Price-Watch’s most active coverage of Trimethylol Propane price assessment:

- Industrial Grade 99% min FOB Shanghai, China

- Industrial Grade 99% min CIF Mersin (China), Turkey

- Industrial Grade 99% min CIF Busan (China), South Korea

- Industrial Grade 99% min CIF JNPT (China), India

Trimethylol Propane Price Trend Q3 2025

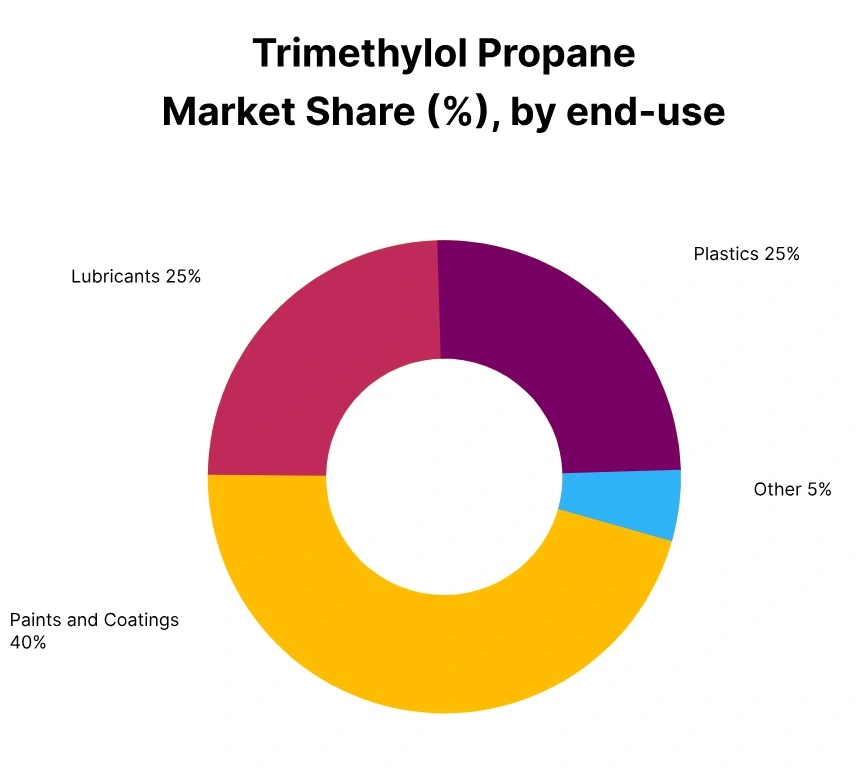

In Q3 2025, Trimethylol Propane (TMP) prices across China, India, South Korea, and Turkey declined compared with Q2, pressured by weaker demand from coatings, adhesives & sealants, plastics, and lubricants industries. China’s TMP price fell about 5% as export demand slowed and inventories built up, though September showed slight stabilization. India’s prices declined 3%, influenced by moderated industrial demand and continued imports from China, with September stabilizing. South Korea recorded a 5% drop, driven by softer consumption and competitive Chinese supply, while oversupply kept sentiment weak. Turkey also saw a 5% decrease, as ample supply and reduced demand maintained downward pressure. Overall, the region reflected subdued momentum and high sensitivity to Chinese export activity.

China: Trimethylol Propane Export prices FOB Shanghai, China, Grade- Industrial Grade (99%).

In Q3 2025, Trimethylol Propane price in China declined again compared with Q2, dropping by about 5% as export demand slowed and downstream industries, including coatings, adhesives & sealants, plastics, and lubricants, moderated purchasing. The Trimethylol Propane price trend in China reflected this downward movement, pressured by inventory buildup and slower overseas inquiries. Production remained stable, but cautious buying kept market momentum subdued. Trimethylol Propane price in September 2025 showed minor stabilization as selective export orders emerged, yet overall sentiment remained soft, with Q3 closing lower than Q2 and highlighting continued vulnerability to international demand fluctuations.

India: Trimethylol Propane import prices CIF JNPT, India, Grade- Industrial Grade (99%).

In Q3 2025, Trimethyl Propane price in India declined by 3% compared with Q2 2025. Trimethyl Propane price trend in India was influenced by a moderate slowdown in demand from coatings, adhesives and sealants, plastics, and lubricants industries. Imports from China continued to support supply, while local inventory adjustments contributed to the price moderation. Despite the decline, steady consumption from industrial end-use sectors helped prevent sharper decreases. Trimethyl Propane prices in September 2025 reflected this trend, stabilizing toward the end of the quarter. Analysts highlighted that continued monitoring of import volumes from China and fluctuations in industrial demand would be critical to understanding future TMP price trends in India.

South Korea: Trimethylol Propane import prices CIF Busan, South Korea, Grade- Industrial Grade (99%).

In Q3 2025, Trimethyl Propane price in South Korea fell by 5% compared with Q2 2025. Trimethyl Propane price trend in South Korea was impacted by softer demand from coatings, adhesives and sealants, plastics, and lubricants sectors, alongside competitive import supply from China. Industrial consumption remained steady, but market oversupply weighed on prices. Trimethyl Propane prices in September 2025 mirrored this decline, indicating a subdued market sentiment compared with the previous quarter. Analysts noted that monitoring Chinese export volumes and domestic end-use industry demand would remain essential for predicting upcoming TMP price movements in South Korea.

Turkey: Trimethylol Propane import prices CIF Mersin, Turkey, Grade- Industrial Grade (99%).

In Q3 2025, Trimethyl Propane price in Turkey decreased by 5% compared with Q2 2025. Trimethyl Propane price trend in Turkey reflected weaker demand from coatings, adhesives and sealants, plastics, and lubricants industries, coupled with imports from China maintaining competitive pricing. While industrial consumption remained stable, price pressures persisted due to abundant supply. Trimethyl Propane prices in September 2025 indicated this downward trend, contrasting with the relative stability observed in the previous quarter. Market analysts emphasized that tracking Chinese export activity and industrial demand patterns in Turkey would be critical to understanding TMP price movements in the next quarter.