Price-Watch’s most active coverage of Terbium price assessment:

- China FOB Sanghai, China

- India CIF Nhava Sheva (China), India

- USA CIF Houston (China), USA

- Netherlands CIF Rotterdam (China), Netherlands

Terbium Price Trend Q3 2025

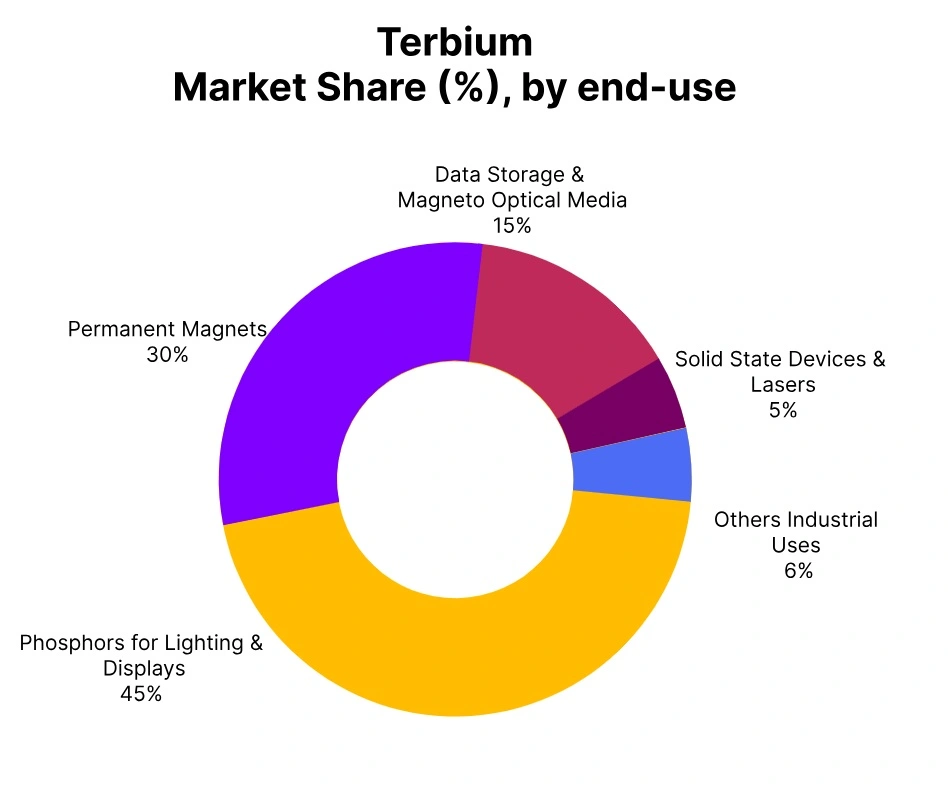

In the third quarter of 2025, prices for terbium have exhibited a favorable increase in the global market owing to a reduction in supply, particularly from China given tightened export controls, and stable magnet and electronics demand. High purity terbium oxide prices have stabilized, maintaining strength after a 26% increase in the first half of 2025.

Market conditions remain positive with additional bullish support for the market, driven by stock replenishment and strategic purchasing from manufacturers, combined with little supply planned outside China.

USA: Terbium Import prices CIF Houston (China), USA, Grade- Purity: 99%.

According to PriceWatch, In Q3 2025, terbium prices in the U.S. market have risen by 8.46% compared to Q2, extending the strong global uptrend fuelled by tightening supply and surging demand from the clean energy, EV, and defence sectors. This growth has reflected persistent supply constraints shaped by China’s dominant position in rare earth processing and the increasing strategic importance of terbium in advanced technologies.

Consequently, U.S. manufacturers have faced higher input costs, while investors and policymakers have intensified efforts to secure diversified, stable supply chains and advance domestic critical mineral initiatives.

The 3.84% price increase in September 2025 has stemmed from heightened demand for high-efficiency magnets and displays, compounded by export restrictions from major producers like China that have further tightened global availability.

Netherlands: Terbium Import prices CIF Rotterdam (China), Netherlands, Grade- Purity: 99%.

In Q3 2025, terbium prices in the Netherlands have risen by 7.97% compared to Q2, extending the global upward trend driven by tightening supply chains and surging demand from high-tech sectors such as electronics and renewable energy. Environmental regulations and logistical challenges have constrained production, while strategic stockpiling has reinforced price growth.

This sustained rise has underscored terbium’s indispensable role in advanced technologies, with the market maintaining strong momentum heading into Q4 2025. The 3.78% price increase recorded in September 2025 has likely reflected heightened demand and supply limitations, signaling continued pressure within the rare earth value chain.

China: Terbium Export prices FOB Shanghai, China, Grade Purity: 99%.

In the third quarter of 2025, the terbium price trend in China displayed an increase of 5.57% from the second quarter. This price rise in terbium has largely been driven by a tight supply picture, firm downstream demand from the magnet and electronics sectors, and continued regulatory restrictions on rare earths.

Average terbium oxide prices increased, as manufacturers provided limited spot availability, and continued to restock cautiously in line with growing demand. The combination of government export controls and production curtailments continued to add supply pressure to a tight initial supply picture.

Additionally, speculative buying by manufacturers and traders facilitated the upward price momentum. However, future price stability remains sensitive to policy shifts, affordability concerns, and global substitution efforts. The 2.87 % price rise in terbium in China in September 2025 reflected tighter supply conditions (e.g. reduced spot availability or constrained mine output) coupled with resurgent demand from magnet and electronics sectors pushing buyers to restock.

India: Terbium Import prices CIF Nhava Sheva (China), India, Grade- Purity: 99%.

In Q3 2025, terbium prices in the Indian market have increased by 6.98% compared to Q2, driven by tightening global supply, rising demand from the EV and clean energy sectors, and strategic stockpiling amid continued import dependence. Although global spot transactions have shown short-term softness, India’s efforts to secure terbium imports and bolster domestic magnet manufacturing have sustained the upward price movement.

The 3.76% rise in September 2025 has reflected strong global demand for rare earth elements in green energy and electronics, alongside supply chain constraints and limited export volumes from major producing countries that have further restricted availability.