Price-Watch’s most active coverage of Sodium Metasilicate Pentahydrate price assessment:

- Granular (Mesh Size 16-30) FOB Qingdao, China

- Granular (Mesh Size 16-30) CIF Houston (China), USA

- Granular (Mesh Size 16-30) CIF Tokyo (China), Japan

- Granular (Mesh Size 16-30) CIF Mersin (China), Turkey

- Granular (Mesh Size 16-30) CIF Bangkok (China), Thailand

- Granular (Mesh Size 16-30) CIF Klang (China), Malaysia

- Granular (Mesh Size 16-30) CIF Nhava Sheva (China), India

Sodium Metasilicate Pentahydrate (SMP) Price Trend Q3 2025

In Q3 2025, the global Sodium Metasilicate Pentahydrate market showed moderate stability with regional fluctuations. The Sodium Metasilicate Pentahydrate (SMP) price trend varied by 0-13% during the July-September 2025 quarter, influenced by steady feedstock costs, energy prices, and regional supply chain dynamics.

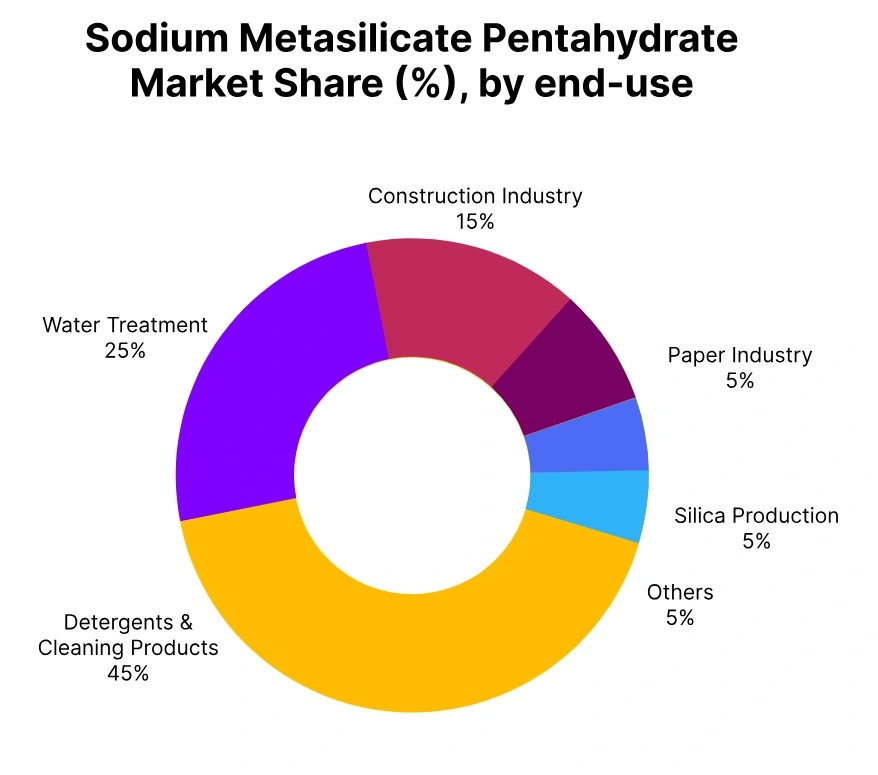

Despite light volatility in upstream factors, strong demand from industries like detergents, cleaning products, and water treatment helped sustain price stability. Ongoing capacity expansions and supply chain adjustments are anticipated to keep prices stable in the next quarter.

China: Sodium Metasilicate Pentahydrate (SMP) Export price from China.

According to Price-Watch, in the third quarter of 2025, the Sodium Metasilicate Pentahydrate price in China is expected to experience a stark decline due to oversupply in the market. This will be most apparent in July when Sodium Metasilicate Pentahydrate (SMP) price trend in China sees a 25.94% drop. Chinese exporters will face reduced global demand and inventory build-up, leading them to offer aggressive discounts to clear excess stock.

