Price-Watch’s most active coverage of Ultra High Molecular Weight Polyethylene (UHMWPE) price assessment:

- Compression Moulding RAM Extrusion (MW: 5.8-7.8E6) FOB Laem Chabang, Thailand

- Compression Moulding (MW: 6.7E6) FOB Houston, USA

- Compression Moulding RAM Extrusion (MW: 5.8-7.8E6) CIF Nhava Sheva (Thailand), India

- Compression Moulding (MW: 6.7E6) CIF Antwerp (USA), Belgium

- Compression Moulding (MW: 6.7E6) CIF Manzanillo (USA), Mexico

- Compression Moulding (MW: 6.7E6) CIF Barranquilla (USA), Colombia

- Compression Moulding RAM Extrusion (MW: 5.8-7.8E6) Ex-Mumbai, India

Ultra-High Molecular Weight Polyethylene (UHMWPE) Price Trend Q3 2025

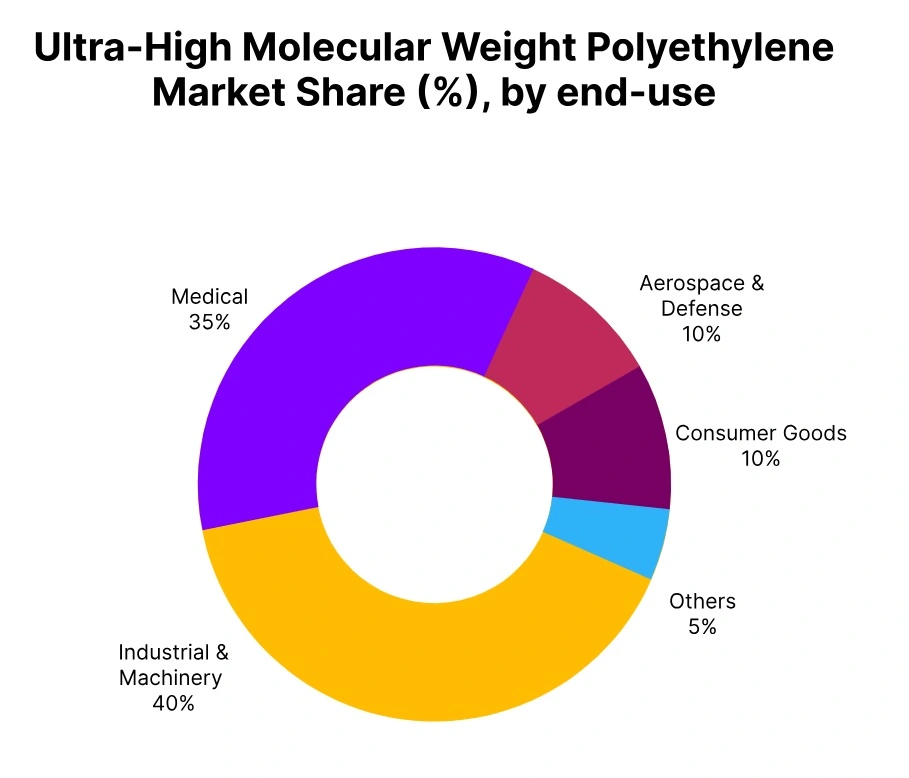

According to PriceWatch, the price trend for Ultra High Molecular Weight Polyethylene (UHMWPE) around the world has generally been stable to weak in Q3 2025, with a mix of modest price movements in important regions. The overarching price trend reflects relatively moderate movements in upstream ethylene costs, weak crude oil values and stable production activity by key suppliers. There has been stable demand in the U.S. and parts of Asia from key end-use segments, including medical devices, filtration, and industrial equipment.

Demand has been less strong in parts of Europe and Thailand due to slower industrial consumption. Inventory levels in most, if not all markets are comfortable, with favourable supply conditions leading to limited price fluctuations. Overall, steady supply, moderate feedstock movement and uneven regional downstream demand have left UHMWPE prices predominantly range-bound globally, with small increases or decreases depending on regional consumption weaknesses or strengths.

USA: UHMWPE Export prices FOB Houston, USA, Grade- Compression Moulding (MW: 6.7E6).

According to PriceWatch, during Q3 2025, the Ultra-High Molecular Weight Polyethylene (UHMWPE) price trend in the USA has displayed a broadly stable tone in the market, frequently circling back to the USD 1,580-1,600/MT price range, which represents only a marginal 0.05% increase from Q2 2025. USA UHMWPE prices have been supported by steady demand from the medical, industrial and conveyor belt sectors while production and supply availability remained in a generally balanced position.

