Price-Watch’s most active coverage of Stainless Steel CR Coil price assessment:

- 304/2B-1mm FOB Shanghai, China

- 316/2B-1mm FOB Shanghai, China

- 304/2B-2mm FD-Willich, Germany

- 316/2B-2mm FD-Willich, Germany

- 304/2B-2mm Del Alabama, USA

- 316/2B-2mm Del Alabama, USA

- 304/2B-1mm Ex-Mumbai, India

- 316/2B-1mm Ex-Mumbai, India

- 304/2B-1mm CIF Hai Phong (China), Vietnam

- 304/2B-1mm CIF Klang (China), Malaysia

- 304/2B-1mm CIF Laem Chabang (China), Thailand

Stainless Steel Cold Rolled (CR) Coil Price Trend Q3 2025

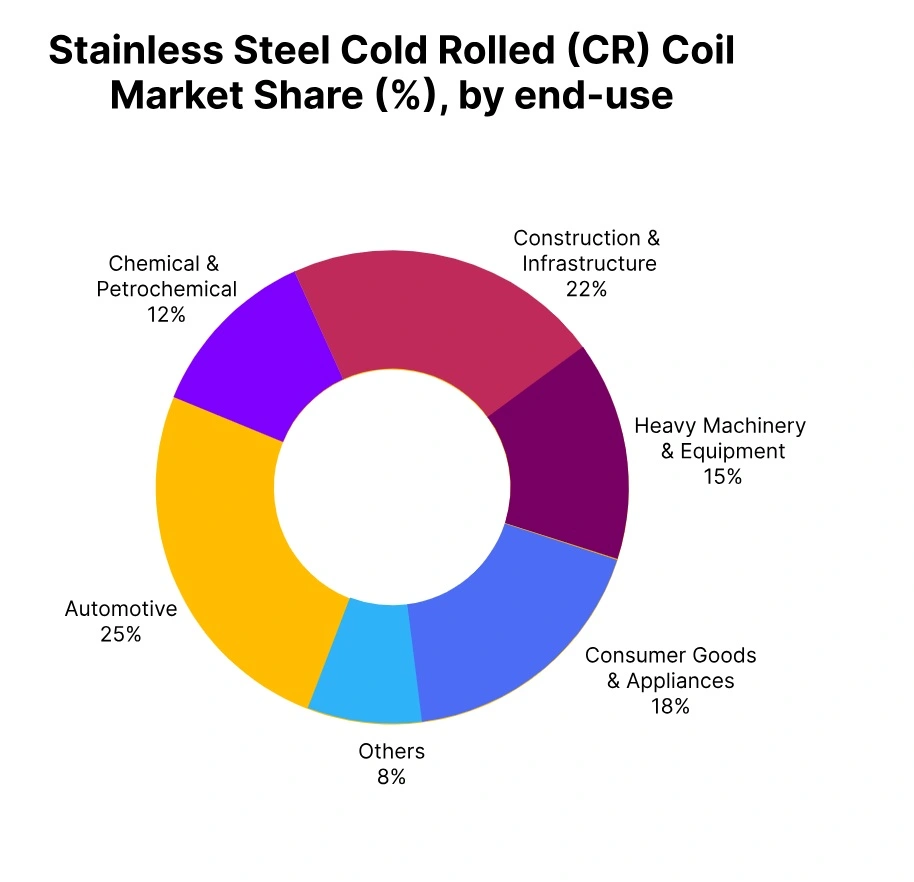

In Q3 2025, the global Stainless Steel Cold Rolled (CR) Coil market showed a mixed trend, with modest gains in some regions offset by declines elsewhere due to uneven demand recovery. Strong fundamentals in North America helped support Stainless Steel Cold Rolled (CR) Coil price trend, while Asia and Europe have been weighed down by weaker industrial activity and intense import competition. Stable raw material costs and cautious buying patterns characterized the quarter. By September 2025, minor positive corrections appeared in select regions driven by restocking, though overall sentiment remained conservative heading into Q4 2025.

USA: Stainless Steel Cold Rolled (CR) Coil prices EX Alabama, USA, Grade- 304-1mm.

The Stainless Steel Cold Rolled (CR) Coil price trend in the USA increased by 1.02% in Q3 2025, driven by consistent demand from manufacturing, construction, and energy segments. Supply remained tight due to limited domestic production schedules and restricted import volumes from overseas suppliers. While raw material prices stabilized, steady end-user demand and firm distributor activity supported overall market strength.

However, Stainless Steel Cold Rolled (CR) Coil price trend in the USA moved up marginally by 0.05% in September 2025, reflecting sustained procurement from distributors maintaining balanced inventories and anticipating stable Q4 demand.

Stainless Steel Cold Rolled (CR) Coil prices EX Alabama, USA, Grade- 316-2mm.

The Stainless Steel Cold Rolled (CR) Coil 316 price trend in the USA rose by 1.00% in Q3 2025, supported by healthy demand from process industries, chemical plants, and marine fabrication units. Reduced import availability and strong domestic inquiries underpinned prices through the quarter.

