Price-Watch’s most active coverage of Toluene Diisocyanate (TDI) price assessment:

- Industrial Grade ((99.5% min purity), T80/20) FOB Texas, USA

- Industrial Grade ((99.5% min purity), T80/20) FOB Busan, South Korea

- Industrial Grade ((99.5% min purity), T80/20) FOB Al Jubail, Saudi Arabia

- Industrial Grade ((99.5% min purity), T80/20) FOB Hamburg, Germany

- Industrial Grade ((99.5% min purity), T80/20) FD Trieste, Italy

- Industrial Grade ((99.5% min purity), T80/20) FOB Shanghai, China

- Industrial Grade ((99.5% min purity), T80/20) CIF JNPT_China, India

- Industrial Grade ((99.5% min purity), T80/20) Ex-Mumbai, India

- Industrial Grade ((99.5% min purity), T80/20) CIF Mersin_South Korea, Turkey

Toluene Diisocyanate (TDI) Price Trend Q3 2025

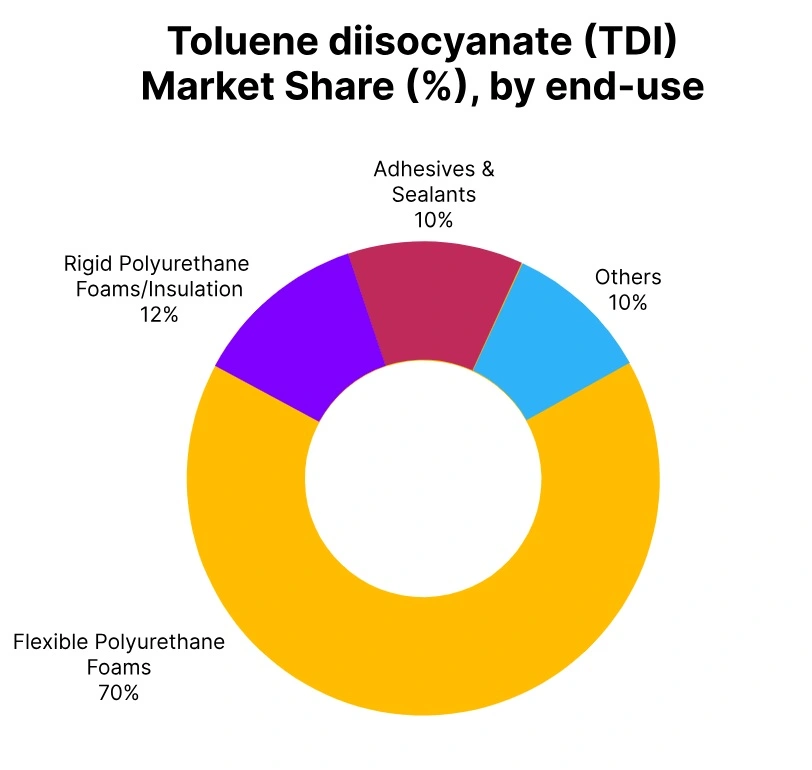

The global Toluene Diisocyanate (TDI) market saw a prominent upward trend in the third quarter of 2025, with prices rising approximately 10-15%. Sustained demand from downstream flexible polyurethane foam converters for Toluene Diisocyanate further boosted price increases across the regions and specifically in furniture, automotive and bedding sectors. A combination of tight supply in key Toluene Diisocyanate producing regions and increased costs of feedstock (toluene and amines) fueled higher prices.

The supply and production capacities for TDI have been steady, although inventory management by TDI converters and cautious stocking by major end-users deepened existing market tightness. Next quarter, demand from downstream flexible polyurethane foam converters continues to be a key factor in sustaining the Toluene Diisocyanate (TDI) price increase and further expanding the market.

USA: Toluene Diisocyanate Export prices FOB Texas, USA, Grade- Industrial Grade (99.5% min purity), T80/20).

According to PriceWatch, in Q3 2025, the Toluene Diisocyanate (TDI) price trend in the USA showed a firm upward movement, with TDI prices in September 2025 ranging between USD 2300–2500/MT in the US. The TDI market trend during the quarter has largely been influenced by tight supply conditions in key producing regions and rising feedstock costs for toluene and amines.

Strong demand from downstream flexible polyurethane foam producers in the furniture, automotive, and bedding sectors supported the price rally. Despite steady production levels of Toluene Diisocyanate, cautious inventory management and strategic stockpiling by major end-users contributed to upward pressure.

South Korea: Toluene Diisocyanate Export prices FOB Busan, South Korea, Grade- Industrial Grade (99.5% min purity), T80/20).

In Q3 2025, Toluene Diisocyanate (TDI) price trend in South Korea recorded an upward trend, with TDI prices in September 2025 ranging between USD 1800–2000/MT in South Korea. The market movement during the quarter was influenced by steady feedstock costs for toluene and amines, coupled with firm demand from downstream flexible polyurethane foam producers serving the furniture, automotive, and bedding sectors.

