Price-Watch’s most active coverage of Vinyl Acetate Monomer (VAM) price assessment:

- (99.9% min) Industrial Grade FOB Jubail, Saudi Arabia

- (99.9% min) Industrial Grade FOB Port of Singapore, Singapore

- (99.9% min) Industrial Grade CIF JNPT (Saudi Arabia), India

- (99.9% min) Industrial Grade CIF Manzanillo (USA), Mexico

- (99.9% min) Industrial Grade FOB Busan, South Korea

- (99.9% min) Industrial Grade FOB Shanghai, China

- (99.9% min) Industrial Grade FOB Los Angeles, USA

- (99.9% min) Industrial Grade Ex-Kandla, India

Vinyl Acetate Monomer (VAM) Price Trend Q3 2025

In Q3 2025, global Vinyl Acetate Monomer (VAM) prices showed mixed trends. Prices in China fell by 4.2%, extending the previous quarter’s 1.3% drop due to weak demand and oversupply. Singapore saw the sharpest decline at 7.8%, driven by poor downstream consumption and aggressive regional pricing. In contrast, the USA and Mexico recorded increases of 4.45% and 4.5% respectively, supported by strong demand and limited supply.

Saudi Arabia and India (CIF) saw moderate rises of 3% and 2.9%, while India prices dropped 3% due to regional supply ease in domestic market. South Korea remained largely stable with a marginal 0.1% increase. Market movements reflected varied regional dynamics in supply, demand, and feedstock trends across key vinyl acetate monomer consuming industries.

China: Vinyl Acetate Monomer (VAM) Export Prices FOB Shanghai, China, Grade- (99.9% min) Industrial Grade.

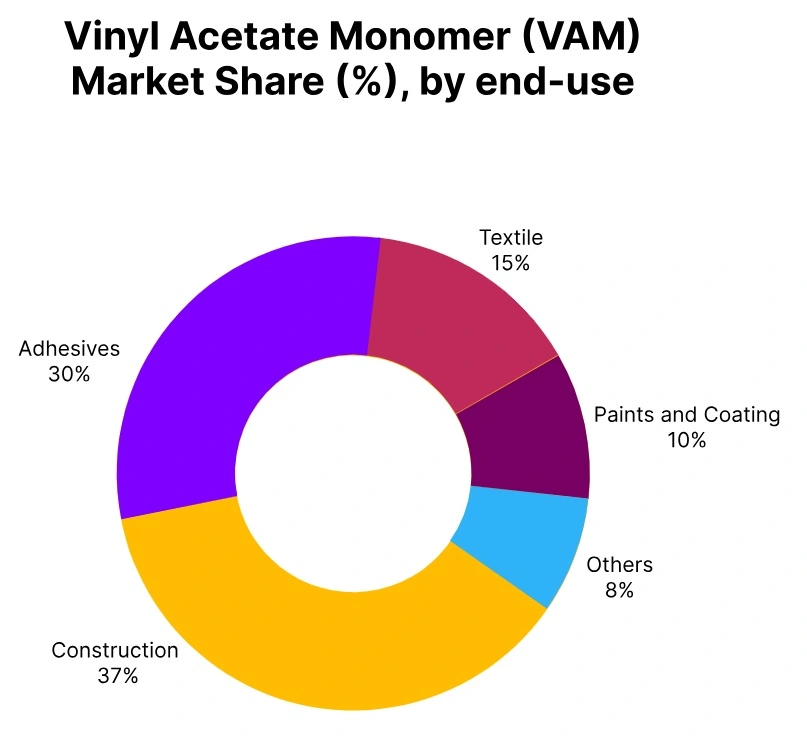

According to PriceWatch, in Q3 2025, Vinyl Acetate Monomer price trend in China have eased by around 4.2%, continuing the soft trend seen earlier in the year. The weakness mainly comes from slower demand in adhesives, paints, and textile industries. Many downstream plants have kept their production rates low, which, along with high domestic availability, has put pressure on prices.

Export activity has stayed limited as overseas buying has not picked up, while feedstock prices have been mostly steady. By September 2025, Vinyl Acetate Monomer prices in China have declined as sellers have been quoting slightly lower offers to clear stock. The overall market has stayed cautious heading into Q4, with sentiment depending on whether demand from packaging and paper segments improves.

India: Vinyl Acetate Monomer (VAM) Import prices CIF JNPT, India, Grade- (99.9% min) Industrial Grade.

According to PriceWatch, in Q3 2025, Vinyl Acetate Monomer prices in India have moved unevenly across regions. On a CIF basis, prices have risen by about 2.9% from the previous quarter, supported by steady imports from Saudi Arabia and consistent demand from adhesives, paints, coatings, textiles, and paper industries. Market activity has remained balanced, with procurement steady and shipping flows largely unchanged.