The weaker demand will be driven by seasonal slowdowns and economic uncertainties, specifically in Southeast Asia and Europe. While there may be mild recoveries in August and September, the overall market will remain under pressure, leading to price stagnation and liquidation.

USA: Sodium Metasilicate Pentahydrate (SMP) import price in USA from China.

In Q3 2025, Sodium Metasilicate Pentahydrate price in the U.S. will go down significantly, with CIF prices from China decreasing by 17.58%. The Sodium Metasilicate Pentahydrate (SMP) price trend in the U.S. will be driven by a combination of oversupply and reduced demand from key industries.

The mid-year period traditionally sees a slowdown in procurement from the U.S., with buyers putting off on large orders. This, along with easing feedstock prices like soda ash, will lead Chinese exporters to lower their prices to maintain market share. The bearish market sentiment and inventory overhang will continue to exert downward pressure on prices.

Japan: Sodium Metasilicate Pentahydrate (SMP) import price in Japan from China.

According to Price-Watch, in Q3 2025, Sodium Metasilicate Pentahydrate (SMP) price trend in Japan is expected to show a slight recovery, with CIF prices from China increasing by 11.79%. This recovery will be supported by improved feedstock pricing, particularly as the supply chain stabilizes key materials like silica sand and soda ash. Increased demand from Japanese chemical manufacturers, especially in industrial cleaning and ceramics, will drive procurement volumes in August and September. While the price increase will be modest, market sentiment will be cautiously optimistic as procurement levels rise.

Turkey: Sodium Metasilicate Pentahydrate (SMP) import price in Turkey from China.

In Q3 2025, Sodium Metasilicate Pentahydrate price trend in Turkey is projected to dip sharply, with CIF prices from China dropping by 19.05%. The sharp drop in prices will be caused by fluctuations in feedstock costs and reduced buying interest. Oversupply in the Turkish market, along with global economic uncertainty, will put downward pressure on prices. Despite a mild recovery later in the quarter, demand will struggle, and prices are expected to remain low throughout Q3.

Thailand: Sodium Metasilicate Pentahydrate (SMP) import price in Thailand from China.

In Q3 2025, Sodium Metasilicate Pentahydrate (SMP) price trend in Thailand is experiencing a decline, with CIF prices from China dropping by 22.65%. This downturn is driven primarily by a sharp drop in feedstock prices and less procurement activity from Thai manufacturers. The summer months traditionally see reduced industrial activity, contributing to excess inventory and further pushing prices down.

Decreased global demand and oversupply in the region will intensify the downward pressure. Though there may be slight improvements in August and September, the overall market trend will remain negative, with prices continuing to soften as the market adjusts to weaker demand and extra supply.

Malaysia: Sodium Metasilicate Pentahydrate (SMP) import price in Malaysia from China.

In Q3 2025, Sodium Metasilicate Pentahydrate (SMP) price trend in Malaysia showed a sharp decline, with CIF prices from China falling by 23.96%. This decrease is driven by reduced feed stock prices and weaker demand from the local market. July sees a drop in prices due to high inventory levels and reduced industrial production during the summer months.

Despite demand returning in August and September, the market conditions will stay bearish as demand struggles to recover. The overall Sodium Metasilicate Pentahydrate (SMP) price trend will stay under pressure due to oversupply and global economic uncertainty affecting trade and purchasing power.

India: Sodium Metasilicate Pentahydrate (SMP) import price in India from China.

According to Price-Watch, in Q3 2025, Sodium Metasilicate Pentahydrate (SMP) price trend in India will drop, with CIF prices from China decreasing by 18.13%. The price decline is primarily driven by lower demand from key sectors during the monsoon season, especially in July, as manufacturing activity slows down.

Feedstock prices, while stabilizing, will contribute to the price decrease, with reduced procurement levels from Indian manufacturers. This will be exacerbated by global economic uncertainty. Despite some minor recoveries in certain sectors toward the end of the quarter, the overall market trend will stay negative as demand stays weak, and prices are pressured by excess supply.