Price-Watch’s most active coverage of Sulphur price assessment:

- Granular FOB Ras Laffan, Qatar

- Granular FOB Jebel Ali, UAE

- Granular FOB Dammam, Saudi Arabia

- Granular FOB vancouver, Canada

- Granular FOB West Coast, USA

- Granular CFR Port of Santos (USA), Brazil

- Granular CFR Qingdao (UAE), China

- Granular CFR Paradip (Qatar), India

- Granular CFR Paradip (UAE), India

- Granular CFR Paradip (Saudi Arabia), India

- Molten Ex-West India, India

- Lump Ex-West India, India

- Molten Ex-East India, India

- Lump Ex-East India, India

- Lump Ex-North India, India

- Pellet Ex-North India, India

- Lump Ex-South India, India

- Pellet Ex-South India, India

Sulphur Price Trend Q3 2025

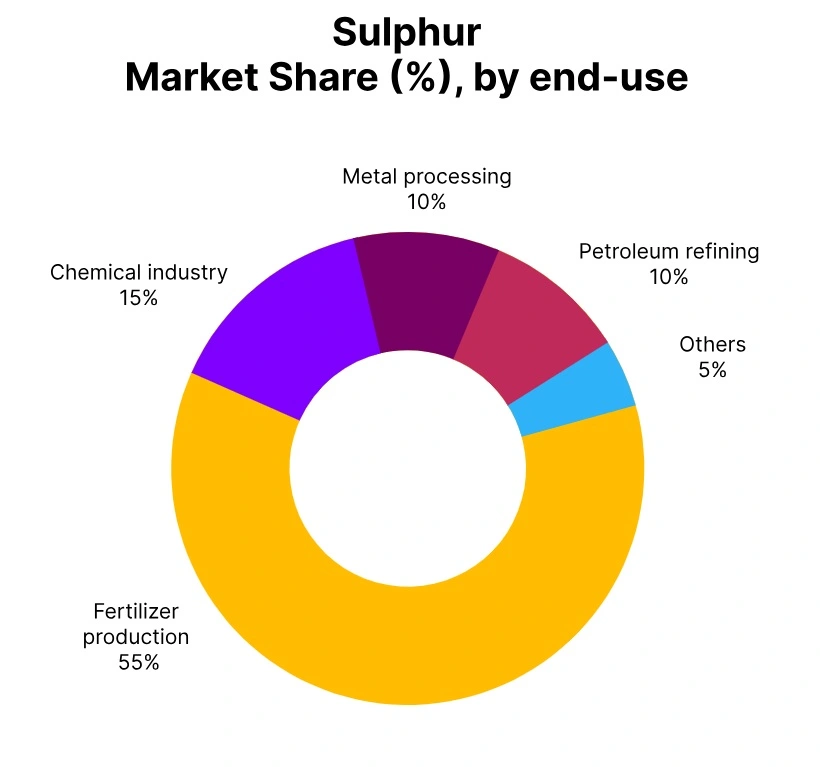

In Q3 2025, the global Sulphur market exhibited a generally soft to stable trend, influenced by balanced supply and cautious downstream demand from fertilizer and industrial sectors. Middle Eastern exporters saw modest price easing amid steady production and ample availability, while buyers in Asia and East Africa limited purchases due to sufficient inventories.

North American markets reflected restrained domestic and export demand, with North America maintaining stable supply flows. South America and East Asia recorded slight declines as importers sourced selectively amid high domestic stock levels.

In South Asia, Sulphur prices across granular, molten, lump, and pellet grades edged lower, shaped by careful procurement and abundant global supply. Overall, the market remained well-balanced, with measured trading activity and limited price volatility throughout the quarter.

Qatar: Sulphur Granular Exported price in Qatar, Grade: Granular.

In Q3 2025, Granular Sulphur export prices from Qatar have softened amid easing demand from fertilizer and chemical sectors. Sulphur price in Qatar has reflected this softening trend, with FOB Ras Laffan prices ranging between USD 250–310 per metric ton, marking a quarterly decline of –2.71%.

In September 2025, Sulphur prices in Qatar have risen by 13.21%, compared to the previous month. Exporters have noted ample supply availability and stable production rates, while buyers in South Asia and Southeast Asia have adopted cautious procurement in response to ample global inventories.

Freight and logistics conditions have remained favorable, supporting regular shipment schedules. Overall, market sentiment has been subdued with modest downward price adjustments reflecting balanced supply–demand dynamics. Sulphur price trend in Qatar indicates a softening trajectory.

United Arab Emirates: Sulphur Granular Exported price in the UAE, Grade: Granular.

In Q3 2025, Granular Sulphur export prices from the UAE have dipped slightly as downstream fertilizer and industrial users have managed inventories conservatively. Sulphur price in the UAE has reflected these dynamics, with FOB Jebel Ali values trading between USD 250–320 per metric ton, down by –2.54% quarter on quarter.