However, the Ex-Kandla price has slipped by nearly 3%, reflecting easier regional supply and reduced port-related costs. By September 2025, Vinyl Acetate Monomer prices in India this have highlighted the mixed tone of the market, where local availability, feedstock trends, and consumption levels have each played a role. End-use industries have continued regular operations, keeping the overall sentiment stable but watchful.

USA: Vinyl Acetate Monomer Export Prices FOB Los Angeles, USA, Grade- (99.9% min) Industrial Grade.

According to PriceWatch, in Q3 2025, Vinyl Acetate Monomer (VAM) prices in the United States have edged up by around 4.45%, following a steady rise in the previous quarter. The increase has largely come on the back of consistent demand from adhesive and coating manufacturers, with domestic consumption staying strong through most of the period. Exports have remained stable, providing additional balance to supply movements.

VAM’s tighter material availability and firmer feedstock costs have kept producers from offering discounts, reinforcing an overall bullish tone. By September 2025, Vinyl Acetate Monomer (VAM) prices in the US have continued to reflect firm market conditions. While buyers have shown some restraint in placing large orders due to cost concerns, underlying demand across construction, textile, and packaging sectors has kept the market supported as the quarter closed.

Saudi Arabia: Vinyl Acetate Monomer (VAM) Export Prices FOB Jubail, Saudi Arabia, Grade- (99.9% min) Industrial Grade.

According to PriceWatch, in Q3 2025, Vinyl Acetate Monomer prices in Saudi Arabia increased by 3%, continuing the upward trend seen in Q2, which recorded a 5% gain. The Vinyl Acetate Monomer price trend in Saudi Arabia was supported by firm regional and export demand from the adhesives and paints and coatings sectors. Domestic producers operated at steady rates, while supply remained balanced, preventing major fluctuations.

Healthy offtake from the textile and paper industries contributed to the positive price momentum. The Vinyl Acetate Monomer price in September 2025 reflected this firming trend, supported by robust industrial consumption and favourable trade flows. Market expectations for Q4 remained optimistic, underpinned by stable demand and controlled inventory levels.

South Korea: Vinyl Acetate Monomer Export Prices FOB Busan, South Korea, Grade- (99.9% min) Industrial Grade.

In the third quarter of 2025 Vinyl Acetate Monomer prices have been relatively flat within South Korea, with only an increase of approximately 0.1% after a sharp increase in the previous quarter. Demand from the adhesive and coatings industries has remained steady and contributed to somewhat of a stable market, whereas some significant reduction in activity from textile and paper producers has limited further price increases.

VAM production continued uninterrupted, and feedstock supply has been more than sufficient to meet domestic demand. As of September 2025, VAM prices in South Korea have changed little and reflect a calm and balanced market state. Overall, most traders and buyers are taking a wait-and-see approach to observe whether or not industrial demand in East Asia will demonstrate improved growth in the last quarter of the year.

Singapore: Vinyl Acetate Monomer Export Prices FOB Port of Singapore, Singapore, Grade- (99.9% min) Industrial Grade.

In Q3 2025, Vinyl Acetate Monomer prices in Singapore saw a sharp decline of 7.8%, reversing the 4.5% increase recorded in Q2. The Vinyl Acetate Monomer price trend in Singapore was largely influenced by weak downstream demand in the adhesives, textile, and paints and coatings industries. Excess inventory and aggressive pricing from other Asian exporters contributed to a bearish market environment.

Additionally, reduced buying sentiment from the paper industry further pressured prices. The Vinyl Acetate Monomer price in September 2025 remained on a downward trajectory as suppliers adjusted offers to remain competitive in Singapore. Looking ahead, Q4 market sentiment depended on inventory adjustments and a potential rebound in regional demand.

Mexico: Vinyl Acetate Monomer Import prices CIF Manzanillo, USA, Grade- (99.9% min) Industrial Grade.

In Q3 2025, Vinyl Acetate Monomer (VAM) price in Mexico experienced a noticeable rise compared to the previous quarter, increasing by 4.5% on a CIF basis. The VAM price trend in Mexico was influenced by steady downstream demand from the adhesives, paints and coatings, textile, and paper industries.

Imports from the USA remained stable, but slight tightening in supply due to scheduled maintenance at some US production units supported the upward movement in prices. Domestic converters reported improved offtakes as industrial activity picked up, particularly in the construction and packaging sectors.

In Mexico, Vinyl Acetate Monomer price in September 2025 reflected this upward trajectory, with market sentiments supported by firm buying interest and consistent consumption in key end-use sectors.