Price-Watch’s most active coverage of Talc price assessment:

- Talc Powder 95% CIF Jebel Ali (India), United Arab Emirates

- Talc Powder 95% CIF Jakarta (India), Indonesia

- Talc Powder 95% FOB Mumbai, India

- Talc Powder 95% FOB Shanghai, China

Talc Price Trend Q3 2025

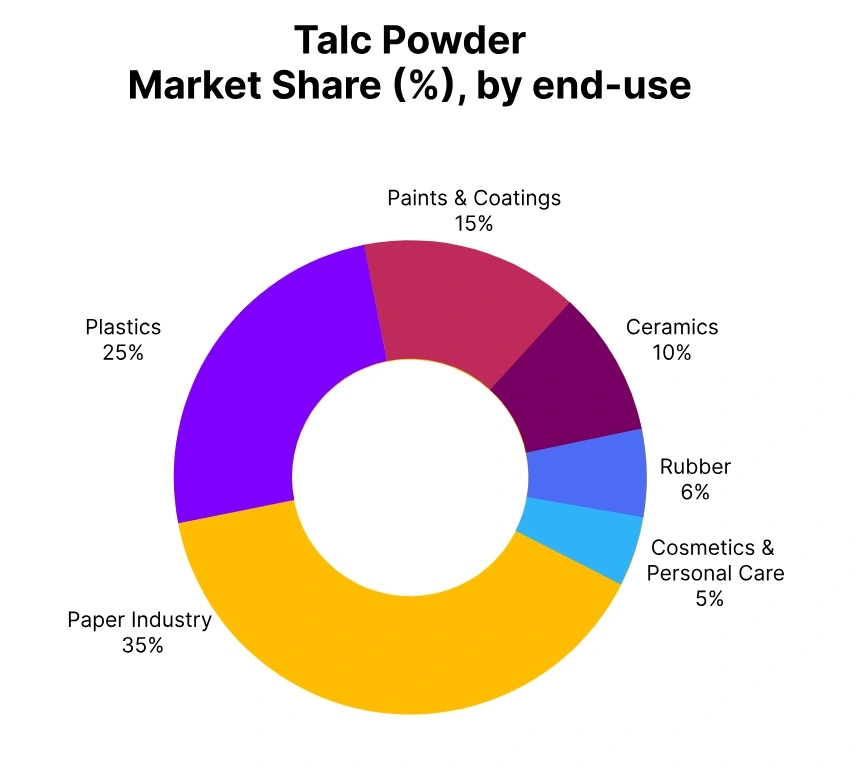

As of the third quarter of 2025, the global talc market is seeing a favorable price trend due to robust demand from sectors including, plastics, coatings, ceramics, and cosmetics, as well as increased production and logistics costs. Restrictions on supply in major producing regions, along with increasing regulatory requirements, particularly for high purity, asbestos free grades of talc, are all contributing to the upward price trend.

High grades sell for much higher prices, and overall forecasts for the market predict a price increase of between 4 to 6 % year on year. The market outlook remains strong, with continued growth expected through 2026.

Indonesia: Talc Powder Import prices CIF Jakarta (India), Indonesia, Grade- Talc powder 95%.

In Q3 2025, talc prices in the Indonesian market have increased by 6.94% compared to Q2, driven by rising demand from manufacturing sectors such as plastics and coatings, along with supply constraints and higher logistics costs. This growth has supported a moderate upward talc price trend, particularly for higher-grade products, as producers have passed on increased operational expenses.

While imports have remained a factor, local sourcing has gained traction due to cost and quality advantages. Overall, the Indonesian talc market has shown a steadily bullish trend, reflecting both robust demand and supply-side pressures.

In September 2025, talc prices in Indonesia have risen by 2.34%, driven by higher extraction and transportation costs amid rising fuel prices, as well as strong demand from the cosmetics and ceramics industries.

UAE: Talc Powder Import prices CIF Jebel Ali (India), UAE, Grade- Talc powder 95%.

In Q3 2025, talc prices in the UAE market have risen by 6.64% from Q2, driven by strong demand across key industries such as plastics, ceramics, and cosmetics, alongside supply chain constraints and higher production costs. The talc price trend has reflected tighter supply and expanding consumption, further influenced by regulatory changes promoting alternative materials under new environmental policies.

In September 2025, talc prices in the UAE have increased by 2.29%, supported by rising production costs and heightened demand in the cosmetics and construction sectors. Supply chain disruptions and higher import tariffs have also contributed to the upward movement.

China: Talc Powder Export prices FOB Shanghai, China, Grade- Talc powder 95%.

In the third quarter of 2025, the talc price trend in China experienced a slight, but sustained change of 2.48% from Q2, due to domestic supply constraints, increased production pressures and transportation costs, and continued improvement in downstream demand from sectors like plastics, paints, and ceramics.

Mining production and output continued to be reduced due to environmental rules and regulations, which presented initial upward pricing pressure. In addition, buyers began to re-stock some inventory in anticipation of further increases in Q4, tracking increased costs and prices. The increase in prices is steadily but with no volatility.

The premium grades of talc noticed a slightly more significant increase attributed to their applications in several specialized industries with a further increase in value. The 1.72% increase in talc prices in China in September 2025 can be associated with moderated demand from the ceramics and plastic industries as a result of tightened environmental regulations that restricted the previous output of talc mines. Further, supply decreases would be associated with decreases in output from key provinces.

India: Talc Powder Export prices FOB Mumbai, India, Grade- Talc powder 95%.

According to Price-Watch, during the third quarter of 2025, the talc price trend in India, increased 18.52% from the previous quarter, as a result of strong demand from end use industries, including ceramics, paints, plastics and personal care products.

The demand for talc increased its price owing to rising input costs, logistics and stricter environmental regulations on mining. The growing demand for exports and the demand for high purity specialty grades of talc further supported price pressure.

Domestic consumption is increasing, yet supply remains tight, which creates an environment of firm prices for all market participants. It is expected to be a bullish outlook for talc in the near term within the Indian market.

The talc price trend in India increased 7.23% in September of 2025, due to the increasing mining and transportation costs, and rising demand from the ceramics and cosmetics industries. Continually rising prices, in addition to supply constraints from environmental regulations on mining operations, has contributed to the price increases.