Price-Watch’s most active coverage of Succinic Acid price assessment:

- (99.5% min) Industrial Grade FOB Shanghai, China

- (99.5% min) Industrial Grade CIF Mersin (China), Turkey

- (99.5% min) Industrial Grade CIF Houston (China), USA

- (99.5% min) Industrial Grade CIF Jakarta (China), Indonesia

- (99.5% min) Industrial Grade CIF Nhava Sheva (China), India

Succinic Acid Price Trend Q3 2025

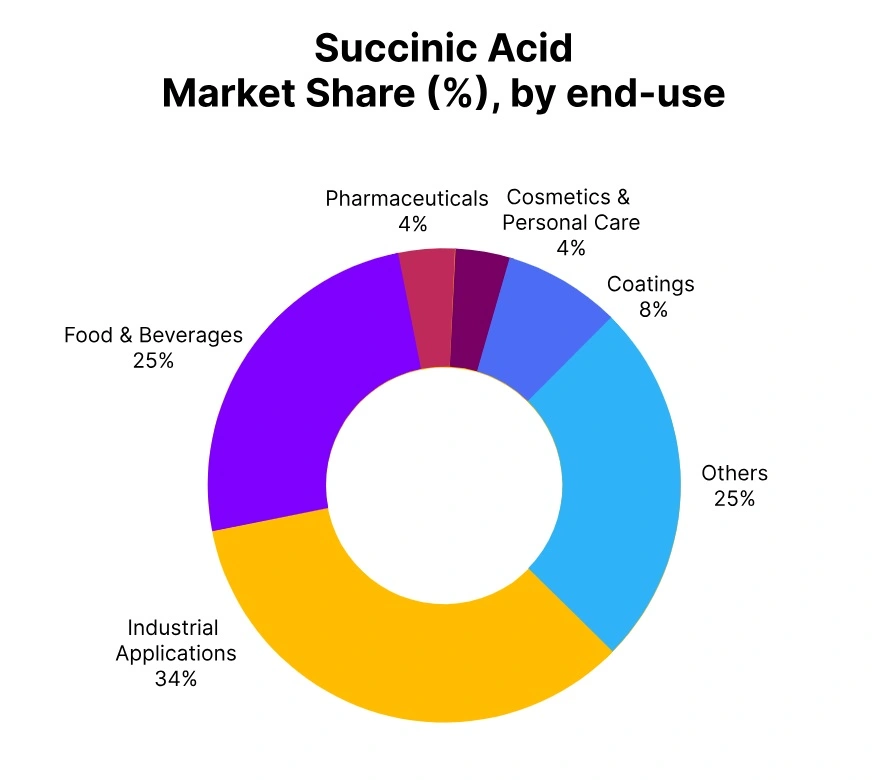

In Q3 2025, Succinic Acid prices declined across key markets, with China seeing a 2.74% drop following a larger decline in Q2, due to weak domestic demand in pharmaceuticals and food additives. The USA saw a 4.69% decrease, driven by weaker demand for chemicals and pharmaceuticals.

Indonesia, Turkey, and India experienced price drops of 3.59%, 2.85%, and 0.96%, respectively, due to slow industrial recovery, economic instability, and high logistics costs. The outlook for Q4 remains cautious, with potential stabilization dependent on recovery in global demand and key sectors such as pharmaceuticals, automotive, and coatings.

USA: Succinic Acid import prices CIF Houston, USA, Grade (99.5% min) Industrial Grade.

According to PriceWatch, Through Q3 2025, Succinic Acid prices in the USA have declined by about 4.7%, extending the downward movement seen earlier with a 12.6% drop in Q2. The Succinic acid price trend in the US has been shaped by weaker domestic demand, particularly from the chemical and pharmaceutical sectors, which have faced reduced production schedules.

A stronger US Dollar has added further pressure on import prices from China. Although supply has remained steady, oversupply within the domestic market and elevated freight costs have weighed on overall sentiment. By September 2025, Succinic acid prices in the US have settled lower than in Q2, and the market has remained cautious, with any recovery likely to depend on a pickup in industrial activity.

China: Succinic Acid Export prices FOB Shanghai, China, Grade- (99.5% min) Industrial Grade.

In the third quarter of 2025, the pricing for Succinic Acid in China declined by approximately 2.7%, after a steep correction of around 12% in the previous quarter. The market seems to have stabilized recently, but demand overall remained soft particularly from the pharmaceutical and food additive segments. Some small improvement in Southeast Asian export inquiries prevented prices from declining further, while feedstock in particular maleic anhydride remained stable and provided some minor support.

By late September, Succinic acid prices in China have been lower than in the second quarter; however, there appeared to be some early signs of stability in pricing. Over the rest of 2025, any lingering price recovery will depend heavily on improvements in global demand and feedstock price movement in the upcoming quarters.

Indonesia: Succinic Acid import prices CIF Jakarta, Indonesia, Grade- (99.5% min) Industrial Grade.

Succinic Acid prices have declined by roughly 3.6% in Q3 2025 in Indonesia, after having already experienced a major decline in Q2. The decline in the price trend has stemmed mainly from lower activity in the automotive and textile sectors, which has softened overall demand. Imports from China have remained consistent, though a weaker Rupiah has added modest pressure on landed costs.

Constant supply chain disruptions and high freight rates have also created further barriers to any price recovery. By September 2025, Succinic Acid prices in Indonesia have shifted lower than Q2, and the forecast is still dependent on purchasing from better sectors, especially the Pharma sector, recovering in the near months.

Turkey: Succinic Acid import prices CIF Mersin, Turkey, Grade (99.5% min) Industrial Grade.

In Q3 2025, Succinic Acid prices in Turkey experienced a decline of 2.85%, following a sharper drop of 14.23% in Q2. The Succinic Acid price trend in Turkey was impacted by ongoing economic instability, which affected industrial production, particularly in the automotive and manufacturing sectors.

Despite competitive pricing from China, Turkey’s market faced pressure from weaker demand and currency devaluation, which increased the cost of imports. Succinic Acid prices in September 2025 showed a decrease compared to Q2. With inflationary pressures and logistical challenges continuing, the market remains uncertain, though a potential stabilization in demand could provide some relief in the upcoming quarter.

India: Succinic Acid import prices CIF Nhava Sheva, India, Grade (99.5% min) Industrial Grade.

In Q3 2025, Succinic Acid prices in India have experienced a minor decline of 0.96%, following the substantial 13.80% drop incurred in Q2. The succinic acid price trend in India remained relatively unchanged, with the pharmaceutical and food sectors maintaining stable demand, although the automotive and coatings sectors continued to struggle. Import prices from China remained competitive, aided by the more advantageous exchange rate.

In addition, some logistical challenges, such as elevated transportation costs, also inhibited price recovery. The prices of Succinic Acid in September 2025 have been lower than what it was in the previous quarter. The outlook for the next quarter is dependent upon the continued stability of both import prices and demand from the key sectors.