In September 2025, Sulphur prices in the UAE have risen by 13.16%, compared to the previous month. Steady production at local refining facilities has ensured consistent export availability, while moderate buying interest from East African and South Asian markets has limited price upside.

Market participants have observed measured procurement strategies amid stable freight conditions and ample global supply. Sulphur price trend in the UAE has been modestly downward.

Saudi Arabia: Sulphur Granular Exported price in Saudi Arabia, Grade: Granular.

In Q3 2025, Saudi Granular Sulphur FOB Dammam prices have eased by –3.17% to a range of USD 250–320 per metric ton. Sulphur price in Saudi Arabia has softened as downstream fertilizer producers in India and Southeast Asia curtailed purchases amid sufficient onshore inventories and competitive import offers. In September 2025, Sulphur prices in Saudi Arabia have risen by 14.02%, compared to the previous month.

Steady output at major refineries has maintained export volumes, and favorable shipping conditions has supported cargo movements. Overall, market sentiment has been cautious as buyers have monitored global supply levels and delayed restocking decisions. Sulphur price trend in Saudi Arabia has shown a mild decline.

Canada: Sulphur Granular Exported price in Canada, Grade: Granular.

In Q3 2025, Granular Sulphur FOB Vancouver prices have fallen by –2.00% to USD 250–300 per metric ton, pressured by tepid demand from Western Hemisphere fertilizer and industrial sectors. Sulphur price in Canada has been modestly lower as exporters have reported steady availability from gas processing plants, but buyers have exercised restraint amid abundant global inventories.

In September 2025, Sulphur prices in Canada have risen by 11.11%, compared to the previous month. Freight costs have remained stable, allowing uninterrupted shipments to Latin American and Asian destinations. Market activity has been subdued, reflecting balanced supply–demand conditions and cautious procurement approaches. Sulphur price trend in Canada has been slightly downward.

United States: Sulphur Granular Exported price in the USA, Grade: Granular.

In Q3 2025, Granular Sulphur FOB West Coast prices have dipped by –1.06% to a range of USD 250–300 per metric ton. Sulphur price in the USA has been stable, as demand from domestic fertilizer manufacturers has been moderate, while export inquiries from Latin America and Asia have remained steady but selective. In September 2025, Sulphur prices in the USA have risen by 10.81%, compared to the previous month.

Production from Gulf Coast and Rockies sources has ensured ample volumes. Buyers have managed stocks conservatively amid stable freight dynamics. Overall, price movements have been modest, reflecting well-balanced supply and demand. Sulphur price trend in the USA has shown slight softness.

Brazil: Sulphur Granular Imported price in Brazil from the USA, Grade: Granular.

In Q3 2025, Brazil’s Granular Sulphur CFR Santos prices from the USA have moved slightly lower by –0.43%, trading at USD 260–330 per metric ton. Sulphur price in Brazil has reflected these developments, as downstream fertilizer and chemical segments have maintained balanced consumption, drawing on both domestic output and imports.

In September 2025, Sulphur prices in Brazil have risen by 13.00%, compared to the previous month. Stable freight rates have supported regular arrivals. Buyers have adopted a selective purchasing stance, mindful of adequate domestic and international inventories. Market sentiment has been neutral, with minimal price volatility across the quarter. Sulphur price trend in Brazil has been nearly flat.

China: Sulphur Granular Imported price in China from the UAE, Grade: Granular.

In Q3 2025, China’s Granular Sulphur CFR Qingdao prices from the UAE have declined by –2.85% to USD 270–340 per metric ton. Sulphur price in China has softened as demand from fertilizer blending and industrial users has remained cautious amid high domestic stock levels.

In September 2025, Sulphur prices in China have risen by 13.38%, compared to the previous month. Importers have leveraged competitive offers and favorable shipping terms to secure volumes. Market activity has been restrained, with minor price concessions reflecting ample supply and measured downstream procurement strategies. Sulphur price trend in China has shown a downward movement.

India: Sulphur Granular Imported and Domestically Traded price in India, Grades: Granular, Molten, Lump, Pellet.

According to Price-Watch, in Q3 2025, India’s Sulphur market has exhibited mixed trends across grades and origins. Sulphur price in India has been mixed across regions and grades, with Granular Sulphur CFR Paradip prices edging lower by –0.19% to –1.13% (USD 270–340 per metric ton) for cargoes from Qatar, UAE, and Saudi Arabia, as downstream fertilizer makers have managed working stocks amid ample global supply. In September 2025, Sulphur prices in India have risen by 11.86%, compared to the previous month.

Domestic Ex-West India Molten and Lump prices have eased by –1.99% (USD 330–350), while Ex-East India grades have dropped sharply –7.10% (USD 280–340). Ex-North and Ex-South India Lump and Pellet prices have fallen by –6.61% (USD 310–360) and –2.31% to –2.41% (USD 290–320), respectively, as regional buyers have tempered procurement. Overall, balanced supply and cautious end-user buying have kept price adjustments modest to moderate. Sulphur price trend in India has varied by origin and grade.