Price-Watch’s most active coverage of Sugar price assessment:

- Refined Sugar FOB Santos, Brazil

- White Granulated Sugar Ex-Guangxi, China

- White Granulated Sugar Ex-Yunnan, China

- Refined Sugar Ex-Sangli (Maharashtra), India

- Refined Sugar Ex-Hirekoppa (Karnataka), India

- Refined Sugar Ex-Hapur (Uttar Pradesh), India

- Sugar No. 11 (NY 11)_Raw Centrifugal Cane Sugar, Global

Sugar Price Trend Q3 2025

During Q3 2025, the global Sugar market experienced moderate price declines ranging between 2-7% across major producing countries, reflecting ongoing supply challenges and cautious demand. In Brazil, oversupply concerns and subdued global consumption pressured Refined Sugar prices, while export competition intensified amid shrinking margins.

China’s market saw a slight softening in White Granulated Sugar prices Ex-Guangxi, supported by steady domestic production and balanced supply-demand fundamentals. India’s Refined Sugar prices Ex-Sangli also declined as stable monsoon conditions ensured steady supply amid consistent demand from beverage and confectionery sectors.

Despite these downward movements, logistical efficiency and quality maintenance in key regions helped sustain export flows. The final month of the quarter saw further mild price softness, signaling cautious buyer sentiment and elevated inventory levels in a broadly bearish but stable global market environment. This global sugar price trend confirmed the cautious stance across regions, highlighting ongoing market balancing acts.

Brazil: Sugar (Refined) Export prices from Brazil.

In Q3 2025, Refined Sugar prices in Brazil FOB Santos decreased by 3.39%, with prices in the range of 450 to 550 USD per metric ton. Furthermore, Refined Sugar price trend in Brazil remained weak due to continuing concerns of excess supply and sluggish global demand. Moreover, exporters began competing heavily, as other producing regions introduced competitive pricing, creating upward pressure on margins.

The country’s continued focus on quality production, logistical flexibility, and sustainable practices kept it as the leading refined sugar exporting country despite the pressures. In September 2025, the last month in the quarter, Refined Sugar prices in Brazil declined slightly by 0.82%, as buyers maintained hesitation while inventories remained high. Brazil’s consistent supply reliability and quality of refined sugar supported stable shipments amidst difficult and volatile market conditions.

China: Sugar (White Granulated) Domestically Traded prices Ex-Guangxi.

In Q3 2025, Sugar prices in China exhibited marginal softening amid well-balanced supply-demand dynamics and adequate production. White Granulated Sugar prices Ex-Guangxi ranged between USD 760-870 per metric ton, declining approximately 1.72% compared to the previous quarter.

Steady refinery throughput, consistent crushing, and moderate consumption across food processing, beverage, and pharmaceutical sectors supported the price trend in China. Efficient inventory management and regular procurement activities helped sustain supply chain efficiency.

Regional distribution and logistics infrastructure operated smoothly. Producers maintained quality standards while applying competitive pricing to secure market share across industrial applications. In September 2025, Sugar prices in China declined further by 0.75%, blending subtly with the quarter’s mild softening trend and reflecting cautious demand conditions.

India: Sugar (Refined) Domestically Traded prices Ex-Sangli.

According to Price-Watch AI, In Q3 2025, Sugar prices in India ranged between USD 395-490 per metric ton, declining by approximately 2.05% compared to the previous quarter. The price trend in China experienced moderate downward pressure amid adequate domestic production and stable monsoon conditions across major Sugarcane-growing regions.

Sugar price trend in India during the quarter reflected steady supply from Maharashtra and Uttar Pradesh, while demand from beverage and confectionery sectors remained consistent. The Refined Sugar market witnessed balanced trading activity, with manufacturers maintaining steady output despite marginal price corrections.

Domestic consumption from food processing industries and festive demand provided support to market fundamentals, ensuring stable market conditions throughout the quarter. In September 2025, the last month of the quarter, Sugar prices in India declined by 0.27%, harmonizing with the quarter’s overall moderate downward trend.

Global (NY 11): Sugar No. 11 (Raw Centrifugal Cane Sugar) Traded prices Globally.

In Q3 2025, the Sugar price trend globally showed a more hefty decline of 6.58%, with prices between USD 320-413 per metric ton as supply-demand balance improved slightly. Global Sugar price trend displayed resilience supported by efficient logistics and steady export volumes. The cautious market environment tempered price movements, with buyers reacting slowly amid lingering uncertainties.

September 2025 recorded a minor price decline of 0.84%, aligning with the quarter’s overall moderate downward trend. Demand stabilization in key consuming markets and controlled inventory levels contributed to limited price volatility.

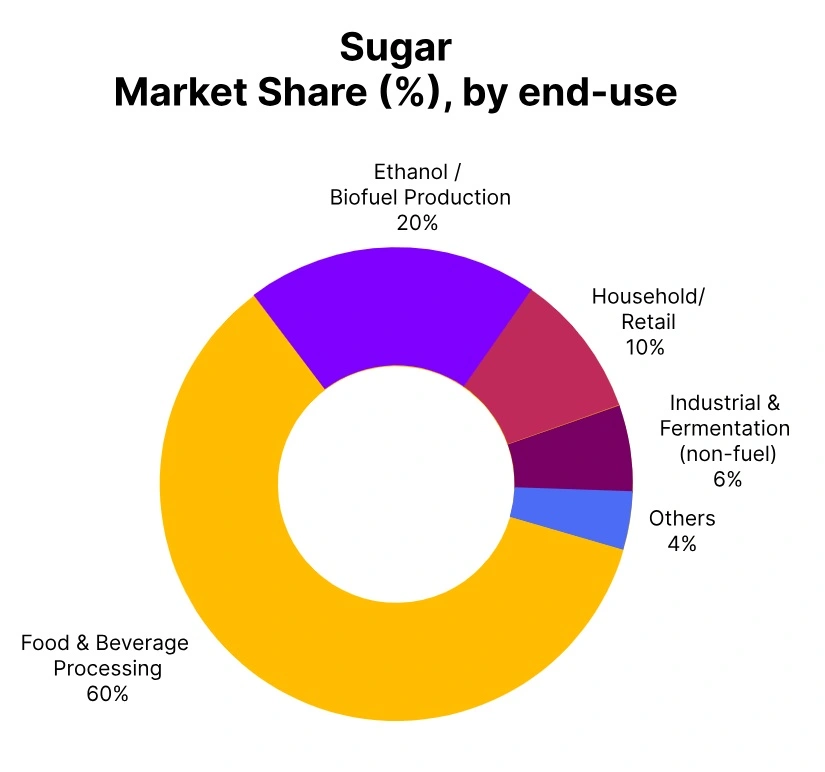

Production discipline and downstream consumption, especially in food and beverage sectors, helped sustain the market despite softness. This quarter reflected tentative stabilization, with prospects for gradual recovery depending on global economic conditions going forward.