Mills managed to maintain steady output, ensuring balanced supply-demand conditions. Positive sentiment prevailed across most consuming sectors. However, Stainless Steel Cold Rolled (CR) Coil 316 price trend in the USA increased marginally by 0.04% in September 2025, as consistent industrial consumption and stable nickel cost trends encouraged moderate price sustainability.

Germany: Stainless Steel Cold Rolled (CR) Coil Domestic prices FD- Willich, Germany, Grade- 304-1mm.

The Stainless Steel Cold Rolled (CR) Coil 304 price trend in Germany fell by 1.20% in Q3 2025, as industrial activity across manufacturing and engineering sectors remained subdued. Economic uncertainties in Europe and strong import competition from Asian mills pressured local producers to reduce prices. Despite stable input costs, weak consumption and limited export opportunities constrained price recovery.

Buyers adopted a cautious approach, aligning purchases with near-term needs. However, Stainless Steel Cold Rolled (CR) Coil (304) price trend in Germany rose slightly by 0.13% in September 2025, supported by small restocking activity from distributors anticipating moderate Q4 requirements.

Stainless Steel Cold Rolled (CR) Coil Domestic prices FD- Willich, Germany, Grade- 316-2mm.

According to Price-Watch, The Stainless Steel Cold Rolled (CR) Coil 316 price trend in Germany slipped by 1.07% in Q3 2025, influenced by weak demand from machinery manufacturing and energy sectors. The availability of competitively priced imports from other EU suppliers further pressured domestic prices. Stable raw material trends and controlled mill output prevented deeper declines but offered little upside.

Overall sentiment stayed subdued as buyers focused on inventory management. However, Stainless Steel Cold Rolled (CR) Coil (316) price trend in Germany inched up by 0.15% in September 2025, aided by limited restocking for industrial applications, though volumes remained low across most regions.

China: Stainless Steel Cold Rolled (CR) Coil Export prices FOB Shanghai, China, Grade- 304-1mm.

The Stainless Steel Cold Rolled (CR) Coil 304 price trend in China dipped 1.35% in Q3 2025, largely due to sluggish demand in consumer goods, automotive, and construction segments. Domestic mills have been operating consistently throughout the quarter, while export orders have also been reduced as global stainless steel consumption fell below normal levels and other Asian suppliers became much more aggressively priced.

Nickel prices remained stable during this period and did not provide any support for a rebound in stainless prices. There has been a rather cautious market sentiment with limited restocking activity. In September 2025 Stainless Steel Cold Rolled (CR) Coil (304) price trend in China fell 0.88% as seasonal demand contracted further and traders have been maintaining conservative inventory levels in anticipation of a bearish Q4.

Stainless Steel Cold Rolled (CR) Coil Export prices FOB Shanghai, China, Grade- 316-2mm.

The Stainless Steel Cold Rolled (CR) Coil 316 price trend in China declined by 1.28% in Q3 2025, reflecting muted demand from chemical, marine, and high-end equipment sectors. While production rates remained steady, export performance was restrained due to softer overseas inquiries and high freight costs. Raw material cost stability offered little upward push, leaving pricing momentum limited.

Market participants avoided aggressive restocking amid subdued consumption trends. Stainless Steel Cold Rolled (CR) Coil (316) price trend in China dropped by 0.85% in September 2025, as downstream buyers delayed purchases and weaker project orders kept trade volumes light, reinforcing a bearish tone in the domestic market.

India: Stainless Steel Cold Rolled (CR) Coil Domestic prices EX-Mumbai, India, Grade- 304-1mm.

In Q3 2025, the Stainless Steel Cold Rolled (CR) Coil price trend in India decreased by 0.63%, as consumption from kitchenware, fabrication, and automotive segments remained soft. Against a backdrop of consistently soft data points, domestic producers faced additional pressure from imported material marketed at competitive prices, depressing sentiment into the quarter’s end. Excess inventory at leading distribution centres further restricted price increases, with raw material price stability.

Export demand offered little support for the market, as limited demand targeting global markets persisted. However, in September 2025, Stainless Steel Cold Rolled (CR) Coil 304 price trend in India increased marginally by 0.71% on the strength of additional restocking activity from fabricators and improved inquiries ahead of the festive season.

Stainless Steel Cold Rolled (CR) Coil Domestic prices EX-Mumbai, India, Grade- 304-1mm.

The Stainless Steel Cold Rolled (CR) Coil 316 price trend in India edged lower by 0.45% in Q3 2025, impacted by slow demand from industrial, chemical, and processing units. Ample supply and stable nickel prices kept the market largely balanced but under mild pressure. Import arrivals from Asian producers added further competition, keeping mill offers subdued.

Buyer sentiment remained cautious as project activity has been steady but unspectacular. However, Stainless Steel Cold Rolled (CR) Coil (316) prices in India climbed by 0.55% in September 2025, supported by moderate restocking and improved inquiries from select high-end industrial consumers.