns or reduced operational activity during the summer holiday period. This mid-quarter lull was short-lived, as September saw renewed strength, with demand ramping up in preparation for Q4 restocking.

The agrochemical and food processing sectors contributed to this uptick. Additionally, higher freight rates and increased feed stock costs during the quarter lent further support to the upward movement. Overall, Q3 was shaped by seasonal demand stabilization, with the most notable recovery occurring from mid to late quarter as industrial activity resumed at higher levels, resulting in a 10.04% increase compared to Q2.