Limited supply availability from key producing regions and strategic inventory management by buyers further reinforced price gains. As a result, the Toluene Diisocyanate price in South Korea strengthened, with the Toluene Diisocyanate price trend in South Korea reflecting positive market sentiment.

Saudi Arabia:Toluene Diisocyanate Export prices FOB Al Jubail, Saudi Arabia, Grade- Industrial Grade (99.5% min purity), T80/20).

In the third quarter of 2025, Toluene Diisocyanate (TDI) price trend in Saudi Arabia demonstrated a significant upward trajectory, Toluene Diisocyanate (TDI) prices in September 2025 reaching between USD 1800–2000/MT. The quarter’s market dynamics derived from ongoing strong feedstock costs for toluene and amines, and healthy demand from downstream flexible polyurethane foam producers in the furniture, automotive, and bedding sectors.

Limited supply from producing regions and preemptive stock builds by buyers were technical features that also provided upward pressure. The result was a considerable strengthening of Toluene Diisocyanate price in Saudi Arabia, which showed the tight market fundamentals reflected in the Toluene Diisocyanate price trend in Saudi Arabia.

Germany: Toluene Diisocyanate Export prices FOB Hamburg, Germany, Grade- Industrial Grade (99.5% min purity), T80/20).

In Q3 2025, the Toluene Diisocyanate (TDI) price trend in Germany recorded a firm upward trend, with TDI prices in September 2025 ranging between USD 2400–2600/MT. The market movement during the quarter was influenced by rising feedstock costs for toluene and amines, coupled with strong demand from downstream flexible polyurethane foam producers across the furniture, automotive, and bedding sectors.

Tight supply from major producing regions and strategic inventory management by buyers reinforced the price gains. Consequently, the Toluene Diisocyanate price in Germany strengthened, with the Toluene Diisocyanate (TDI) price trend in Germany reflecting solid market fundamentals

Italy: Toluene Diisocyanate Domestically traded prices FD Trieste, Italy, Grade- Industrial Grade (99.5% min purity), T80/20).

According to PriceWatch, In Q3 2025, the Toluene Diisocyanate (TDI) price trend in Italy showed a strong upward movement, with Toluene Diisocyanate (TDI) FD prices in September 2025 ranging between USD 2400–2600/MT. The market trend during the quarter was influenced by firm feedstock costs for toluene and amines, alongside robust demand from downstream flexible polyurethane foam producers in the furniture, automotive, and bedding sectors.

Limited supply availability from key producing regions and strategic stockpiling by buyers added further upward pressure. As a result, the Toluene Diisocyanate price in Italy strengthened, with the Toluene Diisocyanate price trend in Italy reflecting tight market fundamentals.

China: Toluene Diisocyanate Export prices FOB Shanghai, China, Grade- Industrial Grade (99.5% min purity), T80/20).

According to PriceWatch, during the third quarter of 2025, Toluene Diisocyanate (TDI) price trend in China experienced a steady increase. In September 2025, Toluene Diisocyanate prices in China have reported within a range of USD 1750–2000/MT.

Market conditions in Q3 2025 indicated higher prices primarily due to increasing feedstock prices for toluene and amines, further supported by growing demand from end-users of flexible polyurethane foam in the furniture, automotive, and bedding sectors.

Additional upward price pressure noted due to tight supply from the main producing areas, combined with a cautious inventory approach by purchasing personnel.

India: Toluene Diisocyanate Import prices CIF JNPT, India, Grade- Industrial Grade (99.5% min purity), T80/20).

According to Price-Watch AI, in Q3 2025, Toluene Diisocyanate (TDI) price trend in India experienced a consistent upward trajectory, with Toluene Diisocyanate (TDI) prices in September 2025 falling between USD 1800–2100/MT. The development of the market during the quarter was led by rising FOB prices from key exporting regions where tight supply and surging feedstock costs for toluene and amines were in place to buoy prices.

Furthermore, solid demand from downstream flexible polyurethane foam manufacturers in furniture, automotive, and bedding sectors supported a firm market sentiment. Prices for domestic TDI in India increased approximately 5–10% in Q3, aided by increasing industrial activity and customers remaining cautious in their inventory information.

Turkey: Toluene Diisocyanate Import prices CIF Mersin, Turkey, Grade- Industrial Grade (99.5% min purity), T80/20).

In the third quarter of 2025, Toluene Diisocyanate (TDI) price trend in Turkey, from South Korea, showed a consistent upward trend, with Toluene Diisocyanate (TDI) prices in September 2025 hovering between USD 1900-2200/MT in Turkey. The market trend for the quarter has primarily been influenced by increasing FOB price from South Korea, bolstered by stable feedstock prices for toluene and amines and limited regional availability.

Additional price momentum has been provided by strong demand from downstream flexible polyurethane foam producers, including those in the furniture, automotive, and bedding sectors in Turkey. Finally, while production has been stable, cautious buying and planned inventories of Turkish end-users put upward pressure on Toluene Diisocyanate (TDI) prices.