In September 2025, UHMWPE prices in the USA recorded a slight 0.13% reduction from August, as moderate restocking activity and consistent feedstock pricing limited additional upside. Consequently, throughout Q3 2025, USA UHMWPE prices remained range-bound due to balanced inventories, demand from consistent industrial end-users, and stable upstream ethylene pricing, though minor fluctuations may be anticipated near beginning Q4 2025.

Thailand: UHMWPE Export prices FOB Laem Chabang, Thailand, Grade- Compression Moulding RAM Extrusion (MW: 5.8-7.8E6).

In Thailand, the price trend of Ultra-High Molecular Weight Polyethylene (UHMWPE) has been declining in Q3 2025, around USD 1,260-1,280/MT, a 1.73% decrease from Q2 2025. The UHMWPE prices in Thailand have been moderated by demand for industrial equipment, packaging, and use in extrusion applications, while adequate supply has been consistent by steady regional production.

In September 2025, UHMWPE prices in Thailand experienced 2.29% decrease from August, as the market has softened by cautious buying practices and slower restocking of inventories. Overall, weaker downstream demand, stable inventory levels, and limited pressure on feedstock prices have kept UHMWPE prices in a softening posture, with the potential for minor downward momentum to continue into early Q4 2025.

Belgium: UHMWPE Import prices CIF Antwerp (South Korea), Belgium, Grade- Compression Moulding (MW: 6.7E6).

The Ultra-High Molecular Weight Polyethylene (UHMWPE) price trend in Belgium has shown a marginal softening during Q3 2025, averaging around USD 1,630-1,650/MT, reflecting a 0.41% decrease from the previous quarter. The UHMWPE prices in Belgium have been influenced by moderate demand from industrial machinery, conveyor systems, and medical applications, while supply availability has remained largely balanced across the region.

In September 2025, UHMWPE prices in Belgium have recorded a slight 0.10% decrease from August levels, as stable inventories and cautious buying sentiment have limited further upward movement. Overall, steady supply flows, moderate downstream consumption, and minimal feedstock pressure have kept UHMWPE prices largely range-bound, with only minor downward adjustments expected in early Q4 2025.

Mexico: UHMWPE Import prices CIF Manzanillo (USA), Mexico, Grade- Compression Moulding (MW: 6.7E6).

The Ultra-High Molecular Weight Polyethylene (UHMWPE) price trend in Mexico has shown a largely stable tone during Q3 2025, averaging around USD 1,640-1,660/MT, reflecting a modest 0.1% increase from the previous quarter. The UHMWPE prices in Mexico have been supported by steady demand from industrial machinery, conveyor belt, and packaging applications, while regional supply has remained adequate and balanced.

In September 2025, UHMWPE prices in Mexico have recorded a slight 0.12% decrease from August levels, as cautious restocking activity and consistent inventory levels have limited further price movement. Overall, balanced supply flows, moderate downstream demand, and stable feedstock costs have kept UHMWPE prices largely range-bound, with only minor fluctuations expected into early Q4 2025.

Colombia: UHMWPE Import prices CIF Barranquilla (USA), Colombia, Grade- Compression Moulding (MW: 6.7E6).

The UHMWPE price trend in Colombia has shown slight increases in Q3 2025, averaging around USD 1,670-1,690/MT, which is a 0.16% increase from the last quarter. The price of UHMWPE has remained firm in Colombia due to consistent demand across industrial machinery, conveyor systems, and medical applications and the availability of adequate supply is balanced in the region.

However, in September 2025, UHMWPE prices in Colombia have showed a slight 0.12% decrease compared to August, while inventory levels remain steady. The reduction in prices has been attributed to gradual restocking and stable inventory levels. Overall, the supply flows have been balanced to new demand, and upstream feedstock costs have also been steady. Therefore, the pricing for UHMWPE should stay mostly stable with minor fluctuations expected early in Q4 2025.

India: UHMWPE Import prices CIF Nhava Sheva (Thailand), India, Grade- Compression Moulding RAM Extrusion (MW: 5.8-7.8E6).

According to PriceWatch, Indian domestic market UHMWPE price trend registered a moderate softening during Q3 2025, averaging near USD 1,320-1,330/MT or a 0.65% decrease from the previous quarter. The UHMWPE prices in India remained underpinned by steady demand from industrial, defence, and medical applications, and supply availability remained generally balanced across domestic producers.

In September 2025, UHMWPE prices in India reported an additional 1.9% decline from August levels, given the muted restocking activity and cautious buying sentiment. All in all, stable inventories, moderate downstream demand, and unchanged feedstock costs pressured UHMWPE prices mildly, with limited price recovery expected over early Q4 2025.