Price-Watch’s most active coverage of Sodium Silicate price assessment:

- Industrial Grade(Powder, 120 Mesh Size) FOB Shanghai, China

- Industrial Grade(Alkaline(2.1-2.3),Glass) FOB JNPT, India

- Industrial Grade(Powder,120 Mesh Size) CIF Jakarta (China), Indonesia

- Industrial Grade(Powder,120 Mesh Size) CIF Manila (China), Philippines

- Industrial Grade(Powder,120 Mesh Size) CIF Haiphong (China), Vietnam

- Industrial Grade(Powder,120 Mesh Size) CIF Buenos Aires (China), Argentina

Sodium Silicate Price Trend Q3 2025

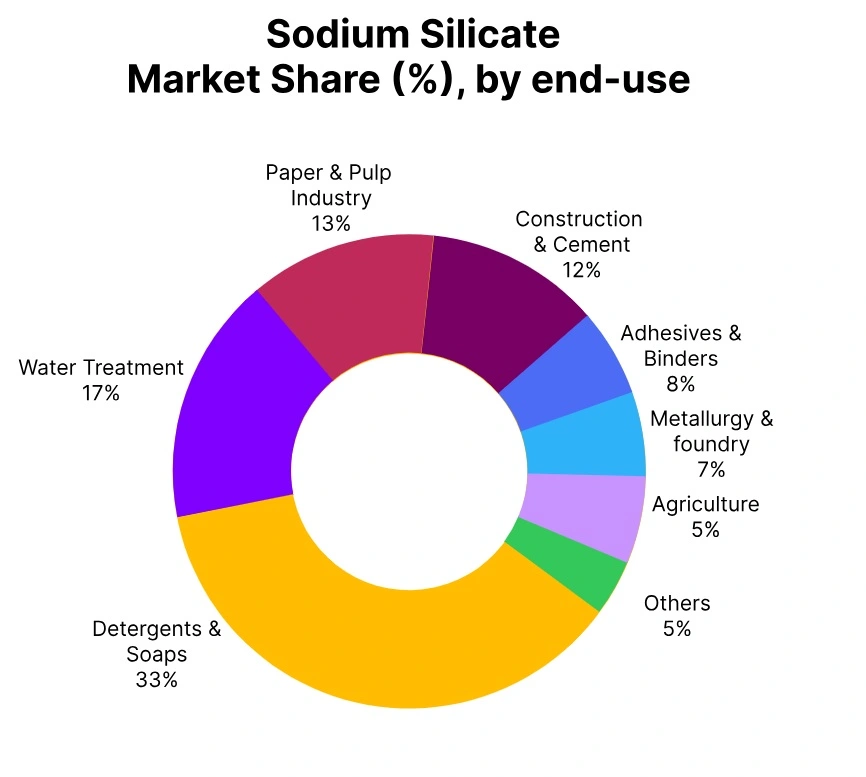

In the third quarter of 2025, the Sodium Silicate market experienced a slight decrease, with prices moving down approximately 4–8%. This decrease has been primarily due to weaker demand from major downstream segments, including detergents, water treatment, and construction, along with a good supply in major manufacturing regions.

Overall, the capacity utilization remained mostly unchanged, and prices have been under additional pressure from slow industrial activity and a more cautious approach to purchasing end-users. Looking ahead to the next quarter, some uptick in industrial consumption and stable supply fundamentals are expected to provide some price sentiment stabilization.

China: Sodium Silicate Export prices FOB Shanghai, China, Grade- Industrial Grade (Powder, 120 Mesh Size).

Sodium Silicate FOB prices have gone down moderately in China in Q3, 2025. In September 2025, Sodium Silicate prices in China have been assessed at USD 400-500/MT. The price trend in China have largely affected by underlying fluctuations in raw material costs including silica and soda ash amid generally stable plant availability and operations from market leading production areas.

Softer demand from downstream sectors (detergents, water treatment and construction) contributed to the overall sentiment in the space. Barring these impacts, balanced supply and some sustained export activity offered robust rationale to avoid sharper market declines.

India: Sodium Silicate Export prices FOB JNPT, India, Grade- Industrial Grade (Alkaline (2.1-2.3), Glass).

In Q3 2025, FOB prices of Sodium Silicate in India decreased modestly, with prices in September 2025 assessed at USD 250–300/MT. This price trend has largely been a result of mixed raw material pricing for silica and soda ash, and steady operation rates in domestic production hubs. Lower demand from downstream sectors, including detergents, water treatment, and construction, added modest pressure to market sentiment. However, balanced supply and steady export activity mitigated declines.

Indonesia: Sodium Silicate import prices CIF Jakarta, China, Grade Industrial Grade (Powder, 120 Mesh Size).

In Q3 2025, Sodium Silicate imports into Indonesia reflected a moderate downward trend, with Sodium Silicate prices in September 2025 ranging between USD 440–500/MT. The market movement has largely been influenced by FOB price trends from major supplying countries, coupled with fluctuations in raw material costs such as silica and soda ash. Softer demand from downstream sectors including detergents, water treatment, and construction contributed to mild pressure on market sentiment.

Philippines: Sodium Silicate import prices CIF Izmir, Turkey, Grade- Industrial Grade (Powder, 120 Mesh Size).

In Q3 2025, Sodium Silicate imports into the Philippines reflected a moderate downward trend, with Sodium Silicate prices in September 2025 ranging between USD 440–500/MT. The market movement has largely been influenced by FOB price trends from China, coupled with fluctuations in raw material costs such as silica and soda ash. Soft demand from downstream sectors including detergents, water treatment, and construction contributed to mild pressure on market sentiment.

Vietnam: Sodium Silicate import prices CIF Haiphong, Vietnam, Grade- Industrial Grade (Powder, 120 Mesh Size).

Sodium Silicate imports into Vietnam have slipped moderately during Q3 2025, with September prices seen around USD 420–480/MT. The Sodium silicate market has mostly moved in line with Chinese export offers, though shifts in silica and soda ash costs have added some unevenness to pricing.

Demand from detergent, construction, and water treatment industries has stayed weak, leaving trade sentiment flat. Overall, the quarter has shown how closely Vietnam’s market has remained tied to regional trends and raw material costs.

Argentina: Sodium Silicate import prices CIF Buenos Aires, Grade- Industrial Grade (Powder, 120 Mesh Size).

According to PriceWatch, In Q3 2025, Sodium Silicate shipments from China to Argentina experienced a mild downward correction, with September 2025 prices assessed between USD 530–590/MT. The market has been shaped by trends in Chinese FOB pricing and periodic fluctuations in key raw materials such as silica and soda ash.

Demand from downstream applications, including detergents, water treatment, and construction, remained subdued, placing moderate pressure on prices. However, consistent import volumes and adequate port stocks helped prevent sharper declines.